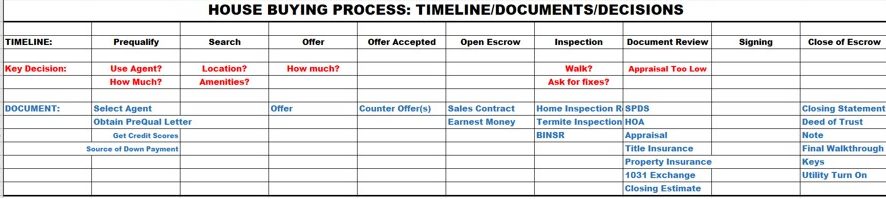

This is the third in a series on how to buy a house. What are the steps? What are the decision points? What documents will you send and receive? What should you pay attention to? And most important what can you ignore?

Today we will discuss “the Prequalification Letter”; see B9 in the spreadsheet below. We’re stepping through the various elements of the process/timeline.

Before we bought TMP house on Valencia in June, the last single family home (SFH) we bought was a cabin on the East Verde River north of Payson.

That was in 2005; 15 years ago! When we started TMP and I started working with Jeff, our outstanding real estate broker, I was surprised by how much had changed in the buying process for a SFH in those 15 years. Although we had done several commercial real estate transactions including loan refinances, two apartment complex purchases, and even several commercial loan renegotiations, the process was different. As an example, Jeff informed me that I “needed” a prequalification letter to be taken seriously by the buyers.

“Nonsense”, I thought. “I have great credit. I don’t need no stinking prequalification letter.”

Alas, I do need a stinking prequalification letter. Jeff is right again.

Here’s Jeff explaining the prequalification process that significantly enhances the probability that your offer will be selected if there are multiple buyers.

Jeff is correct (as usual) that the prequalification process is critical to convincing the seller that you are a serious buyer and that you, as compared to all the other offers/buyers, will complete the transaction. This certainty is critical to the seller especially if they are buying another property (or doing a 1031 exchange in a commercial deal) and need to be certain that this deal is completed on time.

You can see all of Jeff’s informative videos at https://www.youtube.com/channel/UCXa3M6RxV0n4j5mqXiJcRNg