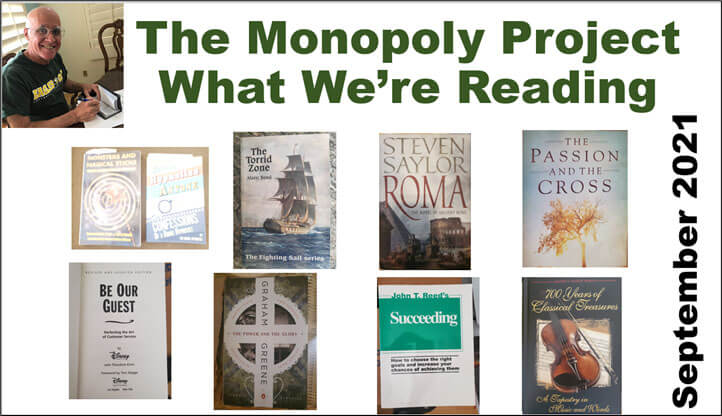

What We’re Reading This Month – “Books Are Piling Up”

Every month we show what is on our reading table. Comments on current reads: "Monsters and Magical Sticks: There's No Such Thing As Hypnosis?” (208 pages, paperback, reprint 2017) by Steven Heller and “How to Hypnotise Anyone - Confessions of a Rogue Hypnotist” (112 pages, paperback, reprint 2014) by The Rogue Hypnotist. I always [...]