Our results to date are reported on a monthly basis on the “Score” table on the Home page. We give you the current total value of TheMonopolyProject (TMP) as a combination of cash held (bank deposits) and the estimated equity of the real estate owned (= estimated value minus liabilities).

To determine how well TMP project is doing we compare it to the other financial investments we could have made with the $100,000. This is known as the ‘opportunity cost’. Note that we could also consider other, non-financial investment uses for the $100,000. We will discuss that later. Life is not all about optimizing financial outcomes in this kingdom.

We started TMP on March 1, 2019. On March 1st, 2019, all 10 investments started at the same nominal value, $100,000.

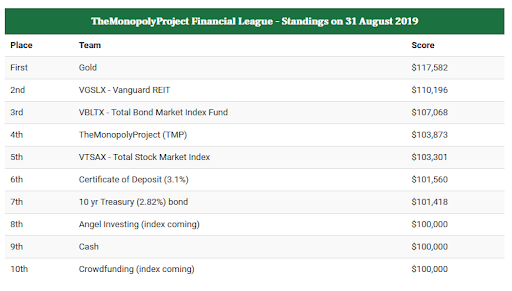

Now that August is completed, we have our results, the “Standings”. It’s easiest to think of this as a football or baseball sports league: The Financial League. We’re one of ten teams competing for number one in the league.

‘Gold’ is still #1 and on fire. Gold is still benefitting from the recession worries and the China trade ‘war’.

Where are we?

We’re moving on up. We’re in 4th place! We jumped up one slot, just barely edging out VTSAX, the broad-based stock fund, which had a down month due to China trade war worries.

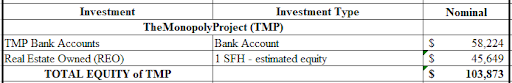

TOTAL EQUITY of TMP is ‘Bank Account’ + ‘estimated equity in 1 SFH’ = $103,873

Here is the accounting for August 2019:

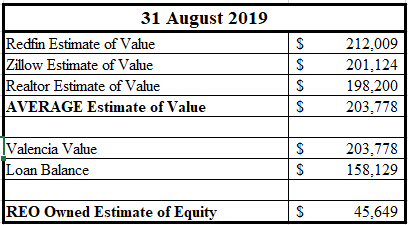

How did we get to the ‘estimated equity’ of $45,649 for the month of August?

We used the arithmetic average of the three websites (Redfin, Zillow, Realtor.com).

Since July, we went up $1,545 (= $203,778 – $202233), about 0.764% for the month, about 9.56% annualized. The market is still hot in Phoenix.

And again, why is Redfin so much higher?

IDK.

And, as an aside, the realtor.com estimate went down. I’m not sure if that is my error or real. But we accept these estimates as proxies to the real world.

For now, we’ve moved up into 4th place. This is how we foresaw TMP performing. We are buying appreciating assets on margin (80% down). We make money on the appreciated value of our down payment money PLUS the value of the borrowed money. With rent collected we paid down, $191 of principal on the loan from the “Bank of Michelle”.