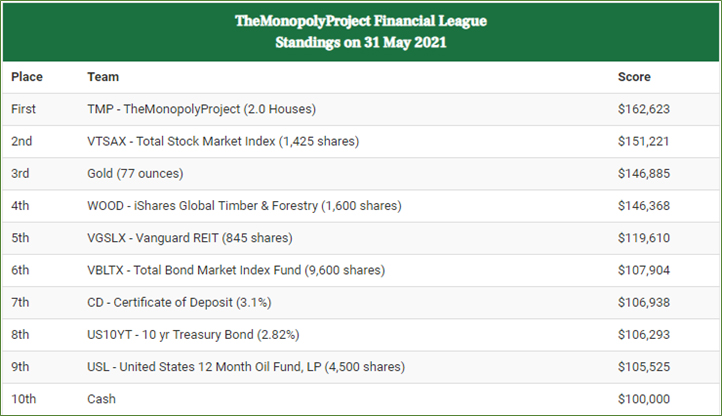

After two years, TheMonopolyProject (TMP) is finally NUMBER ONE!

TheMonopolyProject rocketed to the top with a total Score of $162,623. We easily outscored the stock market (VTSAX), Gold, and even WOOD.

TMP now has 2.0 houses; that is, one house wholly owned (Valencia) and two houses half owned with Jeff; 29th Avenue and Toltec.

TOTAL ASSETS = TMPbank_Account + TMP2bank_Account/2 + TMP_Valencia + TMP2_29th/2 + TMP2_Toltec/2

The dramatic increase in the standings (from $145,609 in April to $162,623) is a result of the increase in value of the two existing houses, Valencia and 29th Avenue.

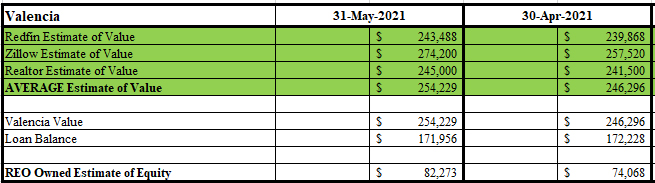

Valencia increased by $8,000:

In fact, Zillow shows it increasing by $16,000 in one month! From $257,520 to $274,200:

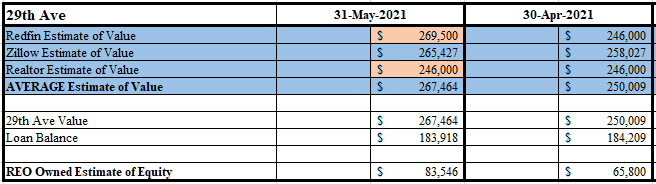

29th Avenue increased by $17,000 due to a slight change in methodology:

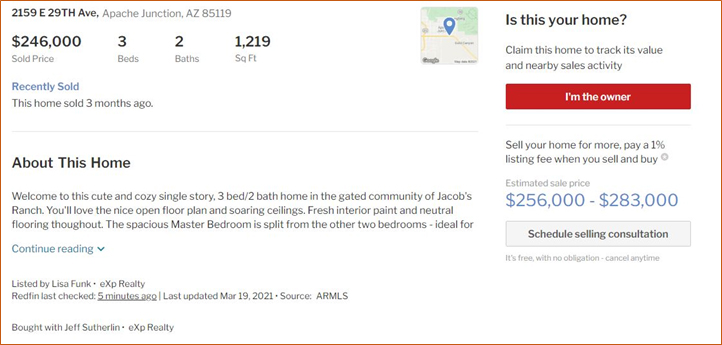

Redfin and Realtor still show 29th Avenue at the sales price of $246,000. Zillow shows an increase from $258,027 to $265,427, about $7,000. We decided to exclude the Realtor estimate as there is not doubt that in this market, we could sell the house for $260-something. Redfin had the following disclaimer:

We took the average of the low and the high and came up with the $269,500. This is consistent with the Zillow estimate and our intuition about the market. So, the $17K increase for all of TMP consists of $8K for Valencia plus $9K (half of the $18K increase) for 29th Avenue.

The new build house on Toltec in Coolidge had no effect because as of now, we took the “Deposit” of $14,100 out of the bank account and put it in our escrow account. We still value the equity of the not-yet-built house on Toltec as the Deposit amount. We explained the methodology in “Start Your Own Monopoly Project – Step 8: As Time Goes By”.

We are not surprised by the massive appreciation in real estate because of our previous post explains that “fiat money, fractional reserve, central banks, Keynesian” systems will inevitably show ‘inflation’ of real assets. You can see the same point made by others in “The Real Estate Boom In Vegas Is More Frenzied Than Ever”.

“In my thesis “Early Speculative Bubbles and Increases in the Supply of Money,” written under Murray Rothbard’s direction thirty years ago, I closed with this:

We expect the craziness to continue, and even increase, in the coming months.