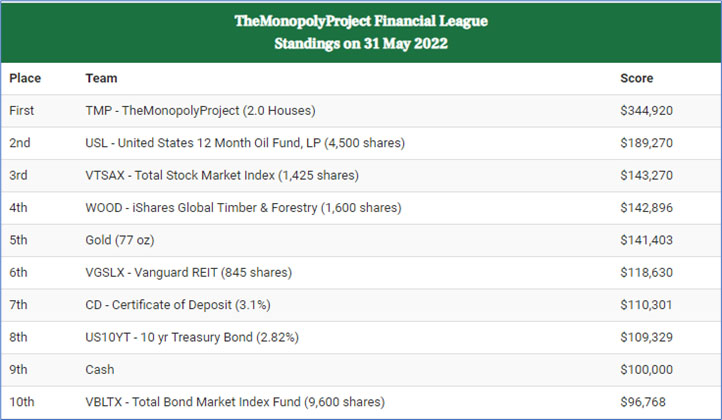

We are up $13K from last month.

Oil stayed in 2nd place thanks to the ongoing international crisis in Ukraine. Oil has the distinction of going the lowest ($47,900 in April 2020) during the initial stages of the COVID panic and coming back the highest. And the stock market is hanging in there. We can’t say that for the bond fund. It lost money compared to $100,000 cash in your sock drawer!

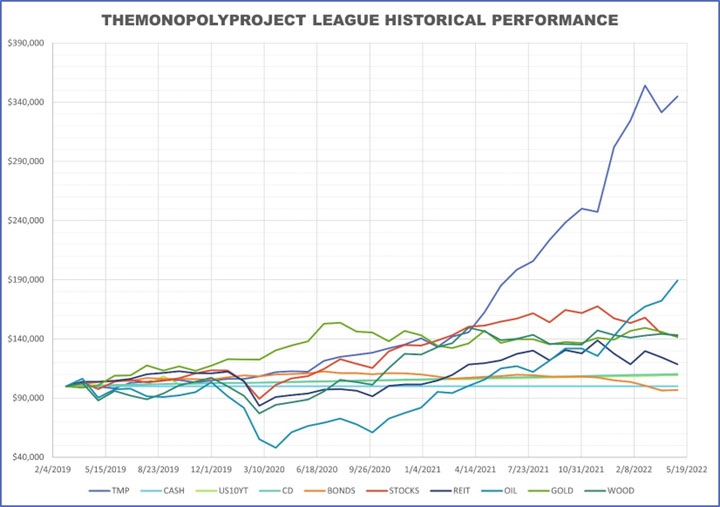

Note that we have also added the historical record for all TheMonopolyProject investment options on our “Historical” page. Here’s what it looks like today going all the way back to the inception of TMP in March of 2019. Note that we regained some of the “losses” from our spreadsheet mistake explained in “Our April 2022 Standings – Beware of Large Spreadsheets”.

TOTAL ASSETS = TMPbank_Account + TMP_Valencia

+ TMP2bank_Account/2 + TMP2_29th/2 + TMP2_Crismon/2

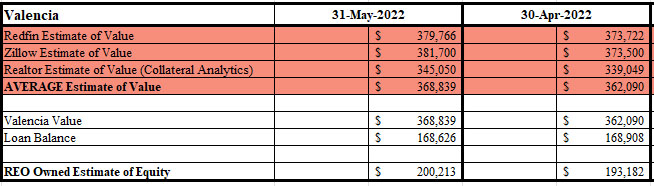

Valencia increased by $7K. The increases have slowed, but prices are still going up.

