Previously, we explained how we got a loan from “The Bank of Michelle” to finance the purchase of our first TMP house when the lender could not meet the close date.

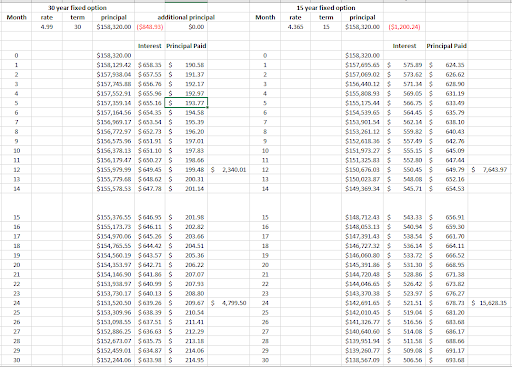

Here’s the comparison of using a 30-year fixed loan at 4.99% versus a 15-year fixed at 0.625% less. The rate differential is per Wells Fargo as of that time. The absolute values don’t matter for this analysis; the difference (lower for the 15-year) is what is important.

At the end of year 1 (12 months in the figure above), you will have paid down $2,340 for 30-year loan versus $7,643 for the 15-year loan. The difference is the higher interest rate on the 30-year loan. Similarly, at the end of year 2 (24 months in the figure above), you will have paid down $4,799 in the ‘additional principal’ 30-year loan or $15,628 for the 15-year loan. Obviously the 15-year loan is better financially but you are locking into the higher monthly payment no matter what happens.

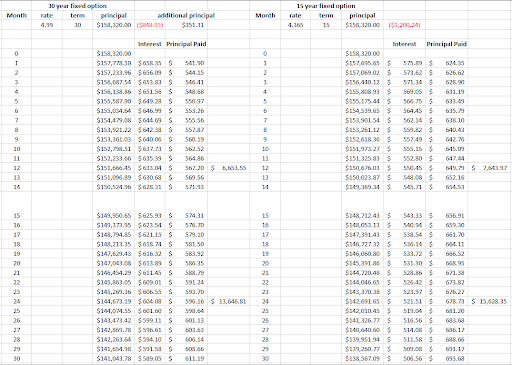

There is another option besides taking the 15-year loan. The issue with the 15-year loan is that you are locked into the $1,200/month payment regardless of what happens, whether good or bad. What if you took the 30-year loan but paid the additional principal, voluntarily, that you would be paying on the 15-year loan. Now you are not locked into paying the $1,200/mon if something, good or bad, happens.

At the end of year 1 (12 months in the figure above), you will have paid down $6,653 in the ‘additional principal’ 30-year loan or $7,643 for the 15-year loan. Close. The difference is the higher interest rate on the 30-year loan. Similarly, at the end of year 2 (24 months in the figure above), you will have paid down $13,646 in the ‘additional principal’ 30-year loan or $15,628 for the 15-year loan.

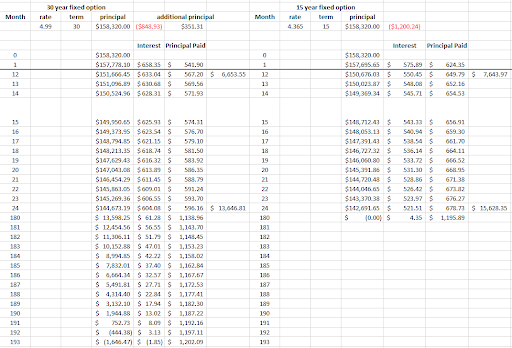

The 15-year loan pays off in 180 months, 15 years. When does the ‘additional principal’ 30-year loan pay off? I’ve hidden some rows below to reveal the answer.

The ‘additional principal’ 30-year loan pays off in month 191-192, just at year 16. So, you have made your 30-year loan into a 16-year loan by paying the additional principal as if it were a 15-year loan with the lower interest rate. The advantage you got was to not be locked into the additional principal payment.

And what’s the total interest paid in the two scenarios? $71,682 for the 30-year, now 16-year loan and $57,723 for the true 15-year loan. You’re paying $13,959 additional over 16 years for the risk reduction of not having to make the additional principal payment. That is $872.44/year or $72.70/month.

Is it worth it?

It depends on your circumstances. If you are in a strong equity position and the risk of having to not make the additional payment is low or zero, then take the true 15-year loan. Otherwise, you can consider the ‘additional payment’ 30-year loan option. But I don’t think it will work in the real world, for the same reason that I stated in a previous post:

But human nature being what it is, virtually no one does this. We need to stop treating humans as financial robots who optimize purely financially and admit that their human nature overrides financial optimization.

Yes, I know this is heresy; but it is the truth and ‘you can’t handle the truth’.

There are lots of articles and advice on ‘additional payment’ strategies. Here’s one:

https://www.americanfinancing.net/saving-money/extra-mortgage-principal-payments

So, conversely, what are the alternatives (instead of making extra principal payments) and what could the benefits be?

- 1. Pay off credit card debt

If you’re having a hard time with credit card debt like many Americans, it’s more than likely you don’t have enough available cash to commit to paying extra on your mortgage. Your credit card rates are going to be significantly higher than your home loan interest rate so it makes sense to tackle credit card debt first. Credit cards typically carry the highest cost to borrow with an average variable interest rate of about 16%.a

- 2. Refinance to a lower rate

This may sound strange to skip paying extra principal and refinance your mortgage instead, but it could prove to save you more and still let you keep the extra money you’d pay toward your principal for other alternatives. The idea is that you may be able to lower your current rate without resetting your term. Your breakeven point could also end up being sooner than you think. Talk with a mortgage professional to see if this might make sense for your situation.

3. Build up a rainy day fund

Save for an emergency. We recommend setting aside 3 to 6 months worth of living expenses in savings just in case you lose your job or incur unexpected costs. Without those financial reserves in place, you could put your mortgage in jeopardy, which includes the extra money you worked so hard to put toward it if you’re making extra mortgage payments

4. Invest in the market

You could stand to make more money by using additional principal payments and investing that money instead of depending on how long you plan to stay in the home. “You’d be better off putting an extra $200/month in an IRA,” says Sullivan.

Consider how long you plan to stay in your home. If you won’t realize the benefit of making extra payments before you plan to sell the home, investing what you would have paid extra might be a more wise choice.

“In a low-interest rate economy, mortgage rates are assumed to be at least a couple percentage points lower than what a moderate risk investment portfolio is likely to earn,” says Tedstrom.

My comment on the four options above are:

- Pay off credit card debt: Absolutely, you should have already done this per Dave Ramsey, specifically; the Seven Baby Steps. He also has a page on paying additional principal.

- Refinance to a lower rate: Absolutely, but why not refinance to a lower rate into a 15-year mortgage; double the benefits. Dave Ramsey agrees: “If you currently have an adjustable-rate, interest-only or even 30-year mortgage, consider refinancing to a 15-year, fixed-rate mortgage.”

- Build up a rainy day fund: Absolutely, see Dave Ramsey’s Baby Step 3. If you haven’t done the ‘baby steps’, you’re not ready for a TMP of your own.

- Invest in the market: Not necessarily. This will be the subject of a future blog post.

Out of curiosity, what would it take to make the 30-year loan into a 15-year loan? A bit of fiddling with the spreadsheet shows instead of the $351.31 true difference between the payments, you would have to pay about $405/month, so about $55/month extra due to the interest rate difference.

Next Sherman will report on how he rented the house so quickly and we will analyze the rental income part of the equation.