Our results to date are reported on a monthly basis on the “Score” table on the Home page. We give you the current total value of TheMonopolyProject (TMP) as a combination of cash held (bank deposits) and the estimated equity of the real estate owned (= estimated value minus liabilities).

To determine how well TMP project is doing we compare it to the other financial investments we could have made with the $100,000. This is known as the ‘opportunity cost’. Note that we could also consider other, non-financial investment uses for the $100,000. We will discuss that later. Life is not all about optimizing financial outcomes in this kingdom.

We started TMP on March 1, 2019. On March 1st, 2019, all 10 investments started at the same nominal value, $100,000.

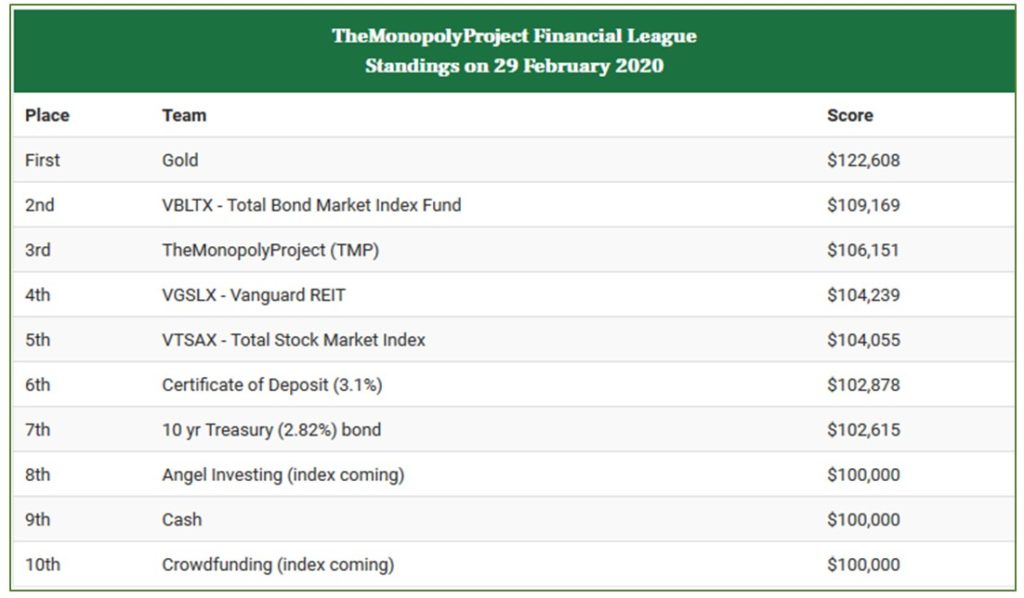

Now that February 2020 is completed, we have our results, the “Standings”. It’s easiest to think of this as a football or baseball sports league: The Financial League. We’re one of ten teams competing for First Place in the league.

‘Gold’ is solidly in First Place.

But TheMonopolyProject jumped to 3rd place.

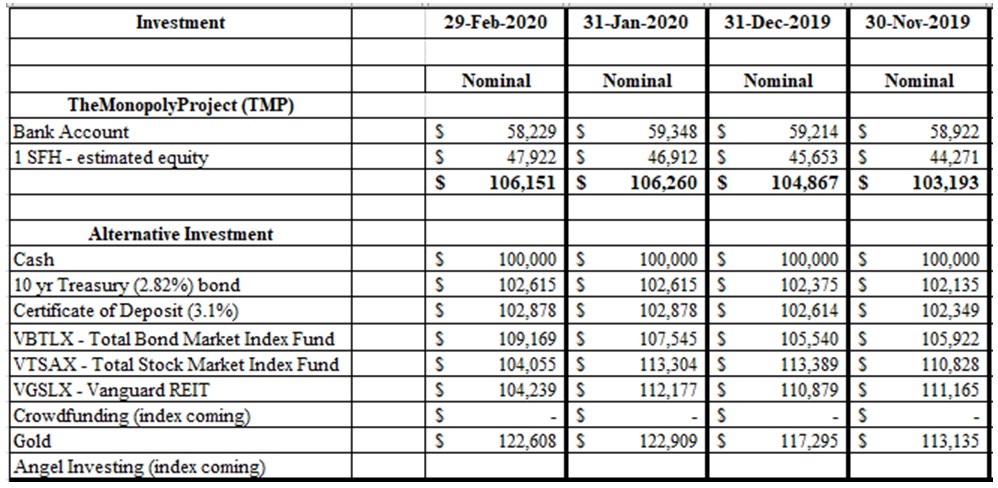

How did we accomplish that? Mostly by the other, equity investments (stocks, REIT) falling due to the ‘end of the world’ CoronaVirus. The Bond investment jumped up to second place due to a ‘flight to safety’. Here’s the last four months:

TheMonopolyProject formula for TOTAL EQUITY is:

TOTAL EQUITY of TMP = ‘Bank Account’ + ‘1 SHF – estimated equity’ = $106,151

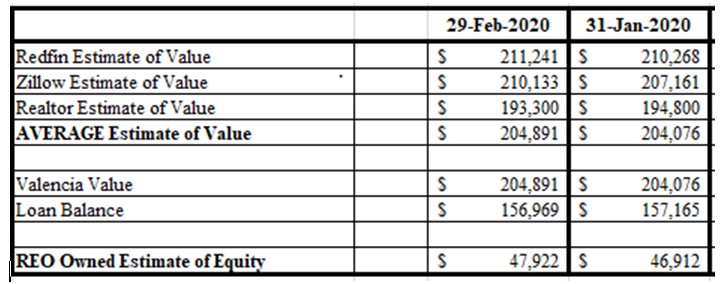

How did we get to the ‘REO Owned Estimate ofEquity’ of $47,922 for the month of February?

We used the arithmetic average of three websites (Redfin, Zillow, Realtor.com) that estimate home values.

Note that both the Redfin and Zillowestimatesincreased; Zillow significantly. TheRealtorestimate actually decreased slightly. I’m not sure why. was unchanged.But we are inching ahead, month by month. This is a long-term project.

A couple of more notes on cash in the bank and our bond rate calculation:

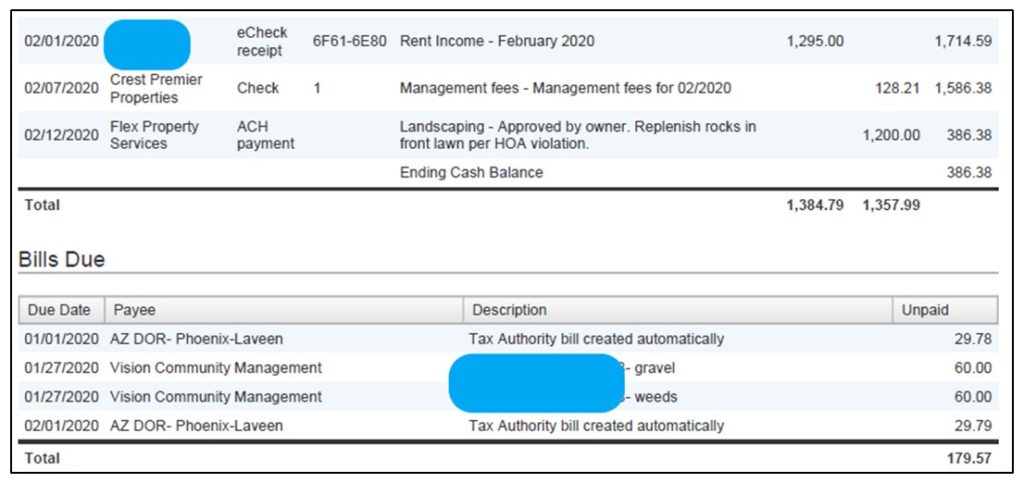

1. “Cash in the Bank” – You will note that the cash in our bank account decreased by about $1,100 from January. We got hit with two HOA fines for $60 each (‘gravel’, ‘weeds’) and had to spend $1,200 to replenish the rocks and pull some weeds. This is a warning that your ‘income’ can easily disappear. Again, TMP is an equity play and we’re not counting on regular income, at least not in the early years.

