We hear it all the time: location! Location! Location! – but does a good location mean that you have a good investment? When I think “location”, I’m not just thinking about linkages (proximity to amenities, supporting services, etc.) or those nice cul-de-sac lots, I’m considering the entire community composition as a whole. Everything from the seismic activity below to the airport noise pollution 40,000 feet above.

In April 2017, my wife and I were ready to move. Our first child was due in a few months, and we were living in a 915 square foot, 2-bedroom, 1.5 bath home in a western part of Mesa, Arizona. The neighborhood was convenient with plenty of shopping, restaurants, parks, good freeway access, etc. But, due to increasing criminal activity, it was becoming an undesirable location to raise a family.

I had been watching the local housing market, which at the time was in short supply and high demand in my immediate area. It was a good time to sell for a lot of reasons. We ended up selling our house for full asking price, which many real estate agents laughingly proclaimed, “would never appraise out…”.

With our house sold, we moved into a family member’s vacant rental, and had to figure out where to go next. My wife and I put together a list of needs and wants, which included more space for our growing family, and all of the things we’d be leaving behind in west Mesa (plenty of shopping, restaurants, parks, good freeway access, etc.).

Here’s how our house hunting process went (whether renting or buying):

- How much can we afford?

- Where do we want to live (desirable neighborhood)?

- Does the prospective house have X, Y and Z?

- Go look at the house

- Put in highest and best offer

- Get rejected

- Back to step 3 and repeat until closing

While shopping for a home, if you can’t satisfy question #1, you can’t move onto questions #2 or #3. In a tight housing market, the answers to questions #2 and #3 often become compromises when #1 can’t be satisfied. This is true for investors and owner-users.

For an investor, when it comes to yield – whether it be through net income or equity realized by an eventual sale – questions #2 and #3 become very important because the market will be to future owner-users, investors, and/or tenants. That said, buyers and renters typically want to live in desirable neighborhoods. Desirable neighborhoods are typically more stable and command higher sale prices and rents.

With regard to location, what exactly is a desirable neighborhood? What are some stabilizing factors that contribute to the overall appeal of a neighborhood? The definition will vary based on personal tastes and goals, but for the most part, a desirable neighborhood in the Phoenix metro area can be characterized by the following criteria:

- Safe

- Clean & well maintained

- Good schools

- Proximity to a wide variety of amenities, supporting services and employment districts

- Nearby freeway access

- Stable or appreciating property values

I list “safe” as #1 in the above list, because I believe that houses in safe neighborhoods are often safe investments. With regard to finding a safe neighborhood, it can be helpful to look at crime trends using the LexisNexis Community Crime Map and local law enforcement registered sex offender location maps.

My own search for a new house was sorted by asking prices of homes, and then by the size of the home we needed (3+ bed, 2+ bath). I then viewed the results on the crime map.

I realize every community has petty crime (scuffles in the park, bicycle thefts, shoplifting, DUIs, etc.), but not every community has chronic issues with homicide, sexual assault, aggravated assault, burglary, and arson. The LexisNexis Community Crime Map allows users to filter for serious crimes in a given area in a given timeframe. Personally, I am most concerned about homicide and sexually motivated crimes as community characteristics to avoid if at all possible.

