Last time we explained how we found “The Perfect Monopoly” house in Apache Junction, made an offer and lost. We came in second. Then we made the offer on a house in Casa Grande that we thought could be “The Perfect Monopoly” house, made an offer and won. But it turned out to be a disaster. We canceled the deal but not before spending $400-$500 on inspection fees. More on those deals later.

Finally, last week we thought we found another “The Perfect Monopoly” house on the same Avenue in Apache Junction. We made an offer and made sure we won. We had a strategy session where we reviewed the repair list line by line and decided which we would have fixed, which we would fix ourselves and which would be leave be and just live with.

Using the above strategy session results, we negotiated a credit from the seller:

Now we’re done with all that and close of escrow is only five days away with Valentine’s Day and the Federal holiday ‘President’s Day’ in between.

So, we got together to settle all the accounting and plan our repair campaign.

When we started looking at houses as partners, we did not have a legal entity (LLC) so we did not have a bank account. We had to pay the various fees personally or with funds from other entities such as TheMonopolyProject LLC. After we successfully formed “TheMonopolyProjectTwo LLC”, got an EIN from the IRS; we opened an account at Chase Bank with the two of us co-owners.

Today was the time to settle the advances made on the house closing on Tuesday the 16th and the house in Casa Grande that we had our offer accepted but rejected after the inspection showed major problems (more on that later). Plus, we both needed to transfer the funds for close of escrow based on the draft Closing Statement.

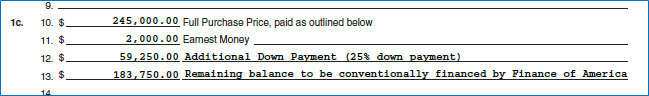

So Jim owes $30,000 and Jeff owes $25,695. Why less for Jeff? Because Jeff is contributing his commission of $6,150 (2.5%) as the buyer’s agent, less taxes, to cover some of the closing costs. We figured a marginal Federal plus State tax rate of 30% so Jeff’s contribution is decreased to $4,305. He retains the balance to pay the federal and state taxes on his income.

We had a side discussion on the source of funds for the down payment. Lending institutions are now incredibly careful to ascertain the source of funds for the down payment. They want to ensure that there are no additional liens on the principals as would be true if you “borrowed” the down payment from Uncle Louie or a loan shark. We wanted to ensure that it would be legitimate to transfer our personal funds to “TheMonopolyProjectTwo LLC”, then to escrow. So, we called our super competent Loan Agent Brian Szabo to get the verdict:

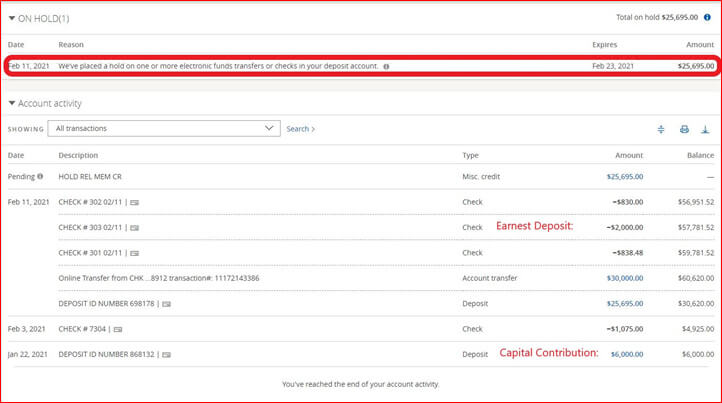

Jim does an online transfer of $30,000 from “TheMonopolyProject LLC” to “TheMonopolyProjectTwo LLC” so that the house will be half owned by “TheMonopolyProject LLC”. Jeff planned to do a wire transfer from his personal bank but they convinced him to use a cashiers check to save the wire fee (typically $35). When he deposited it at “TheMonopolyProjectTwo LLC” account, Chase told him there could be a hold of a week or more! Apparently cashier’s checks, even from a major national bank, are no longer ‘good as cash’. We have a backup plan but are still counting on the check clearing before we need the funds.

The initial $6,000 deposit is the capital contribution to fund the LLC: $3,000 from each partner. The ‘Online Transfer from …” is Jim’s contribution. The ‘DEPOSIT ID NUMBER 698178’ is Jeff’s contribution. Checks #302 and #301 are various fees and costs personally paid before we setup this entity/account. Check #7304 is a down payment for the work that will be done by Bill of “Southwest Home Tenders, LLC”. Check #303 is reimbursement for the ‘Earnest Money’ as called for by the contract:

Price was increased to $246,000 per our effective use of the escalation clause:

Next, we see if the cashier’s check clears by Tuesday morning the 16th.