In his last post, Ryan compares two Phoenix neighborhoods, ‘85031 – Maryvale’ and ‘85212 – East Mesa’ to ask which is the better investment.

I appreciate Ryan’s insight and detailed knowledge of the phoenix housing market. His detailed and specific knowledge of the ancillary elements (demographics, growth patterns…) allows him to discern trends in advance of the market.

I also agree with his seven step “house hunting process’ and his six step “desirable neighborhood criteria”. I would note that a simplification of the process would be just to go to step 3, “Good schools”. That criteria pretty much predicts or is correlated with all the others. When we first moved to the East Valley area of Phoenix from California in 1998, we asked everyone, “What is the best school district in the East Valley?” The universal answer was, Ahwatukee, the Kyrene school district. We didn’t end up buying there, partially due to dynamite, but that’s a different story.

And I acknowledge that Ryan expressed discomfort with the Laveen area when we first set our search criteria for TheMonopolyProject. He expressed concern about the area even before we found the ‘shot up’ house.

But I disagreed with him then, and still now for at least two reasons.

1. Nobody can predict the future, ‘which will do better’, even the wisest man ever. God asked King Solomon to request anything he wanted.

1 Kings 3:5 ‘At Gibeon the Lord appeared to Solomon during the night in a dream, and God said, “Ask for whatever you want me to give you.”’

King Solomon requested “wisdom”.

This is what King Solomon says about ‘knowing which will succeed”:

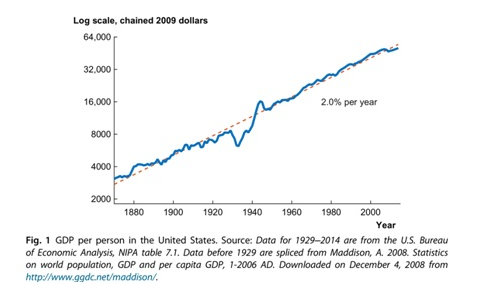

2. President John Kennedy famously said in the a 1963 speech that ‘a rising tide raises all boats.’ He was and is correct. As the general market rises, all submarkets rise. This is the basis of TheMonopolyProject. Here is a graph of GDP per person over the last 160 years:

Note how GDP reverts to the 2%-per-year-mean-increase through recessions and even after the “Great Depression” in the 1930’s. The subcomponents of GDP will do the same. So, the fear of a recession shouldn’t concern a long-term investor. When the recession comes, house prices go down, and it’s a buying opportunity.

Paraphrasing Warren Buffett, “You like hamburgers, right? You should be happy when they go down in price”.

And the Laveen market is (still) hot: