This is the second in a series on how to buy a house. What are the steps? What are the decision points? What documents will you send and receive? What should you pay attention to? And most important what can you ignore?

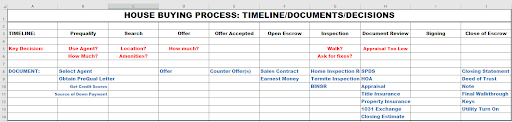

Previously we introduced the series and showed this spreadsheet that explains the house buying process; line by line, column by column and address all of the elements of buying a house. This includes the TIMELINE, the DOCUMENTs you receive and/or are required to provide, and the KEY DECISIONS in the process. We will tell you what is important, what is REALLY important and ‘what you can safely ignore’

We’ll start at the very beginning (cell B5 for you Excel aficionados). Should you use an agent? Some might argue that you should start with “How Much?” (cell B6) so you know how much house you can afford to buy. We recommend picking your agent first so that he or she can guide you through the “how much?, obtain prequal letter, get credit scores, document source of down payment” steps. For a first-time home buyer, these can be intimidating. Having a trusted, knowledgeable, experienced person at your side will significantly decrease your stress level and help you make better decisions.

So, what kind of agent? Or no agent at all? We sold real estate without the services of an agent. Should you?

ABSOLUTELY NOT: As we explained in one of our very first posts, TMP recommends that first time buyers should use a full service agent:

Four reasons:

- We have lots of other stuff to do; SO, DO YOU.

- The broker/agent does your work for you. You specify the criteria. They do the work.

- A broker/agent knows all the legal/regulatory/disclosure/scams in the industry. They will advise and protect you against these.

- Using a broker/agent is the best way to start. When you get experienced, you can explore other options.

How do you go about selecting an agent? First of all, don’t pick your brother-in-law, your brother, your pastor (unless his name is Jeff Sutherlin) or anyone else based on a personal relationship. This is the largest financial transaction you will be involved with. You need an expert, not a friend or relative.

Dave Ramsey, as usual, has good advice. Do get references from friends or coworkers who recently bought a house. But be careful of their recommendations, other people probably have different expectations than you.

Also note that you are signing an ‘agency agreement’. The real estate agent is acting as your ‘agent’. Duh! But ‘agency’ necessitates several important criteria on the part of the agent; all enveloped by the principle that your agent acts in your best interest; not their best interest.

Here’s a minor example of not acting in our best interest. When we bought our current house over 20 years ago, the agent presented an offer which was countered. We asked the agent to deliver our response back that evening because we were concerned about other buyers and offers. She said she would do it tomorrow since she had a kid’s soccer game that evening. We immediately called her broker and had her replaced. The broker delivered the counter-counter offer. Much as I understood the importance of the soccer game to her, she was not acting in our best interests.

Jeff gives some valuable advice on the criteria to select an agent in this video:

Thank you, Jeff.

And note that Jeff makes the important point, that “the buyer controls the decisions, but the agent controls the process.” The agent’s control (or not) of the process almost cost us our house in the example above.

You can see all of Jeff’s informative videos at https://www.youtube.com/channel/UCXa3M6RxV0n4j5mqXiJcRNg