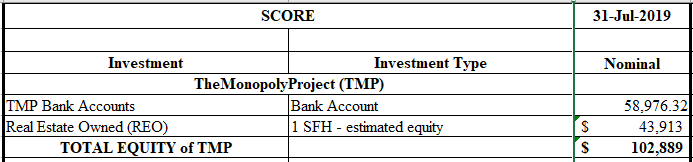

Our results to date are reported on a monthly basis on the “Score” table on the Home page. We give you the current total value of TheMonopolyProject (TMP) as a combination of cash held (bank deposits) and the estimated equity of the real estate owned (= estimated value minus liabilities).

To determine how well TMP project is doing we compare it to the other financial investments we could have made with the $100,000. This is known as the ‘opportunity cost’. Note that we could also consider other, non-financial investment uses for the $100,000. We will discuss that later. Life is not all about optimizing financial outcomes in this kingdom.

We started TMP on March 1, 2019. On March 1st, 2019, all 10 investments started at the same nominal value, $100,000.

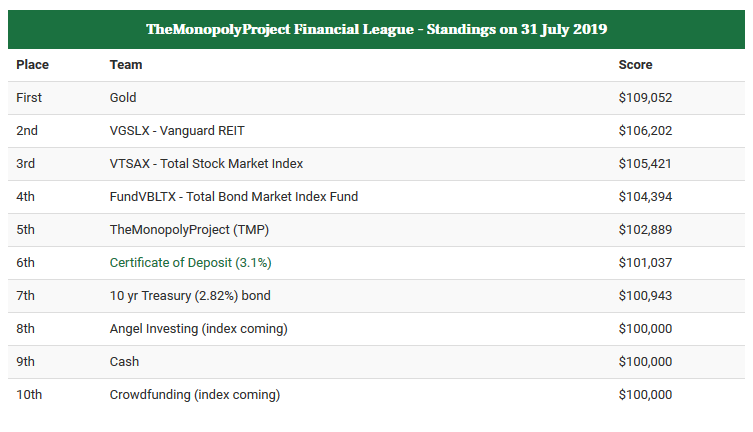

Now that July is completed, we have our results, the “Standings”. It’s easiest to think of this as a football or baseball sports league: The Financial League. We’re one of ten teams competing for number one in the league.

‘Gold’ is still #1. Gold is benefitting from the recession worries and the China trade ‘war’.

Where are we?

We’re moving on up. We’re in 5th place!

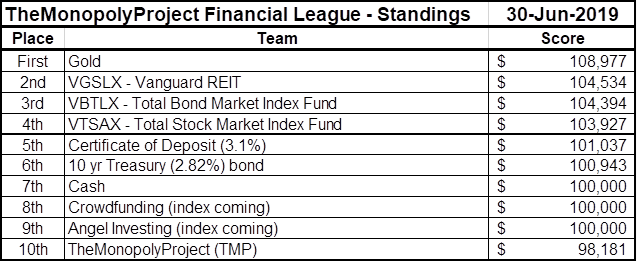

Remember last month, we were ‘shot down in May’ (or maybe June) according to Frank Sinatra.

We were DEAD LAST.

Our TMP equity went from $98,181 to $102,889. How did we do that?

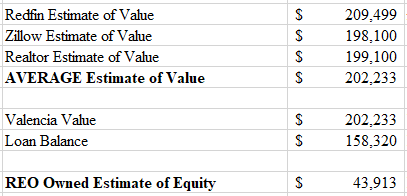

As you remember last month, we valued the property at the sales price, $197,900 even though we had different estimates from Redfin, Zillow, and Realtor.com.

TOTAL EQUITY of TMP is ‘Bank Account’ + ‘estimated equity in 1 SFH’ = $102,889

The “Bank Account” is simply the balance in TMP checking account on 31 July 2019. We actually used the 1 August 2019 value to include the ‘rent less expenses’ collected for July. We received $375.59 from our property manager reflecting initial tenant placement costs among others. We will discuss the income revenue stream in a later post; when we have a few months under our belt. For now, the net proceeds are included in the bank account balance.

And, next month we will make our first payment to “The Bank of Michelle” which will decrease the bank account balance but increase the equity by the balance of principal payed down. Here is the accounting for July 2019:

How did we get to the ‘estimated equity’ of $43,913 for the month of July?

We used the arithmetic average of the three websites (Redfin, Zillow, Realtor.com).

Why is Redfin so much higher?

IDK.

We will track these over the coming months and see if they converge.

The market is still super-hot in Phoenix and who knows how to get a ‘true value’. Here’s an anecdote that I will expand on in a later blog. An acquaintance of mine bought a house last weekend. It went on the market on Saturday. By Saturday evening, there were 10 offers! Yes, above asking price. They were the winning offer, although not the top bidder.

For now, we’ve moved up into 5th place. This is how we foresaw TMP performing. We are buying appreciating assets on margin (80% down). We make money on the appreciated value of our down payment money PLUS the value of the borrowed money. We should expect that TMP would/will outperform fixed rate assets (CD’s, 10-year Treasury Note).