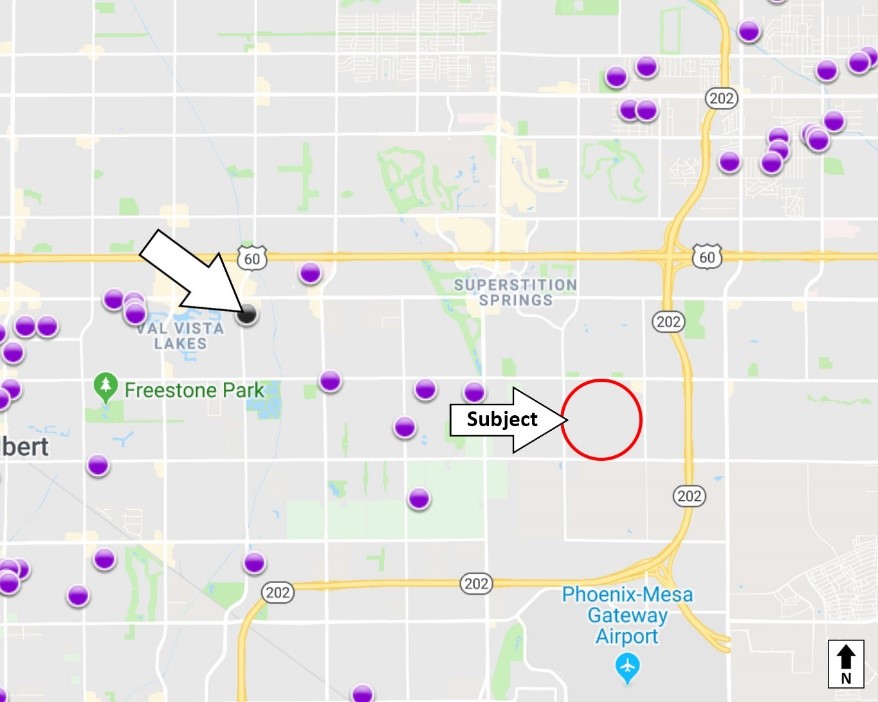

The map above represents the most serious crimes in the area of our new home from 4/1/2017 – 10/1/2017 (the time frame in which I was home shopping). The red circle in the map is where we purchased our house in East Mesa. The purple dots represent sexual assaults of varying degrees of seriousness. The single black dot represents an “intentional second-degree murder”. In my neighborhood zip code (85212) there were 56 “serious” crimes, of which, one was a homicide.

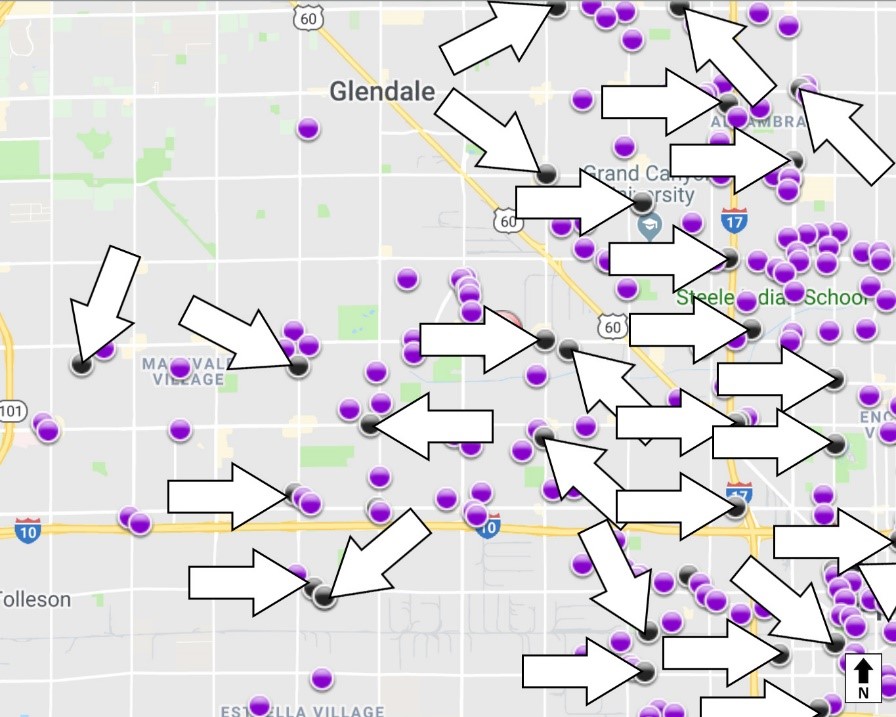

For the sake of contrasting, let’s compare the crime map above to one of the “tougher” neighborhoods in the Phoenix metro area – zip code 85031 (Maryvale). If you’ve lived in the Phoenix metro area for any period of time, you might think Maryvale is not a place you want to live. Here’s one reason why.

