The “Rent Vs Buy” question has been discussed/analyzed/argued ad infinitum:

Agree: https://www.financialsamurai.com/how-to-decide-whether-to-buy-a-home-or-rent/

Disagree: https://www.abodo.com/blog/renting-vs-buying/

Disagree: https://twocents.lifehacker.com/why-the-rent-vs-buy-debate-is-completely-pointless-1773179027

Disagree: https://jamesaltucher.com/blog/own-house/

Agree: https://www.financialsamurai.com/have-you-ever-regretted-buying-a-house-instead-of-renting/

Here’s my qualitative take.

First some qualifying parameters. This analysis applies to 21st Century First World Countries, especially the USA. These are characterized by three conditions that ensure that assets, especially income producing assets, will appreciate in both nominal and real terms:

- rule of law: Ensures that the benefits of the contract will be enforced in your favor.

- fiat money, fractional reserve banking system: Ensures that there will be a mild, or severe, nominal inflation. If you’ve financed with 20% down, the 80% appreciation on the balance belongs to you, not the lending institution.

- population growth, productivity growth, innovation growth, new industries growth: Upwards price pressure in real and nominal terms, again accruing to your benefit even on the borrowed portion.

That coupled with the ability to buy real estate on 90%, 95%, 97% or more margin guarantees that you will get rich, absent the collapse of the entire 21st Century First World environment.

You can run all the spreadsheets and Monte Carlo analyses you want, but these three factors in our first world environment, ensure that owned assets will outperform renting, even if you are disciplined enough to ‘invest the down payment’.

What is the difference between ‘buying’ and ‘renting’ from a contract view?

Both are contracts in which the two parties (third party to the contract is the “government” that ensures the contract is enforced equally and impartially via the rule of law) have certain rights and responsibilities

Both buy and rent contracts give the (new) owner or tenant exclusive rights to occupy the property for the purpose of a residence.

The two main differences between the buy and rent contracts are:

- The buy contract is in perpetuity (as long as you fulfill the terms of any other associated contracts; e.g., the bank loan). The rent contract is for a stated period of time and both sides can terminate it at any time (with various financial penalties)

- The buy contract gives the buyer a complete financial interest in the property. A rent contract only gives you the exclusive rights to occupy the property for it’s stated use for a fixed period of time. You have no ownership rights in the asset. And in reality, it is cancelable by either party, at any time. The ‘buy’ contract is ‘in perpetuity’. The buy contract provide protection against the nominal increases in price.

The Opportunity Cost in the buy option is using the down payment (plus closing costs) for another investment. You rent, paying a deposit typically the monthly rent and invest the down payment plus closing costs elsewhere. If you’re doing a traditional 20% down loan, this can be a substantial sum: $40,000 plus closing costs for a $200,000 home. Many of the ‘rent vs buy’ analyses go into great financial detail on alternative investments for this $40,000 plus. It is a valid [financial] point. But human nature being what it is, virtually no one does this. We need to stop treating humans as financial robots who optimize purely financially and admit that their human nature overrides financial optimization.

Yes, I know this is heresy; but it is the truth and ‘you can’t handle the truth’.

In the above opportunity cost of purchasing an alternative investment with the down payment, you could also leverage that. For example, you can buy stock on 50% margin. So, if you’re your down payment for a house is $3,000; you could buy $6,000 in stocks. Not much. But if we’re talking more expensive properties at higher downs; you might be talking ‘real money’, say $100,000. But in reality, no one ever does this in real life.

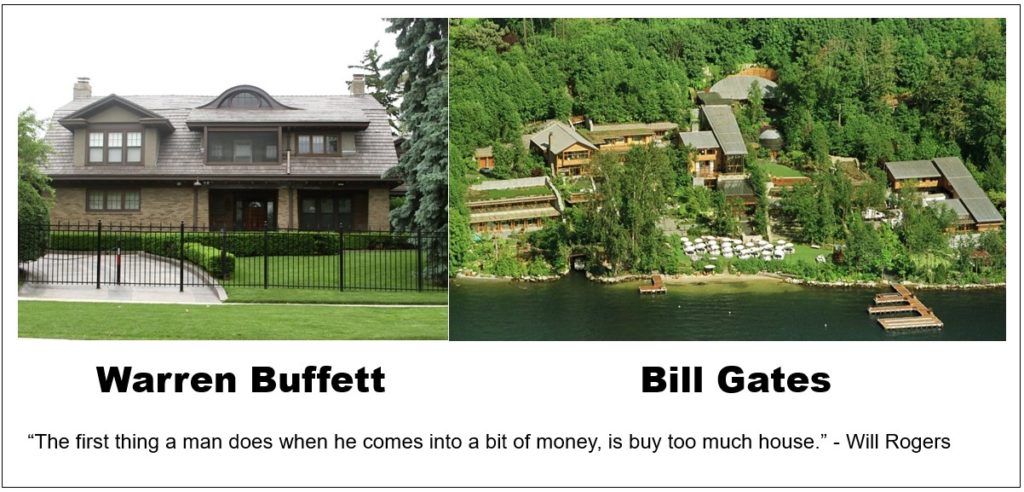

Note also that shelter is a basic need. You should only buy, or rent, as much shelter as you need. “The first thing a man does when he comes into a bit of money, is buy too much house.” I remember that being attributed to Will Rogers but can’t find any evidence.

Both Warren Buffett and Bill Gates ‘came into a bit of money’. Warren did not buy too much house; Bill did.

You should listen to Will Rogers and do as Warren Buffett.