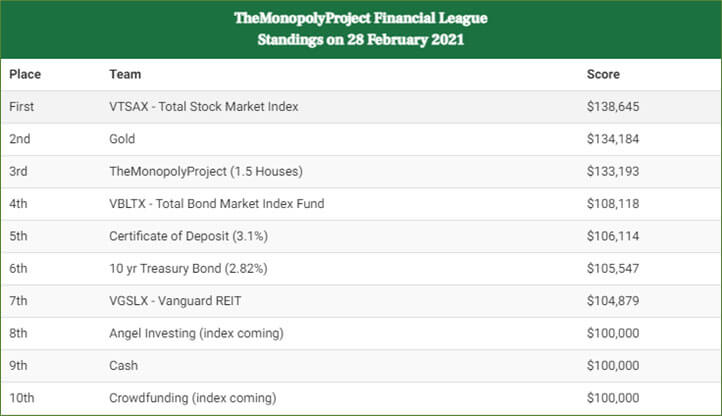

We fell to 3rd place just as we were going to take First Place! How did we let that happen?

Stocks surged! Gold fell, but not as much as TMP because we incurred costs: We completed two major financial actions in February – we bought half a house (in a partnership) and we refinanced our existing Valencia house.

“Gold” finally got knocked off First Place. It has been in First Place since June 2019. Gold fell, stocks surged; so now First Place is held by “VTSAX”, a stock market fund.

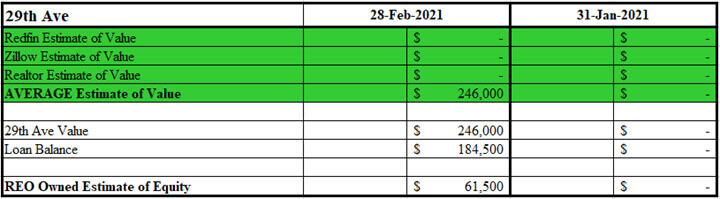

And the big news is that TMP now consists of 1.5 houses. How can we own half a house? We bought half of it with our partner, Just Jeff. We formed an LLC, “TheMonopolyProjectTwo LLC” (TMP2) to hold the real estate and bank account.

And TheMonopolyProject (TMP) turns two years old this month of March 2021. We started in March 2019 and bought our first house in June 2019.

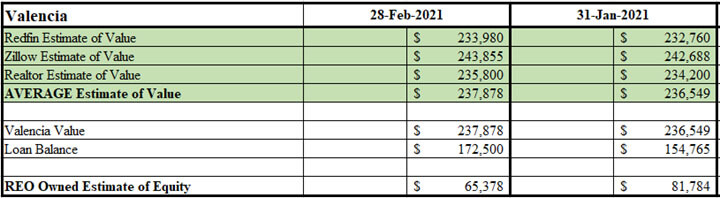

- REFINANCE: We refinanced the house we bought in June 2019 on Valencia Street, Laveen. We bought that house for ‘all cash’ since the mortgage company we were using could not close the loan. We used TMP bank account for the closing costs and ‘down payment’ of 20% and borrowed the rest from the “Bank of Michelle”. We had always planned to refinance the house to pay back the “Bank of Michelle” and possibly extract some of the appreciation without selling the house. We were able to borrow about $11,000 more than the ‘payoff’. We will go into the financial details of the refinance and purchase loans (below) in a separate post. The loan was a $172,500 (75% LTV – loan to value, the house appraised at $230,000), 30 year fixed at 3.5% (3.75% APR) with almost $6,000 in closing costs.

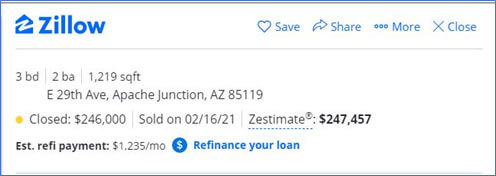

- PURCHASE: We purchased the house on 16 February on 29th Avenue, Apache Junction. The loan was $184,500 (75% LTV, the house appraised at $246,000), 30 year fixed at 3.5% with almost $6,000 in closing costs that were largely offset by a seller contribution and buyer agent contribution.

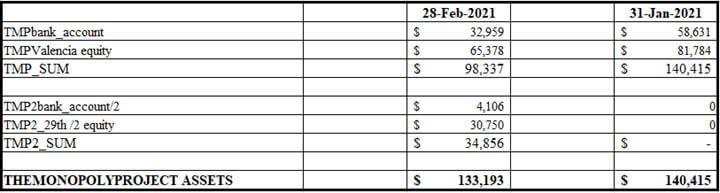

We will continue to use the same methodology to calculate the “Assets” held by TheMonopolyProject. Our formula is:

TOTAL ASSETS of TMP = ‘Bank Account’ + ‘1 SHF – estimated equity’

We will update the formula to include the new TMP2_29th Avenue house; but only credit one half of the value of the house and bank account:

TOTAL ASSETS of TMP = TMPbank_account + TMPValencia + TMP2bank_account/2 + TMP2_29th/2

Why did TOTAL ASSETS go down compared to last month ($140,415)? We incurred costs: costs to get two loans and to “re” the purchased house. The “re’s” included repair, repaint, replace, remove, restore. The costs were offset by slight increase in Valencia house estimate of value contributions to house purchase from a seller credit, and contributions by Jeff allocating the buyer’s commission less taxes to TMP2. Note that extracting the $11,000 from the TMPValencia appreciation does not affect the ASSETS: we put the cash in the bank account, but we have an offsetting amount owed in the loan. Borrowing is not income, although on a cash out refinance it often feels like income. Be careful of this trap.

Note that we carry the ‘estimate of value’ for the new house at the sales price even though Redfin and Zillow already show an increase in value since the sale on February 16th. Also, the cost of “re’s”, about $5,000, is not reflected in the house equity; they are captured in the decrease in the bank account.

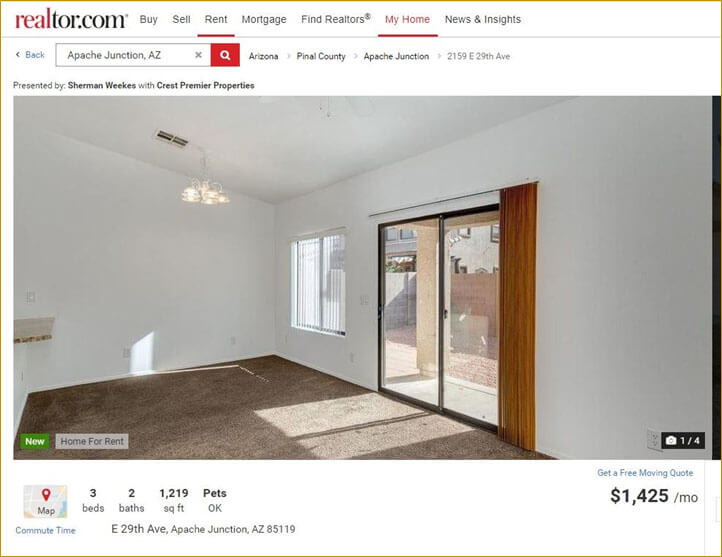

Sherman has listed the house on the MLS for $1425/month:

In the upcoming “Opportunity Cost” review we will look at the two remaining alternative investments: “Angel Investing” and “Crowdfunding” and suggest some changes.