The map above shows the “serious” criminal activity in the area of zip code of 85031. In the same time period (4/2017 – 10/2017), there were 338 “serious” crimes, of which 59 were homicides.

Suppose you didn’t know about the free crime map? You’d probably drive through the prospective neighborhood to get a feel for the area instead. You’d want to know if your future neighbors park an RV on their front lawn, or if a lot of the houses on your street are suffering from deferred maintenance. A quick tour of a neighborhood can provide a lot of valuable insight about the current state of a neighborhood, its residents, and what the future may hold.

Here are two Google street views from a typical residential subdivision in 85212 and then from 85031:

85212 – East Mesa

85031 – Maryvale

One could drive through East Mesa and Maryvale and see a marked difference in quality, age and condition of the homes and neighborhoods.

So, if you’re out shopping for a home (owner-user or investor), and you drive through these two neighborhoods, maybe you don’t need a crime map to figure out that one is a little nicer, and therefore should be a superior choice. Let’s back this assumption up with some numbers.

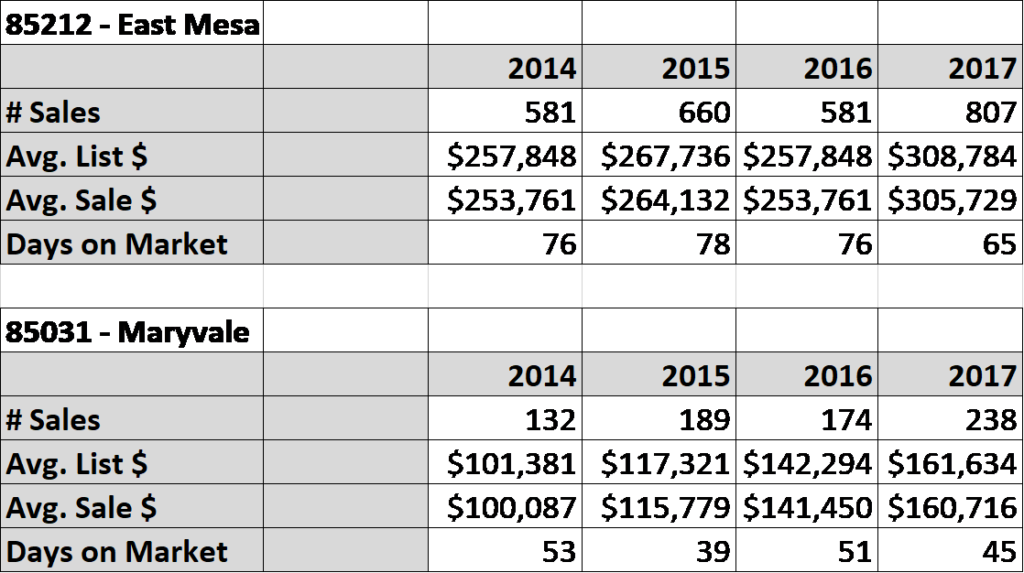

Search criteria: Single-family, detached, 3+ bed, 2+ bath

Considering the average home sale prices from 2014 – 2017, 85212 experienced an overall ±5.1% annual appreciation rate. 85031 experienced an overall ±15.1% annual appreciation rate. Without considering historical rents, vacancy rates, and other holding costs, it would appear that Maryvale, with all of its issues related to crime, beats out East Mesa from 2014 – 2017. I didn’t expect this result.

However, the historical data and trends presented above are not guaranteed to continue. The economy in Arizona is cyclical. What might the future hold for me as an investor or owner-user if another recession were to occur? To get some idea, I might consider single-family housing trends from the previous recession, and the results of the post-recovery era.

