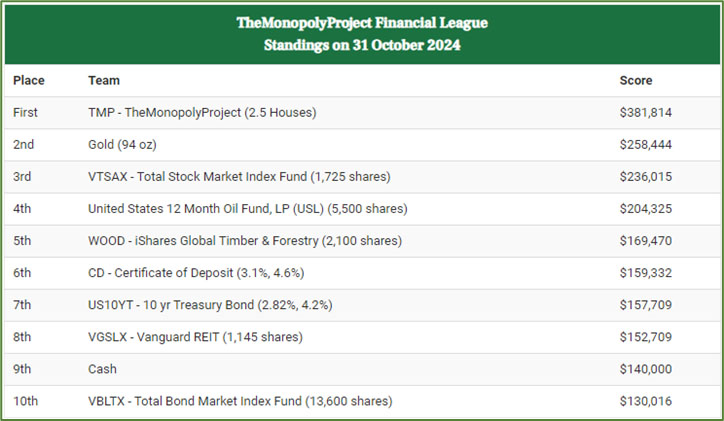

TMP equity was up $8K this month. Stocks, Gold, and Oil are competing for second place with Gold winning this month.

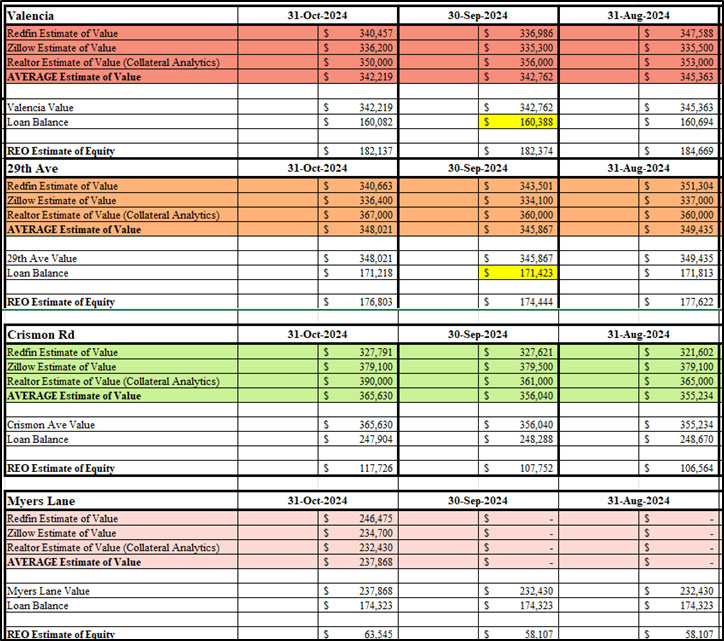

You can see that the estimating websites we use (Redfin, Zillow and Realtor) have started reporting on the value of the new build house we bought in South Carolina. Realtor still shows the purchase price but Redfin and Zillow both show a slight increase.

Jeff and I bought the new construction house a few months ago. Some investors caution against this:

- The delays were ridiculous

- We were overcharged for upgrades because our builder knew we had no other option

- We got stuck with really high property taxes

Our take on these three issues is:

- The delays were ridiculous: If you’re buying to live in, this could be an issue. But we are buying as an investment. In fact, in a rising market, delays help financially since the asset is appreciating.

- We were overcharged for upgrades because our builder knew we had no other option. This is true. Our solution was to absolutely minimize the upgrades.

- We got stuck with really high property taxes. I’m not sure if this is true. Property taxes are typically based on the ‘Fair Market Value’ of the property. All other things being equal, a new build house property taxes should be the same as an existing house of the same value.

Here’s Jeff on the advantages of a new construction buy:

A couple of months ago, we asked, “Name That Horse”.

And we have. We bought two grapevines and put the horse head on a swirling brick pillar.

We call it Black Horse Vineyards. With two vines, we might get a whole bottle of wine next year!