WE BOUGHT THE HOUSE ON 29th AVENUE IN APACHE JUNCTION!

Previously we explained how we found “The Perfect Monopoly” house in Apache Junction, made an offer and lost. We came in second. Then we made the offer on a house in Casa Grande that we thought could be “The Perfect Monopoly” house, made an offer and won. But it turned out to be a disaster. We canceled the deal but not before spending $400-$500 on inspection fees. More on those deals later.

Finally, last month we thought we found another “The Perfect Monopoly” house on the same avenue in Apache Junction. We made an offer and made sure we won. We had a strategy session where we reviewed the repair list line by line and decided which we would have fixed, which we would fix ourselves and which would be leave be and just live with. So, we got together to settle all the accounting and plan our repair campaign.

On the morning of the 16th, we signed all the papers at close of escrow:

There were a few glitches, as there is in any deal:

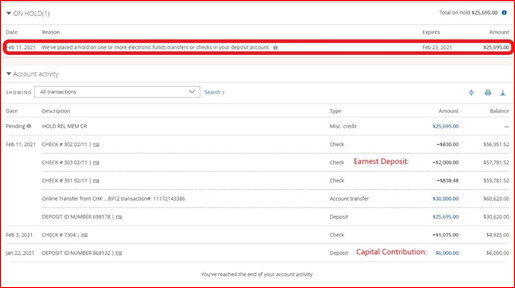

- Jeff’s cashier’s check is “ON HOLD”.

- We are short on funds because our previous accounting was incorrect and we learn that for a loan of this type, you cannot have more than a 2% ‘contribution’.

- Two small items were not credited.

We were concerned that the ‘hold’ would not be released in time to transfer the closing funds to the escrow company on Tuesday morning. We checked the account before the close of escrow on early Tuesday morning, and the funds were released! We had a backup plan but fortunately didn’t need to use it.

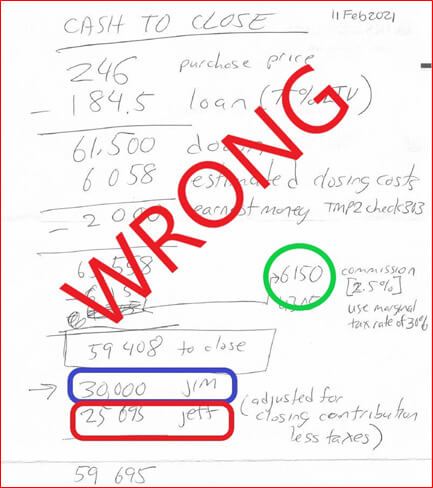

SHORT ON FUNDS: Our initial estimate was that we would need about $56,000 additional funds to close. The actual amount was a little over $60,000 for two reasons. One, our accounting on contributions (blue and red rounded rectangles) was wrong.

We will explain later on why this is wrong and what the mix-up was. In addition, we had planned to apply Jeff’s $6,150 commission (see green circle) to the escrow. Besides accounting for it incorrectly, we also ran into a “contribution” limit as explained by our loan agent, Brian Szabo:

We have to make an adjustment to the final funds to close due to a Fannie Mae guideline that we can’t get around. My sincerest apologies, as I missed that for an investment property the maximum interested parties contribution is capped at 2% of the purchase price (primary residences and second homes are 6% so it’s never an issue). The seller is already contributing $2,750, therefore, the maximum amount of Jeff’s commission that we can use towards the rest of the closing costs is $2,170. The closing costs did come in much lower than my original estimate at $5,492.49.

[,,,] It’s very uncommon to have both seller credits and commission credits on an investment property purchase, but I still should have caught it so it wasn’t a last minute change.

Since we were short on funds in the TMP2 account, we transferred funds from TMP temporarily to cover the wire transfer using the backup plan discussed above:

…and completed the wire transfer to escrow:

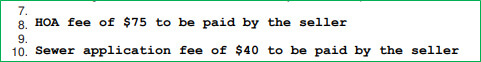

TWO SMALL ITEMS NOT CREDITED: As we were reviewing the last of the closing documents, we noticed a new charge; for a HOA transfer fee and a sewer service fee. We had previously agreed with the seller, that they would cover those two fees. Although they only totaled to $115, Jeff did an addendum (#4) to the contract to correct the error.

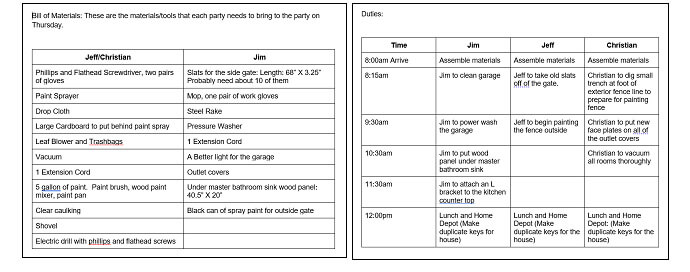

Here’s the “Punch List” that Jeff created to plan our work at the property.

Next, we will show you the work at the property, we’ll explain the accounting error and settle up the accounts.