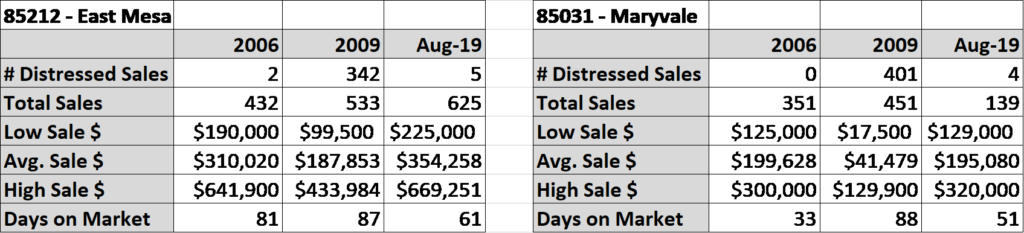

As seen in the tables below, the 3BD/2BA+ housing prices in 85031 fell nearly 80% from 2006 – 2009; however, the average buy-in was also lower in 2006. The housing prices in 85212 fell ±40% from 2006 – 2009. Both neighborhoods suffered a great deal as evidenced by the number of distressed sales. Sale prices, rents, and occupancy rates dropped dramatically throughout the entire metro area. But, if you owned a house in a desirable neighborhood, you likely fared better during this time period.

Search criteria: Single-family, detached, 3+ bed, 2+ bath

Given Maryvale’s poor reputation, lower asking prices and rents are necessary to induce sales or leases in the area. The asking prices and rents are lowered when unloading unwanted portfolio inventory or trying to maintain feasible occupancy rates. This trend will continue so long as high crime rates are sustained in the Maryvale area. Why?

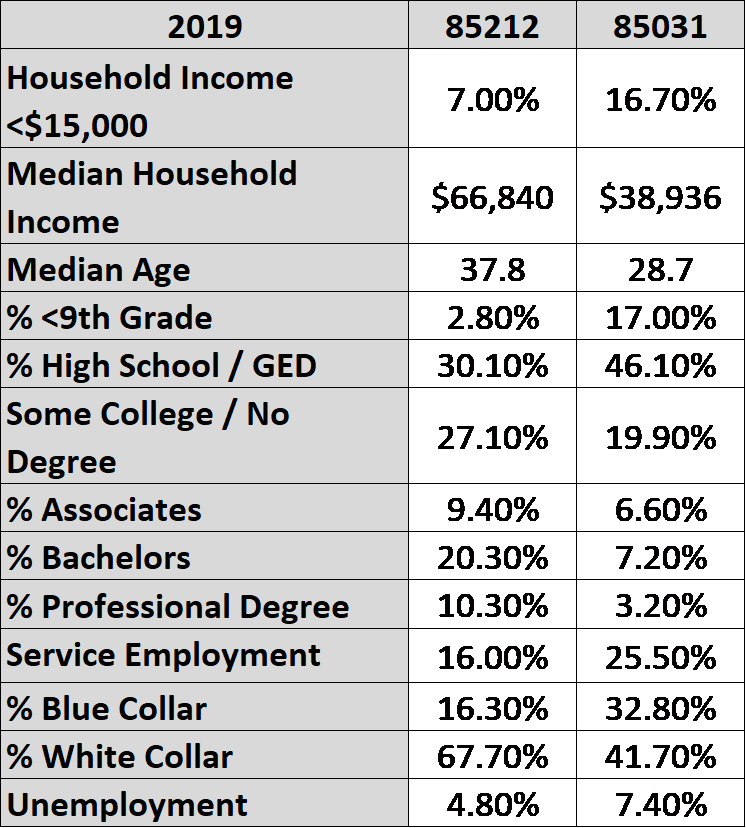

The table below summarizes key demographic data comparing the community profiles of 85212 (East Mesa) and 85031 (Maryvale) in 2019. As seen in the two previously presented crime maps, the two areas and their respective demographics have very different levels of serious crime. Lower crime rates are associated with superior demographics, which are also associated with a stabile community. A stable community will attract higher earning and more stable buyers and tenants, which in turn keeps the needle moving higher on sale prices and rental rates.

