Since Jeff and Jim became “partners” in buying, renting, holding, selling and trading single family homes (SFH) for TheMonopolyProject in January, we have bought two houses.

What are we looking at now?

The question on everyone’s mind is ‘how long can this crazy market go on?’.

There is no answer. Everyone has an opinion. Bulls to bears, you can find an analyst who agrees with you.

Here’s a bear who illustrates his opinion with a house on a cliff, “The popular spring home-buying season is just ramping up. But one analyst is warning that it could be a bust.”

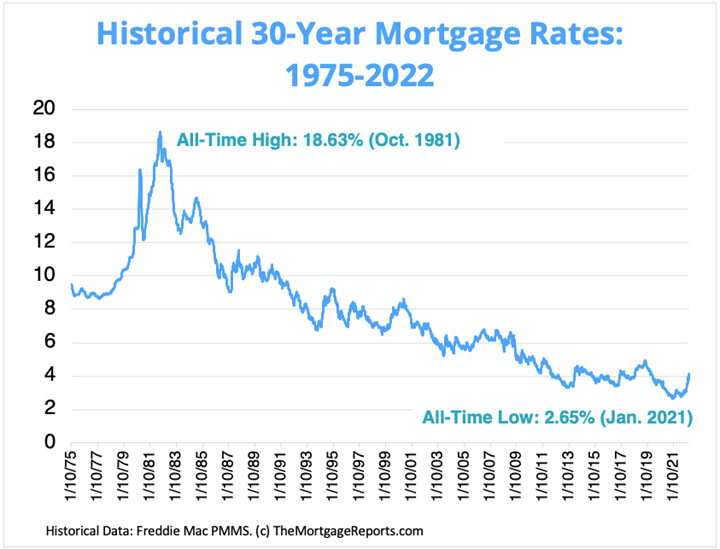

Here’s a graph of US mortgage rates going back 40 plus years:

I remember the spike to 18% in the early 1980’s. I bought my first house in January 1979 at an interest rate of about 7%. Two years later, rates had spiked to over 18%. The house was probably worth less than I paid but it didn’t matter to me since I wasn’t going anywhere.

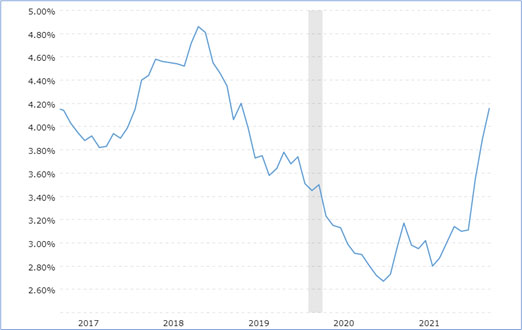

The last four years of mortgage rates is expanded below:

Rates have shot up an absolute 1.5%. This should slow demand. “However, it seems likely – based on history – that we will see a decline in new home sales from recent levels.”

For now, Jeff and I are not looking to buy in the TMP2/SFH market. We will monitor conditions through this summer and go from there.

In the meantime, Michelle and Jim continue buying commercial real estate:

- Closed Dec 2021: 10,000 two tenant building, with our announcement from last month, more to follow…

- In escrow, 12,000 sq ft, five tenant building in a historical neighborhood in Phoenix, more to follow…

- Planned $3-5M…

- An RCFE, Residential Care Facility for the Elderly, more info here.