This month we are reviewing three books from our “What We’re Reading This Month –1944 Classic Novel, 1950’s Science Fiction, Commercial Real Estate Advice, Daily Bible” post.

The first two are financial books; “How To Create A Real Estate Money Machine…” and “Fundamentals of Angel Investing”. The third is a classic novel made into a movie, “The Razor’s Edge”.

We’ll start with Michael Douville’s book, “How To Create A Real Estate Money Making Machine and Retire With Income”. Michael started his MonopolyProject more than 40 years ago in Phoenix. He was buying SFHs in the 1980s. One story he tells is how he bought a SFH in Phoenix in 1984 for $44,000 that he still owns. You can see his website at https://michaeldouville.com/. I recommend his book and other materials at his website to anyone who is considering doing a MonopolyProject or even if you have already started on one. He gives practical advice interspersed with interesting stories of his experiences. I like and respect Michael because he has done everything he writes and advises about. Many on-line gurus do one or two; or zero, deals and then become instant experts and are selling books, videos, courses, checklists, training, boot camps and more. Michael did it all and continues to be active in the field.

I found out about Michael’s story from our real estate agent and partner, Just Jeff. He recommended a video by Michael and I liked what I heard. Note that this book I’m reviewing here is being updated by Michael from the 2016 version I reviewed. You can read a free chapter at this website.

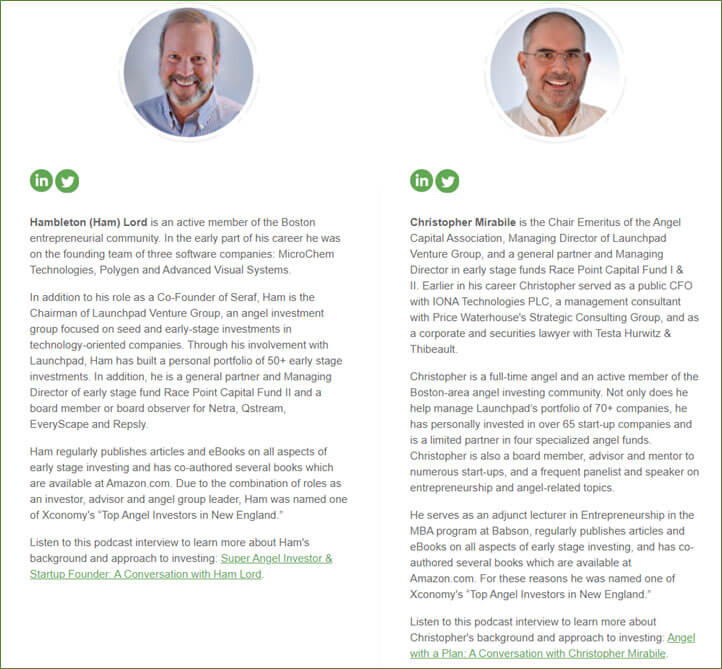

Next up is “Fundamentals of Angel Investing” by Hambleton Lord and Christopher Mirabile. I’ll let you read their bio’s from their website, “PORTFOLIO MANAGEMENT FOR EARLY STAGE INVESTORS”:

Suffice it to say, these are experienced angel investors in EVERY aspect of the field. I recommend the book, and all their materials, to anyone who is curious about angel investing, is thinking of getting started in it, just started in it, has watched “Shark Tank” and would like to do that, or even is currently an active angel investor. They email a weekly, informative article on various aspects of angel investing. I subscribe and read everyone. I break the review up into four phases:

1. Comments on the book:

2.Comments to the authors:

Here I make a few comments to the authors acknowledging that I am just a “Baby angel” with only 3 deals in two years’ experience. The comments are mostly organizational but there is one on content: Ham and Christopher state (p35) that the biggest focal point is ‘the team’. I think that the biggest focal point is the question, “is there a problem here that needs to be solved and is the market for that solution a big enough one to generate angel/VC returns?” Without a problem or a market, you do not need a team.

3.Conclusion about angel investing:

In my conclusion to the review, I ask ‘is angel investing for everyone?’ No.

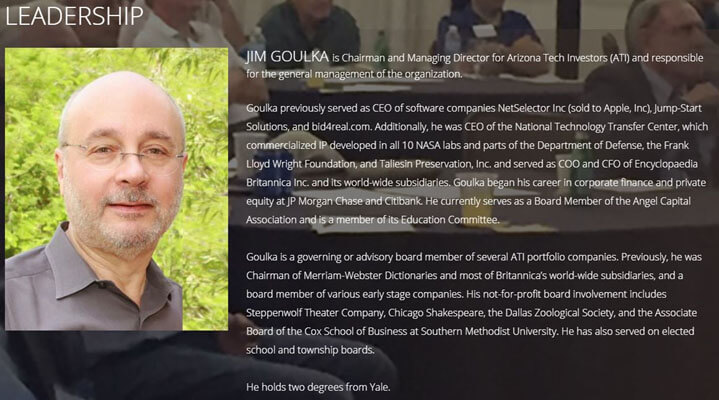

4. A shout out to my local group “Arizona Tech Investors” led by Chairman Jim Goulka.

I joined the “Arizona Tech Investors” (ATI) angel group in spring of 2019.

Previously that winter I had taken the “Angel 101” course (six, two hour sessions as I remember) taught by Jim Goulka who is the Chairman of the group.

Since joining I have invested in three companies (On Board Dynamics, Aural Analytics, Virtuous) for a total of $24,000 initial outlay, followed by increases in two of the companies totaling another $12,000.

If you are at all interested in learning about angel investing, or doing it, or like the “Shark Tank” excitement, contact Jim at ATI. You can see a Q&A with Jim here:

Finally, I reviewed the classic 1944 novel by W. Somerset Maugham, “The Razor’s Edge” and the movie of the same name from 1946. The review is more of a comparison of the book to the movie. Typically, I am disappointed in the movie in that it is not “true” to the book. In this case, the movie is even “truer” to the book, than the book itself. Is that possible?

Here’s the video:

Later this month we will update you on what we have been reading in March and do another Floating Book Review.