May Day is the International Distress signal, asking for help in a life-threatening situation. May Day is also the celebration of communism. Apparently, Mayday has many meanings.

But May Day (May 1st, 1975) was also when the SEC deregulated commissions on stock. Commissions fell 95%, almost overnight. In fact, you can almost trade stocks for free now.

So, why has the 6% commission rate for SFH lasted so long?

Note that there is no central agency that sets a 6% commission rate for SFHs like the SEC that set stock commission rates prior to May 1975. The 6% in SFH transactions is ‘customary’.

The 6% commission is a ‘result’ of The MLS – Multiple Listing Service.

The Wikipedia description of the MLS states:

“A multiple listing service (MLS, also multiple listing system or multiple listings service) is a suite of services that real estate brokers use to establish contractual offers of compensation (among brokers) and accumulate and disseminate information to enable appraisals…”

while the owner of the MLS, the National Association of Realtors, defends their position as:

“REALTORS® have spent millions of dollars to develop Multiple Listing Services (MLS) and other real estate technologies that make the transaction more efficient. An MLS is a private offer of cooperation and compensation by listing brokers to other real estate brokers.”

The difference between a stock and an SFH is that every share of stock of a given company, domestic or foreign, is identical. It is identical in the rights that it conveys.

Whereas, two SFHs sitting right next to each other may be worth totally different amounts. Each house is different in terms of features and conditions.

This gets to the second reason why commissions on SFHs are so much more than on stocks. There is now broad information on the value of a company. Information on any given SFH is not broadly available. The real estate agent/broker commission reflects this information disparity.

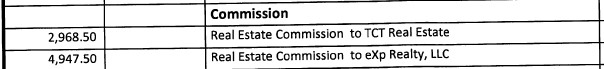

But information on each SFH is becoming increasingly available via Zillow, Redfin, Opendoor, Offervana, even Realtor. Com associated with the National Association of Realtors. We see some chipping away at commissions now (e.g., 2.5 + 2.5% splits on MLS versus the ‘customary’ 3% + 3%). In addition, Zillow and other large investors are already chipping away at 6% due to their pricing power. You saw this in our Valencia deal where the selling agent got a smaller commission (1.5%) than the buyer’s agent (2.5%) because the seller was an investor who had pricing power to demand a lesser commission from his agent.

But Zillow and the other investors are just one front in the war on the 6% commission.

“Lawsuit Alleges Collusion, Inflated Commissions Among Realtors”

“A recently filed class-action antitrust suit against the National Association of Realtors, among other major real estate players, could spell a serious shakeup for the industry. If the plaintiffs win out, it may change the face of buying and selling real estate as we know it.

In Moerhl v National Association Realtors (NAR), home sellers from across the nation are claiming that NAR’s compensation policies—which require all member brokers demand blanket, non-negotiable buyer-side commission fees when listing a home on a Multiple Listing Service—is a violation of antitrust law.”

More here:

https://www.omegalendinggroup.com/new-lawsuit-targets-real-estate-agent-commissions/

Another set of current plays involve sticking with the 6% model but using incentives/gimmicks to get the listing; e.g., $10,000 free fixup loan, guaranteed base price (we’re in the middle of a guaranteed base price deal now, more later), Knock.com, Faira.com/, Here’s one I just learned about: https://www.noinvestors.com, https://homesmart.com/

I think that these three direct fronts (Zillow/Redfin/OpenDoor, other investors with pricing power, lawsuit) or the incentives/gimmicks plays will not be the reason for the demise of the 6% commission. The answer is hinted at in the Forbes article above:

But I think the Forbes article misses the bigger threat. SFH real estate commissions will fall from the customary 6% rate when an entity (Zillow, OpenDoor, some unknown/unstarted unicorn company) actually ‘makes the market’ as opposed to ‘brokering the market’. The ‘market maker’ will offer to sell or buy any SFH in a certain area at a specific buy/sell spread; buying low (say 98%) and selling high (say 102%). The 4% spread in this example is compensation for the ‘market maker’s’ expenses and PROFIT. If they can do it for 2% on each side of the transaction, the initial seller and ultimate buyer saves the 6% ‘customary’ commission.

OpenDoor is almost already doing this. But their typical 8% “fee” won’t break the 6% commission model. It is structured for “convenience” of sellers who don’t want the hassle of selling a house.

So, who would benefit from reducing the typical 6% commission?

- Obviously, sellers and buyers,

- Investors (like me) would see a more liquid market allowing us to enter and exit deals at lower costs (you saw this in stocks and bonds as the commission rate went to near zero),

- Finally, lending institutions. More liquidity would mean more transactions which would mean more fees for loan origination and such.

So, how would we implement this ‘market maker’ model? We would start locally with relatively small areas in which an entity ‘makes the market’ offering to buy at 9x% and sell at 10x%. The houses must be relatively the same; e.g., no million-dollar houses next to a $200,000 house. The neighborhood must be ‘homogenous’ with perhaps 3-5 models of houses. The Phoenix area could be ‘ground zero’ for this having a huge SFH inventory and good, homogenous neighborhoods.

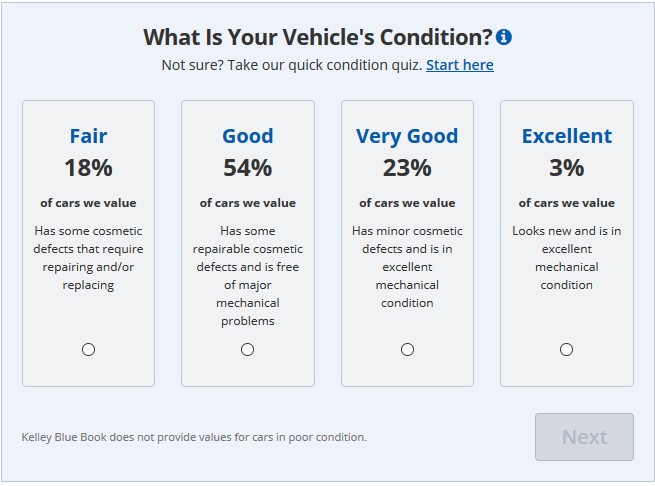

The quality of house will be rated (by current home inspectors?) similarly to how cars are currently rated. Here’s an example from KBB, Kelly Blue Book.

Real estate equivalent will be, worst to best:

The market maker won’t deal in ‘Major Repairs’ properties and will have different buy/ask spreads for the other categories.

It would be best to change laws/regulations to allow the ‘market maker’ to not ‘take possession’ but simply facilitate the transaction between the seller and the eventual buyer. You can think of it like a 1031 exchange; but the ‘market maker’ performing a ‘super escrow’ function.

In 1977, Wyoming pioneered the LLC business entity. But they can’t pioneer a new housing transaction model, the housing market in Wyoming is too thin. Maybe Arizona could be the pioneer? Phoenix is ground zero for the housing market innovations and driverless cars:

https://www.wsj.com/articles/the-future-of-housing-rises-in-phoenix-11560957036

https://www.nytimes.com/2019/05/07/business/economy/ibuying-real-estate.html

https://arizonabrief.com/zillow-to-start-buying-and-selling-metro-phoenix-homes/

https://www.amazon.com/Zillow-Talk-Rewriting-Rules-Estate/dp/1455574759

TOP 10 REASONS PHOENIX IS DRIVERLESS CAR CAPITAL OF THE WORLD

https://tribunecontentagency.com/article/going-driverless-in-the-city-of-cars/

https://therooster.com/blog/arizona-becomes-ground-zero-for-driverless-grocery-delivery-services

It could be ground zero for a new housing transaction model. Governor Ducey, are you interested?