Previously, we explained our ongoing purchase of the house on Valencia.

The financial analysis assumed a purchase price of $203,200 with a 20% down, 30 year fixed mortgage of $162,560 at 4.99% yields a monthly PI (Principal and Interest) of $871.66. Taxes ($105), insurance ($51), HOA ($65) and management fee ($127) total $348. Assuming a rent of $1,300 yields a monthly income of $80. This is a 2.4% return on our 20% down. And the income is actually slightly better because the PI includes principal paydown. For example, in the first month, of the $871.66 PI, $675.98 is interest to the bank and the balance of $195.69 is principal paydown. From that point of view, the “gain” for the first month is $80 + $195.68 = $275.74. The annualized return on the down payment is then 8.1%. For the first year, the principal paydown is $2,403. Add the monthly $80 and the total is $3,362 for a return of 8.3% on the down payment. Much better, and better than a bank account return, CD return, or 10 yr Treasury note return. Note that this analysis does not consider extraordinary events such as capital costs, e.g., you must buy a new air conditioner. That can easily erase all the earnings for the year. But again, TMP is an appreciation play. If we make money on the renting/income side, all the better.

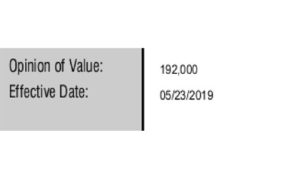

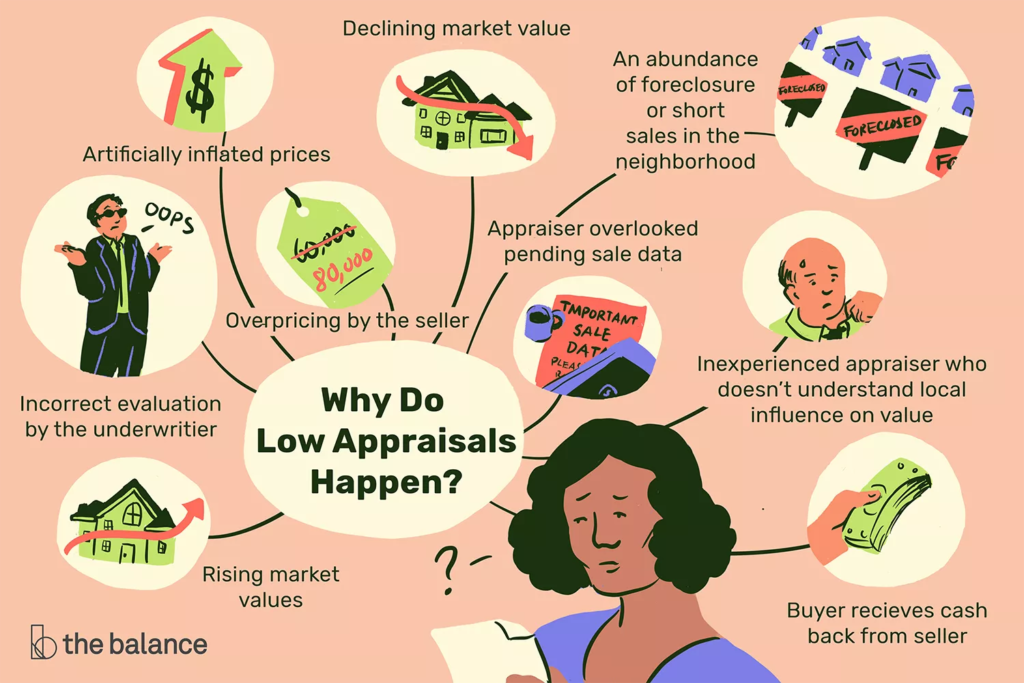

At the end of May, the appraisal came in, more than $11,000 BELOW the contract value.

