Well, we completed all the transactions: one sale, one refinance, three purchases. TMP now owns four houses, two fully owned, four half owned with TMP2.

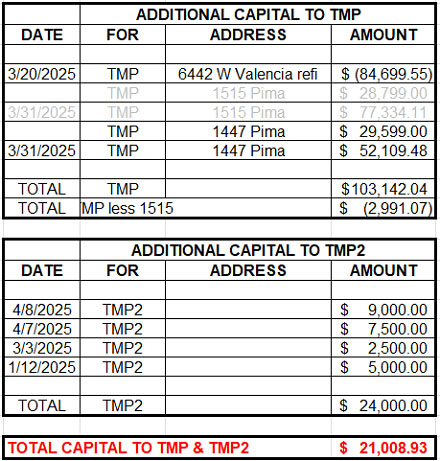

During the selling, refinancing and buying, we had to add $20,000 additional capital to TMP/TMP2.

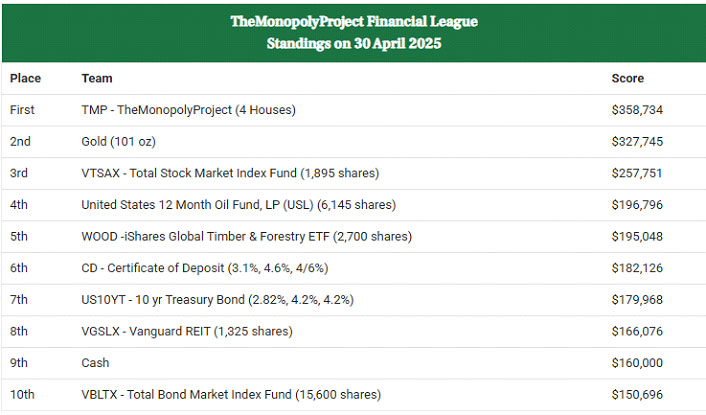

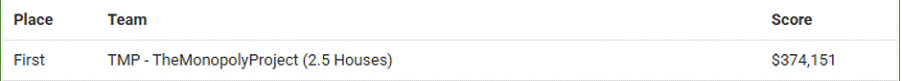

Last month we had an estimated equity of $374K, now we’re at $358K even after adding $20K? How did that happen?

Transaction costs. One major weakness of real estate as an investment is that the transaction costs are high; very high; like 4 – 10 % per transaction. Transaction costs are basically zero for the other investment opportunities. Estimates for transaction costs on a real estate sale are 8%, on a real estate refinance 4%, and on a real estate buy 4 -6 %.

So a rough estimate assuming each transaction was $300K, close enough, is 8% sell, 4% refinance, three times buy at 5% = $81K in transaction costs! Later we will do an estimate of actual transaction costs.

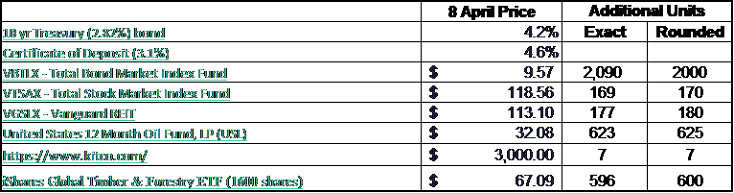

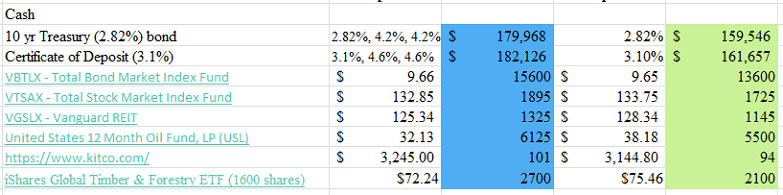

We did add an additional $20K to each investment at the April 8th value. This resulting in the additional rounded units as below. The 10 yr Treasury and CD rates were at the same level (4.2%, 4.6%) as our last addition of capital. Save

The new total units are blue below, as compared to before in green/yellow.

Note on we bought an additional house; 1515 W Pima Ave, a story for later.

Now is probably a good time to list the negatives of real estate as an investment.

⦁ Takes a “lot of capital’ to get into,

⦁ Takes personal expertise and knowledge,

⦁ High transaction costs,

⦁ Management costs,

⦁ Long Time to see results,

⦁ All of the “advice” you hear ⦁ says don’t do it, be safe, buy mutual funds…

And here is a response to the negatives:

⦁ Takes a “lot of capital’ to get into, You already did it by buying your first home, you did? Then buy another, using owner financing while keeping the first, ‘wash, rinse, lather, repeat, repeat; at least four times; then you own 5 houses…

⦁ Takes personal expertise, this is good, build skills, you need them anyway, basic skills for life…

⦁ Transaction costs, True, transaction costs are an issue. But over time, they are much less significant.

⦁ Management costs, do it yourself and learn (see #2), you will come to appreciate good property managers, roll it into the cost of ownership, management fees are a usual expense in commercial real estate which is where you are headed…

⦁ Long Time to see results, That’s life, how long does it take to see your children as successful adults…

⦁ All of the “advice” you hear says don’t do it, be safe, buy mutual funds… don’t listen to experts for normal life things, they don’t know any more than you and are only looking out for their own best interest (not fiduciaries), live you own life.

And I got a Yahtzee in one roll, all sixes!