Source: ESRI STDB, 2019 Data

When The Monopoly Project first began, we were sifting through several single-family houses as options for an initial investment property. In reviewing the proposed listings and locations, I put on my “dad hat” and began looking at the looking at pros and cons of each property presented in terms of neighborhood safety.

There were some affordable options in Laveen, Phoenix, Mesa, etc. Laveen turned out to be the crowd favorite. The conversations surrounding the Laveen properties were mostly about what the houses looked like, possible repair costs, what the potential rents were, linkages, ongoing developments in the area, etc.

I was not excited about the houses in Laveen for a number of reasons, but primarily due to the reputation of the area and the financial consequences related to ongoing crime. See HERE, HERE or HERE as quick examples of crime in the area of 51st Avenue and Baseline Road. One only needs to Google “Laveen crime” to see the latest ongoing issues.

The Google street view below represents a typical single-family subdivision in Laveen, in the 51st Avenue & Baseline Road area. Compared to the 85212 (East Mesa) street scene, this neighborhood looks superior. If it weren’t for the drive times related to living in Laveen, and ongoing crime, I might have been tempted to purchase here as well.

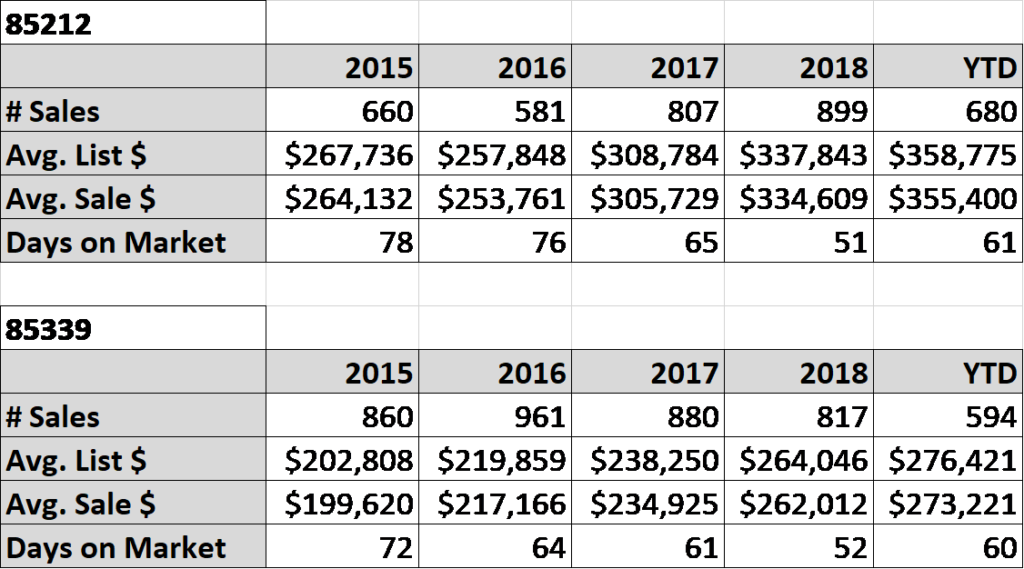

Let’s take a look at the current housing trends in the area. The tables below summarize single-family sale trends in 85212 (East Mesa) and 85339 (Laveen).

Search criteria: Single-family, detached, 3+ bed, 2+ bath

Housing in 85339 has appreciated ±24% from 2015 – YTD, or about 8% per year. There is certainly no question that an investor could turn a profit by purchasing a home and flipping for ±24% more 4.5 years down the road. But this assumes a property was acquired in 2015. Will these positive trends continue, stabilize, or sharply decline?

The Monopoly Project is acquiring investments in 2019, in a peaking market, and approaching an election year. We also have doomsday economists warning of a pending recession, and the stock market isn’t doing so great these days. Just a few things that tell me we should also look at housing price trends from the previous recession in Laveen – just in case. Afterall, we’d want some idea of what the worst-case scenario could be if another recession were to occur.