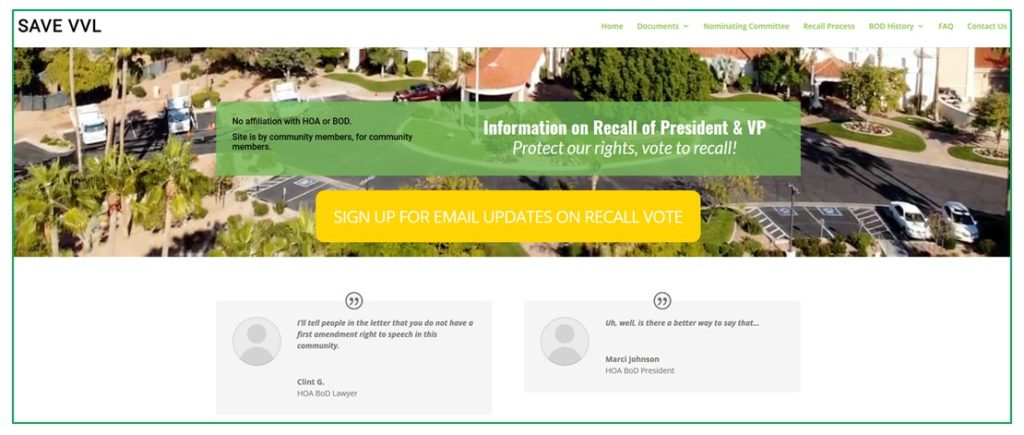

Note that we will have a lot more to say about HOA’s since TMP founder Jim is in the middle of a nationally reported HOA controversy in Val Vista Lakes, Gilbert, AZ. The board (or at least some members) of the VVL HOA paid the HOA attorney to draft a letter threatening nine (?) members with daily fines of $250 for posting ‘negative comments’ about the Board on various social media sites.

The anti-Board site is savevvl.com.

The pro-Board site is https://recallreality.com

Here are a few links to the reports:

https://www.sacbee.com/news/nation-world/national/article239616558.html

https://www.builderonline.com/money/arizona-hoa-wants-to-fine-residents-over-social-media-rants_c

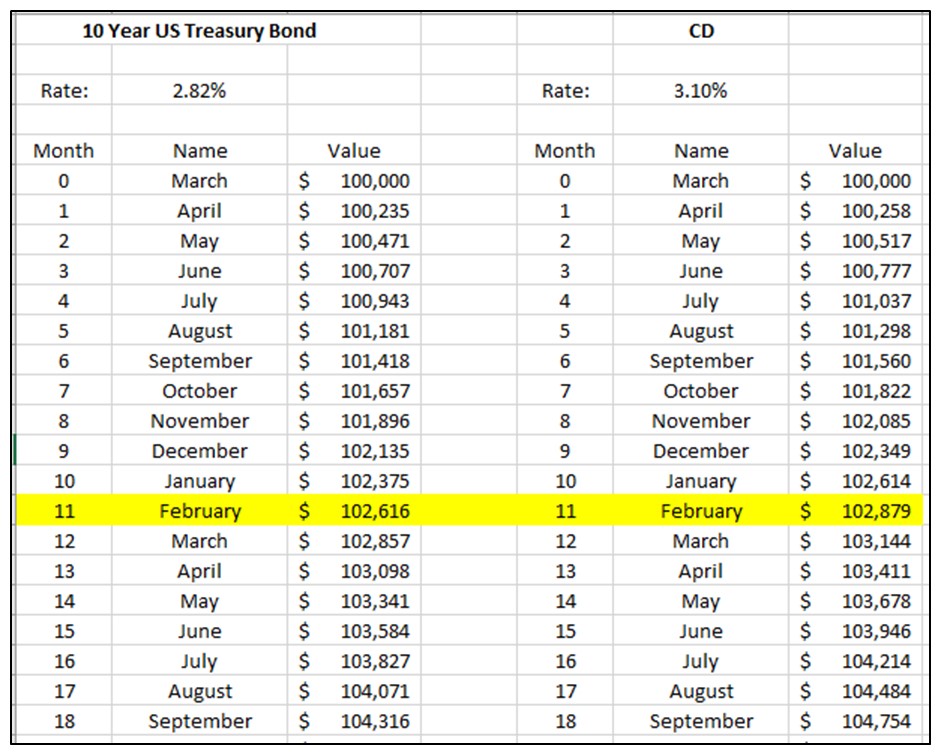

2. “Calculating Bond Values” – If you look carefully at the bond (Treasury Note and CD) above, you’ll see that February and January are identical. We confused the monthly values in the table below (based on an Excel spreadsheet). We are calculating the bond value monthly by taking 1/12th of the stated interest rate. This slightly increases the actual value. The easiest way to see this is to consider the 3.10% CD below. After one year, March 2019 to March 2020, the value would be $103,100. Our calculation below shows $103,144. For purposes of TMP this is close enough since we are looking at the long term trend of the various investment options.