Last month I attended a real estate seminar presented by our local KellerWilliams team, the “Bill and Cindy Flowers Team“.

The seminar was informative, and remunerative as I won the $25 gift card at the raffle. Cindy Flowers provided several interesting handouts; including an excerpt from ‘The Cromford Report’ (must reading for Phoenix residential real estate information) and Gary Keller’s book “The Millionaire Real Estate Investor”.

In 2005 Garry Keller with collaborators Dave Jenks and Jay Papason wrote, “The Millionaire Real Estate Investor”.

I reviewed the book on video for TheMonopolyProject’s “Floating Book Reviews” held on TheMonopolyProject yacht:

The book consists of four parts:

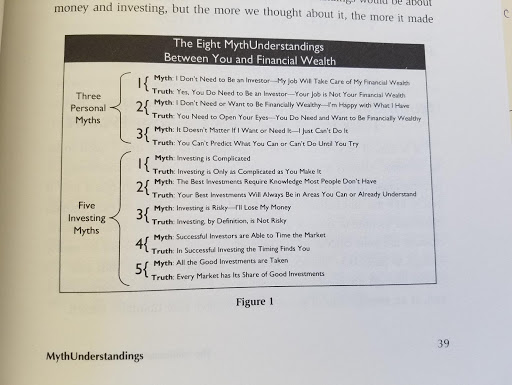

1. A ‘Dale Carnegie’ self-improvement section that includes some interesting ‘8 myths about real estate’.

2. A ‘Dave Ramsey’ get-your-financial-house-in-order section (Dave Ramsey’s Seven Baby Steps) that explains the basics of financial health before you begin investing in real estate.

3. The core of the book: basics of SFH investing.

4. Bios of successful RE investors.

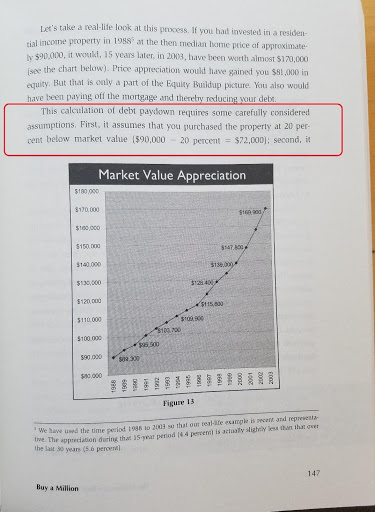

I particularly enjoyed reading the biographies in the back about the many different ways people made money in the SFH real estate market. The “8 myths” section is also valuable for directly addressing what really are “myths”. I will raise one pet peeve that is common to almost all of these types of ‘get started in real estate investing’ books. On page 147 and several other places, Gary recommends that when you buy, you should get the property for 20% below market value.

Where are these mythical sellers that are willing to sell you their property at 20% below market value? Especially in this market (or the 2005 market that was in effect when this book was written)? This is simply a way to sell books, seminars, ‘education programs’, training classes and such to uninformed people. If I could consistently buy real estate at a 20% discount from fair market value (FMV), I wouldn’t waste my time writing books. I would be out there buying every single property I could find at a 20% discount.

Bottom line: the book is interesting, and it has some valuable information (with a 20% discount for the obvious reason).