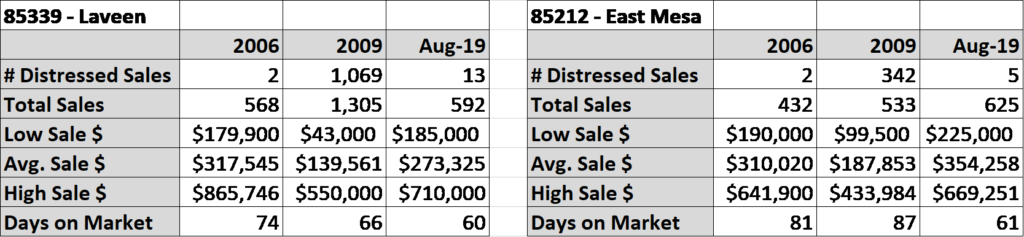

The tables below summarize and compare single-family home sales in 2006, 2009 and August 2019, for zip codes 85339 (Laveen) and 85212 (East Mesa).

Search criteria: Single-family, detached, 3+ bed, 2+ bath

As seen in the tables above, the average housing prices in 85339 fell ±56% from 2006 – 2009. Compared to 85212, the average buy-in was also higher in 2006. The housing prices in 85212 fell ±40% from 2006 – 2009. ±82% of the home sales in 85339 in 2009 were distressed sales compared to 64% in 85212. Again, if you owned a house in a desirable neighborhood, you likely fared better during this time period.

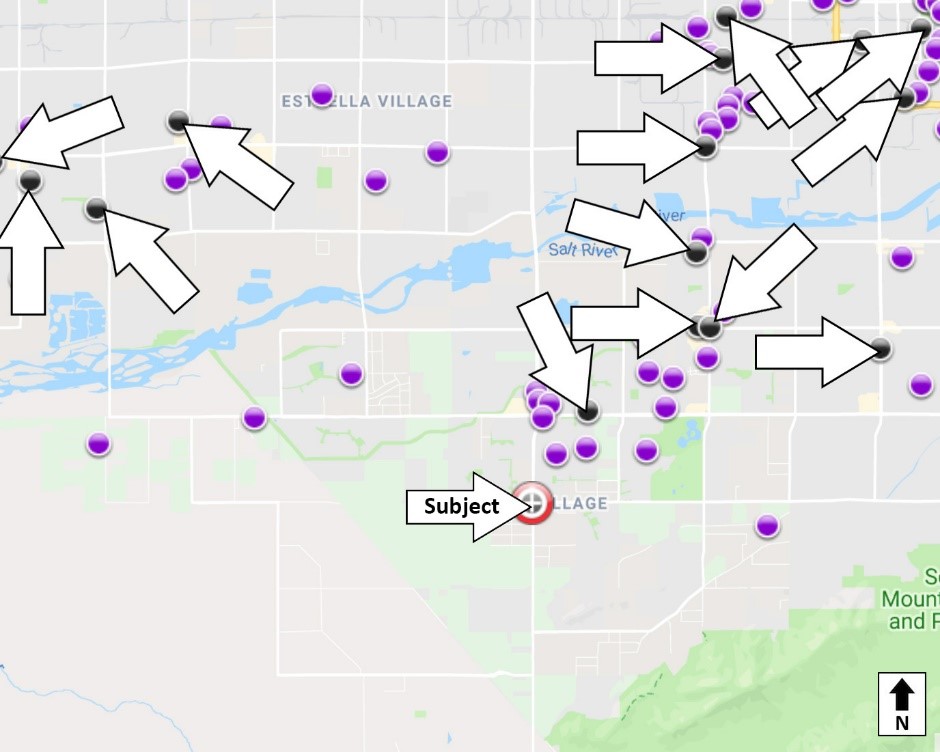

Regardless of how the economy performs, people are still going to want to live in safe neighborhoods. Let’s take a look at the Laveen crime map below.

From 4/2017 – 10/2017, the crime map showed 111 serious crimes, of which 22 were homicides in the Laveen area. Maryvale is located north of Laveen, on the north side of the I-10 freeway. The South Phoenix area is located east of Laveen and is also known as high-crime region in the metro area. All considered, Laveen seems to be faring well considering the nearby crime hubs.