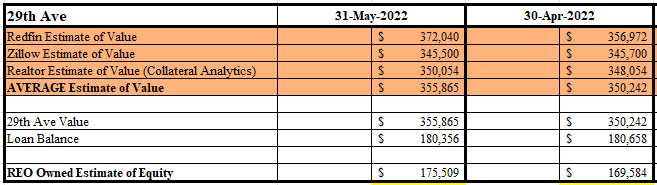

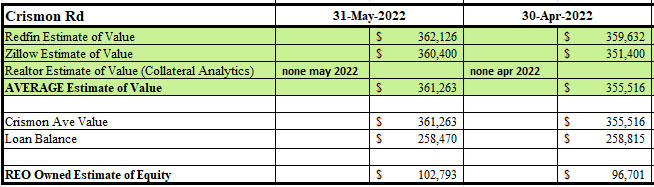

Our latest TMP2 property, a condo on Crismon Rd in Mesa, AZ was purchased on 14 January 2022. It shows a $6K gain over last month.

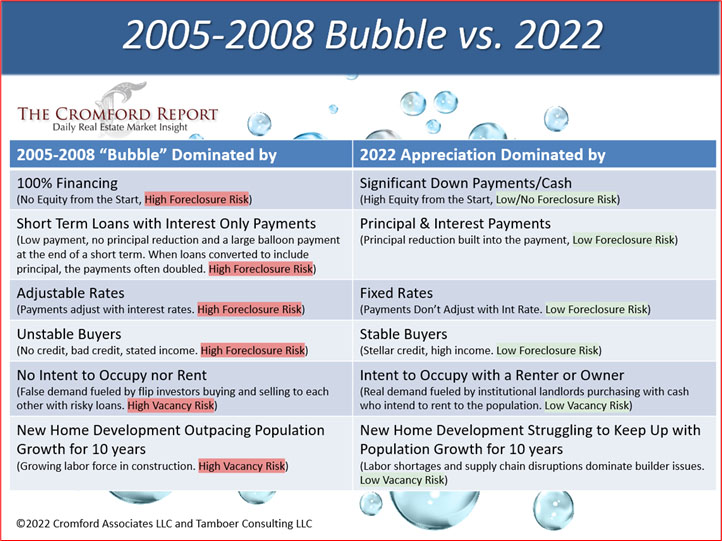

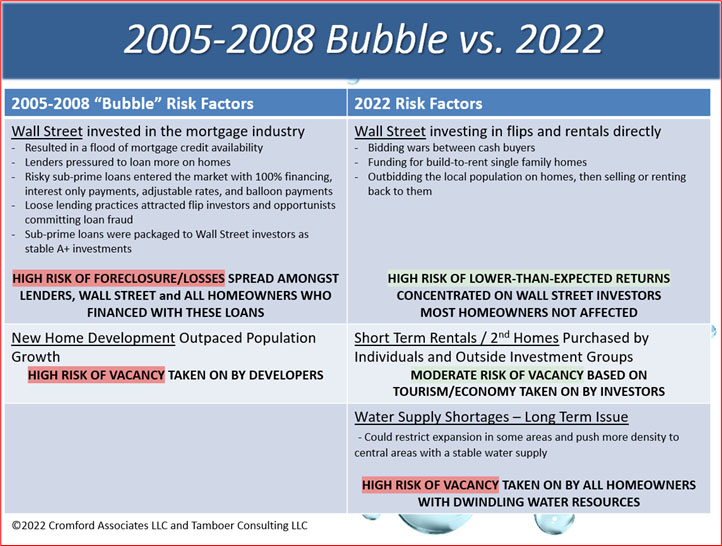

We are often asked if we’re headed for another crash like in 2008. We think not. We think that real estate prices will continue to increase, although at a slower rate than in the past three years. As usual, you can find “experts” on either side of the argument. Here’s one we particularly trust on our side, the Cromford Report:

“Ten reasons why there is NOT a bubble in Phoenix housing right now:

Two key slides explaining why 2022 is NOT 2008 from their May 2022 report:

If you into real estate, read the ‘free’ Cromford Report. Even, better, subscribe to get all the inside information.

Here’s one the other side of the argument “The 2022 Real Estate Collapse is going to be Worse than the 2008 One, and Nobody Knows About It”.

‘Just Jeffs’ latest update:

From Phil Ware’s Verseoftheday:

Thoughts on Today’s Verse…