Previously, we had to buy our first house on Valencia St in Phoenix for ‘all cash’ when our lender could not fund the loan in time for closing. It was an error of closing dates on their part, that we did not catch in time to correct, due to more ‘opportunity costs’.

How are we going to ‘score’ this for purposes of TheMonopolyProject? We started with $100,000, so we can’t possibly assume the extra capital in TMP accounts. As we explained previously:

We will assume that we got a loan from somebody else.

Who?

“The Bank of Michelle”.

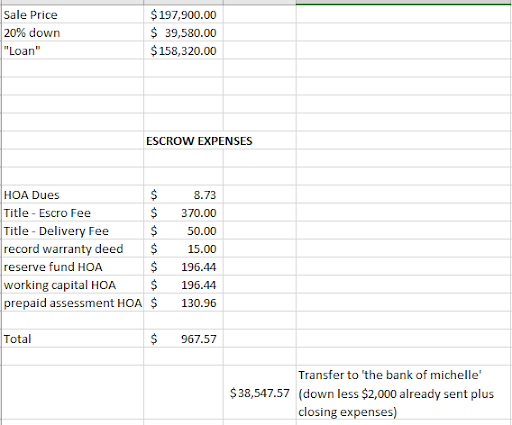

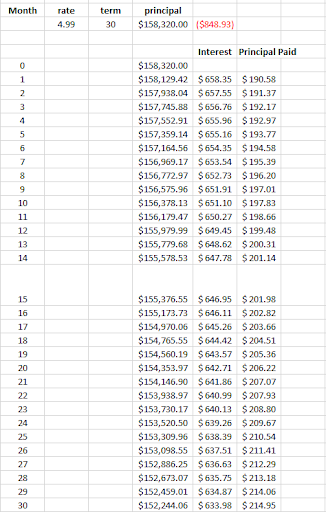

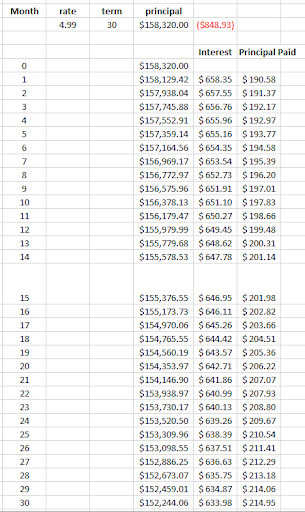

We will assume a loan on the same terms and conditions of the failed loan: 30 year fixed, 20% down, 4.99% interest rate. Every month, starting on 1 August 2019, we will pay “The Bank of Michelle” the monthly payment of interest and principle. So TMP bank account will reflect paying the “mortgage” and collecting the rent, less expenses, on a monthly basis.

Here’s two screen shots of the relevant details from our ‘loan terms and conditions, amortization spreadsheet’:

TMP is paying ‘The Bank of Michelle’ $848.93 per month. The 20% down and associated closing costs ($967.57) were paid out of TMP account. Note that the closing costs were unusually low since we did not get a loan from an actual lender which would have additional costs. We have deferred these costs, not avoided them. Eventually when we refinance to pay back ‘The Bank of Michelle’, we will incur those costs.

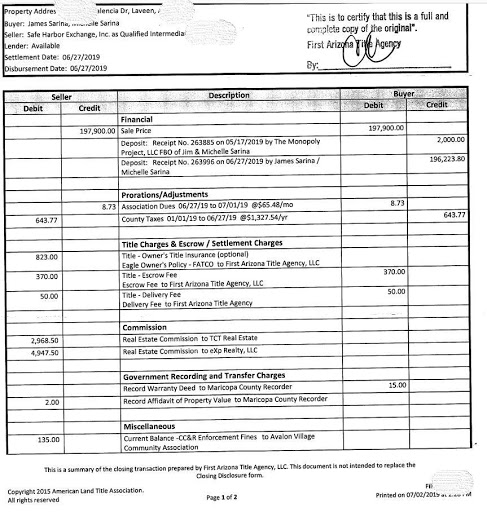

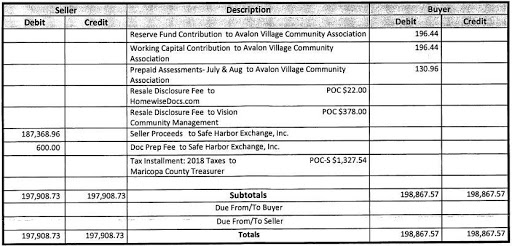

Here’s the settlement statement from escrow documenting the complete transaction:

When will we refinance? Not sure.

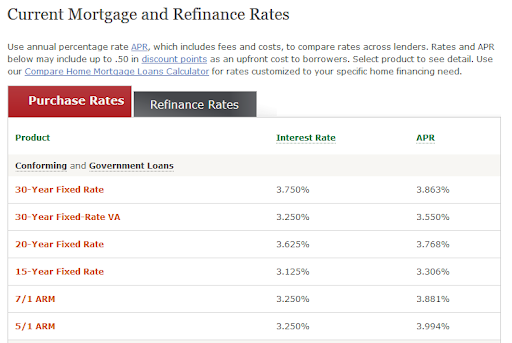

Mortgage rates are trending down. In July, the Fed has reduced the ‘federal funds rate’ for the first time in over 10 years. The relationship between SFH mortgage rates and the ‘fed funds rate’ is not direct but is positively correlated. You can read some analysis of what it means for you, and TMP, here:

Here’s what that Fed rate cut means for you

Fed Cuts Interest Rates for First Time Since 2008 Crisis

The Fed Just Cut Interest Rates. Here’s What That Means for You

When we do refinance, we will look at several options: 30 year fixed, 15 year fixed, maybe 10 year fixed, and 5/1 ARM, if available on investment property. Note that all these should be available for owner occupied properties. This is an important point is you are considering doing a “TMP” of your own.

Why look at a 15-year fixed loan? Because the rates are lower (about .625%).

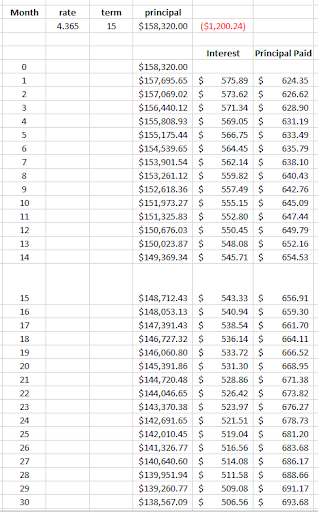

You get a double benefit: the rate is lower, and the loan is paid off faster. Here’s the amortization table equivalent to the above comparing the 30 fixed to the 15-year fixed (the 4.99% 30-year rate has been retained and we lowered the 15-year rate by .625%):

Note that in the first year of the 30-year loan, you’ve paid down the principal, $2,340.

For the 15-year loan, you paid down the principal, $7,644!

You’ve made over $5,000 more in the first year using the shorter term, lower rate loan.

What’s the catch? The payment is much higher, $1,200 per month as opposed to $848 per month. From a cash flow point of view, you are worse off.

If you don’t need the cash flow, the 15-year option is much better financially.

When we get our first few months of rent, less expenses, we will calculate the rate of return on our down payment, comparing the two options above.

Thank you “Bank of Michelle” and thank you, Michelle.