Laveen is somewhat removed from the core employment districts in central Phoenix, Tempe, and Scottsdale. The new Loop 202 freeway that is being constructed will help commuters going to and from the East Valley and will ease traffic on the I-10, too. A number of large distribution/warehousing facilities are being built in the West Valley, particularly around the Loop 303 and in Goodyear. The resulting jobs will be a welcome boost for the area. South mountain portion of loop 202 projected to be finished 2020.

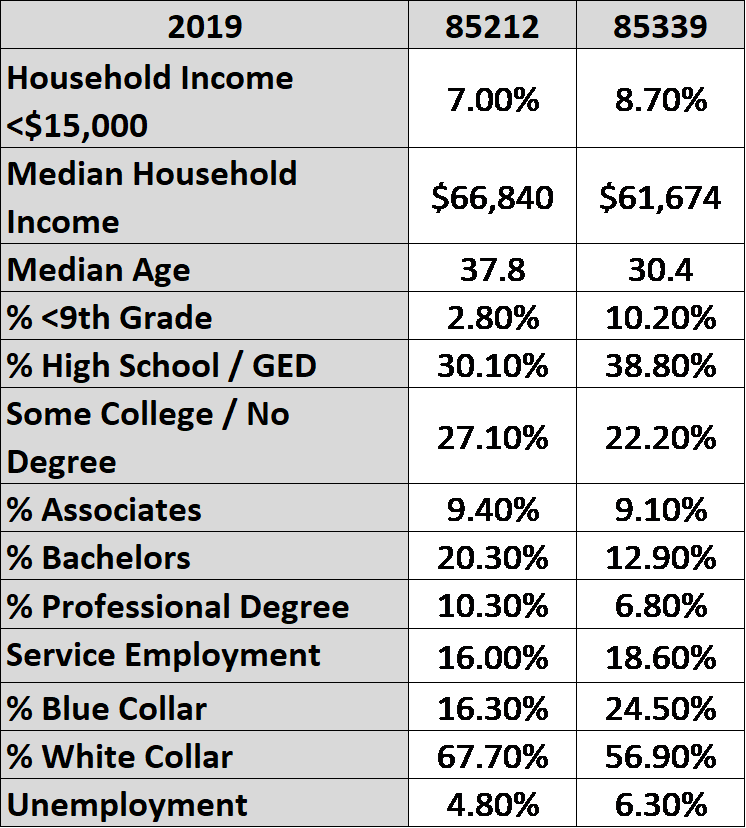

Presented below are key indicators that compare the demographics of Laveen and East Mesa.

As I previously argued, I believe these demographic figures can be tied to the crime rates in the area of study – or vice versa. The demographics in Laveen are mostly similar to East Mesa. I believe the difference in crime is due to Laveen being surrounded by other areas of Phoenix known for high crime.

Given the current trends in our local and national economies, there is a very good possibility of ongoing appreciation in real estate values in Laveen. One idea that I would like to explore when the Laveen house is eventually sold would revolve around how much more or less The Monopoly Project would have yielded if an investment was acquired in an outlying area of the East Valley (Queen Creek, San Tan Valley, East Mesa) Vs. outlying areas of the West Valley.

At the end of the day, I argued (mostly unsuccessfully ranted) against buying a home in Laveen as an investment. I thought the crime in the area would suppress rents, and would also negatively impact the future asking/sale price, days on market, and seller concessions when the holding period ends. Shortly thereafter, The Monopoly Project made an offer on a house in Laveen.

Jim called me a few days later to share some interesting news:

https://themonopolyproject.com/laveen-house-riddled-with-bullets/

I’m not going to lie; I was very surprised that the Laveen house had been shot up. Quite a coincidence, or just the same old story?

Glad nobody was home at the time… and I’m glad The Monopoly Project passed on that house.

I hope we’ll have better luck with the other Laveen house.