At the End of March 2019

Our results to date are reported on a monthly basis on the “Score” table on the Home page. We give you the current total value of TheMonopolyProject (TMP) as a combination of cash held (bank deposits) and the estimated equity (current market value minus any loans) of the real estate owned (REO).

To determine how well TMP project is doing we compare it to the other financial investments we could have made with the $100,000. This is known as the ‘opportunity cost’. Note that we could also consider other, non-financial investment uses for the $100,000. We will discuss that later. Life is not all about optimizing financial outcomes in this kingdom.

We started TMP on March 1, 2019. On March 1st, 2019, all 10 investments started at the same nominal value, $100,000.

Now that March is completed, we have our first results, the “Standings”. It’s easiest to think of this as a football or baseball sports league: The Financial League. We’re one of ten teams competing for number one in the league.

THE FINANCIAL LEAGUE

- 1. TheMonopolyProject – Us

- Here are the other 9 other investment options, in (perceived) order of risk; lowest to highest:

- 2. Cash – Stick It In Your Sock Drawer: Place the $100,000 in cash (one thousand 100 dollar bills) in a safe place.

- 3. 10 yr Treasury (2.82%) bond – Risk free as it comes: As of March 1, 2019 the 10 year US Treasury Bond was yielding 2.82%. So, for ‘opportunity cost’ purposes we bought 100,000 dollars’ worth of US Treasury Bonds. So who was the big winner? Who’s in first place in The Financial League?

- 4. Certificate of Deposit (CD) – Bank CD, FDIC insured, very low risk: “A certificate of deposit, or CD, is a type of federally insured savings account that has a fixed interest rate and fixed date of withdrawal, known as the maturity date.” As of March 1, 2019 a typical CD was yielding 3.10%. So, for ‘opportunity cost’ purposes we bought a 100,000 dollar bank CD.

- 5. VBTLX – Total Bond Market Index Fund: “This [Vanguard] fund is designed to provide broad exposure to U.S. investment-grade bonds.” As of March 1, 2019 VBTLX was trading at $10.76 per share so for ‘opportunity cost’ purposes we bought 9551.1 shares.

- 6. VTSAX – Total Stock Market Index Fund – “This [Vanguard] Fund seeks to track the performance of a benchmark index that measures the investment return of the overall stock market.” As of March 1, 2019 VBSAX was trading at $70.28 per share so for ‘opportunity cost’ purposes we bought 1422.88 shares.

- 7. VGSLX – Vanguard Real Estate Index Fund Admiral Shares – “This fund invests in real estate investment trusts [REIT] — companies that purchase office buildings, hotels, and other real estate property.” As of March 1, 2019 VBSLX was trading at $118.67 per share so for ‘opportunity cost’ purposes we ‘bought’ 842.673 shares.

- 8. Crowfunding (investing in real estate with lot’s of other investors) – index coming soon

- 9. Gold – “Of all the precious metals, gold is the most popular as an investment.” As of March 1, 2019 the spot price of gold was $1293.15/oz so for ‘opportunity cost’ purposes we ‘bought’ 77.33055 ounces.

- 10. Angel Investing – “An angel investor is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity.” – index coming soon

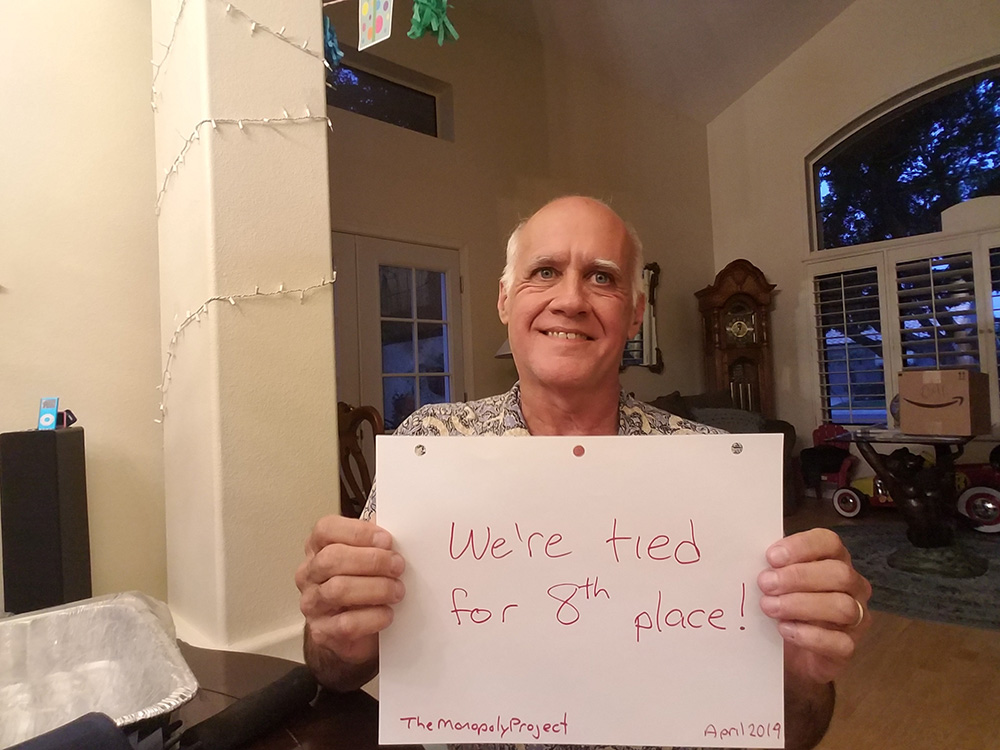

How did we do? Not well. We are tied for 8th/9th place with “Cash”.

We only beat out “Gold” which lost money in March 2019. So, who’s the big winner in the Financial League? Who’s number one?

The big winner in March 2019 was Vanguard Real Estate Index Fund Admiral Shares, a REIT, another real estate investment option. Maybe we’re on the right track after all.

We will go through these investment options one-by-one in future posts. There are advantages and disadvantages to all ten.

[Note on 25 July 2019: This is a corrected blog post. I had confused you, and especially myself, on posting the date of the standings. From now, on we will post as of the last calendar day of the month. This will reflect the nominal standings as of that date.]