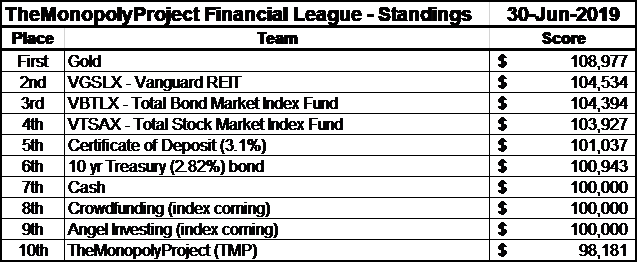

Our results to date are reported on a monthly basis on the “Score” table on the Home page. We give you the current total value of TheMonopolyProject (TMP) as a combination of cash held (bank deposits) and the estimated value of the real estate owned minus liabilities (loans).

To determine how well TMP project is doing we compare it to the other financial investments we could have made with the $100,000. This is known as the ‘opportunity cost’. Note that we could also consider other, non-financial investment uses for the $100,000. We will discuss that later. Life is not all about optimizing financial outcomes in this kingdom.

We started TMP on March 1, 2019. On March 1st, 2019, all 10 investments started at the same nominal value, $100,000.

Now that June is completed, we have our results, the “Standings”. It’s easiest to think of this as a football or baseball sports league: The Financial League. We’re one of ten teams competing for number one in the league.

Here’s the standing as of the end of June. ‘Gold’ is on fire, #1, roaring back from last place!

This shows you that the market is fickle; one month you’re up, next month you’re down. The philosopher Frank Sinatra captured this lyrically.

How did we do? Last place!

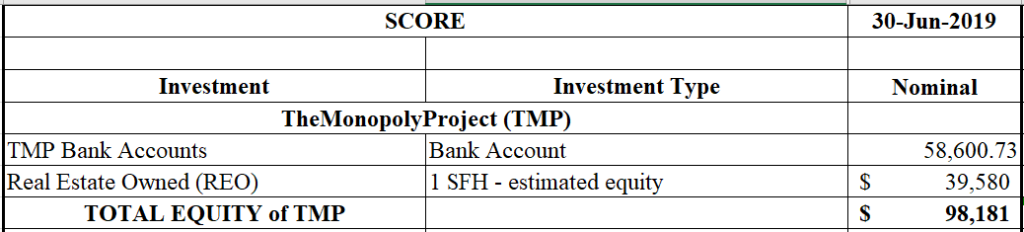

How did we calculate our $98,181 TMP equity?

TOTAL EQUITY of TMP is ‘Bank Account’ + ‘estimated equity in 1 SFH’ = $98,181

The “Bank Account” is simply the balance in TMP checking account on 30 June 2019. We paid the down payment and various related closing costs.

How did we get to the ‘estimated equity’ of $39,580 for the Valencia house since we paid ‘all cash’?

First, we valued the house at the sales price, $197,900. There are lots of estimates for house values (e,g., Redfin, Zillow, Realtor.com), but the best indication is the price a willing seller and a willing buyer agree to.

If we paid $197,900 for the house, why is TMP estimated equity only $39,580?

For the purpose of keeping score in TMP we assumed that we got a 20% down loan from the “Bank of Michelle”. The 80% “Bank of Michelle” loan is $158,320. TMP equity is then 197,900 minus $158,320 equals $39,580.

I will explain the entire thinking and rationale of assuming there is a loan component in the equity calculation in an upcoming post.

An interesting aside on estimates. Redfin “values” the house at $209,431 even though it was just sold at $197,900 ($11,531 more!). And the appraiser said, $192,000!?.

If we used the Redfin number, TMP score would jump to $109,712 putting us in FIRST PLACE!

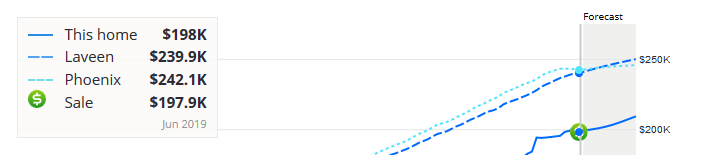

Zillow says $198,000:

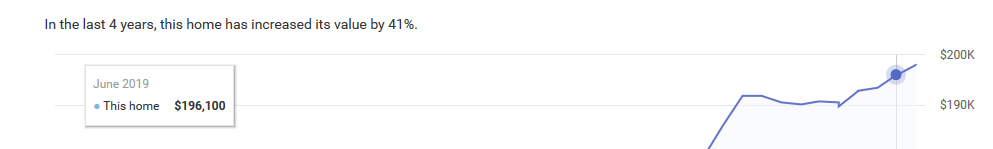

Realtor.com says $196,100:

For now, the sales price is the best estimate. As we go forward, we will have to decide which of the above “values” is the best. Let’s see if they converge over the next year or so. And, of course, these “values” do not include transactions costs (estimated at 6% – 8%) on the sales side.

Since this is the Fourth of July, we did go see fireworks. We were lucky to attend the Payson, AZ fireworks where you can still sit directly beneath the fireworks; see the colors and feel the concussion, Here’s a video of the last 12 minutes of the 35-minute program. Spectacular!

From the Payson Roundup newspaper