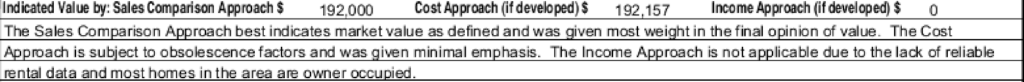

The appraisal was done by an independent, third party working for the lending entity. They delivered a 34-page report using two methods of appraisal: the ‘sales comparison’ and the ‘cost approach’:

The ‘sales comparison’ method is exactly what it sounds like: they compare the subject properties to similar, nearby properties that have recently sold. In this case, they compared it to six properties in the same neighborhood that sold recently. The appraisal based on this method is $192,000.

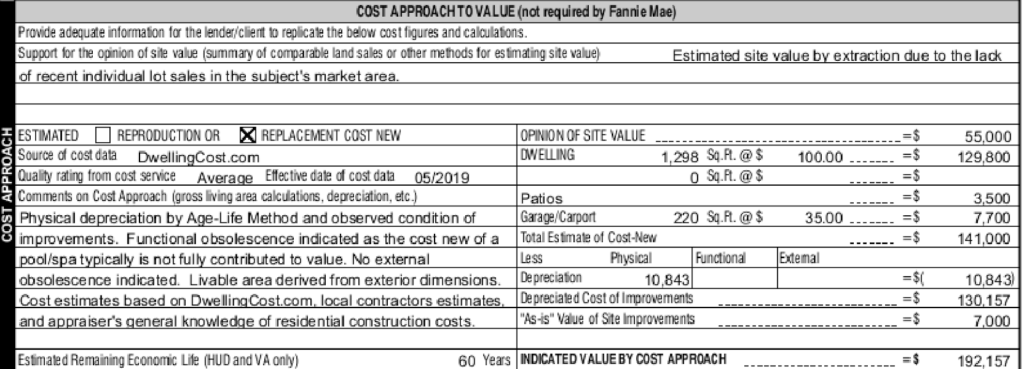

The ‘cost approach’ estimates the value by adding up the values of the elements of the property. They estimate the value of the lot itself, without the house and add the value of the dwelling on a square footage basis, the value of the garage and so forth as below. The appraisal based on this method is $192,157,

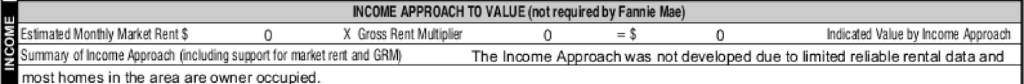

The ‘income approach’ was not used due to “…limited reliable rental data and most homes in the area are owner occupied.” The income approach is mainly used in evaluating commercial properties.

Is the low appraisal good news or bad news?

Here’s some informative links on what to do if you are in a ‘low appraisal’ situation.

https://www.realestate.com/articles/buying-a-house/is-a-low-appraisal-good-for-buyer

https://realestatedecoded.com/the-untold-truth-of-home-appraisals/

https://www.thebalance.com/how-to-deal-with-a-low-appraisal-1798414

https://www.realtor.com/advice/buy/4-ways-to-deal-if-your-appraisal-comes-in-low/

https://www.zillow.com/sellers-guide/appraisal-came-in-low/

If you remember the post on our offer being accepted, this house had fallen out of escrow twice before, the last time because the appraisal came in low and the seller and buyer could not agree on a new price.

We think this is GOOD news! We can negotiate with a motivated seller to reduce the price.

We did just that. The obvious answer is to ‘split the difference’. That would mean $203,200 minus $192,000 equals an $11,200 delta. Split the difference ($5,600) and the price is $197,600. We actually ended up at 197,900 due to some seller dynamics I won’t go into here.

Still, we got the house for $5,300 less than we were willing to pay before. If it was a good deal at $203,200 it’s an even better deal at $197,900!

Updating the analysis above:

“This is a 2.4% 3.1% return on our 20% down. … For the first year, the principal paydown is $2,403 $2,340. Add the monthly $80 $103 and the total is $3,362 $3,576 for a return of 8.3% 9.03% on the down payment.”

A better deal indeed!

Next we run into more problems! The loan will not be ready in time for closing!