Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time or any other asset.

We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Here are the other 9 investment options, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Fund (VGSLX – Vanguard REIT)

- Crowfunding (a real estate play)

- Gold

- Angel Investing (investing in start up companies)

We are going to review the nine options in perceived order of risk: from least risky to most.

We’ll start with cash since there appears to be no risk of losing your $100,000 absent theft or fire.

Instead of investing in SFHs in Phoenix, you could hold your $100,000 in cash. You could put 1,000 one hundred-dollar bills in your sock drawer. At the end of 10 years you will (still) have 1,000 one hundred-dollar bills.

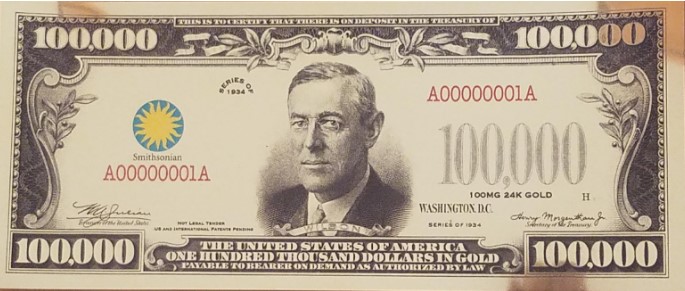

Instead of 1,000 hundred-dollar bills you could have ‘bought’ one 100,000 thousand ‘gold certificate’ bill issued in 1934.

Here’s some information about the opportunity cost of cash and the one hundred-thousand-dollar bill:

Is it sinful according to the Bible to hold cash? Well, maybe according to the parable of the talents; Matthew 25:14-30 and Luke 19:11–27. A man entrusts three servants with money while he is ‘out of town’. When he returns, he compliments and rewards the two who invested the money and made a profit. But for the third who ‘buried it in the ground’ (held as cash) he criticized as “You wicked, lazy servant!” And then he punishes him “And throw that worthless servant outside, into the darkness, where there will be weeping and gnashing of teeth.” The man also points out that the third servant could have ‘went to the bankers and deposited’ the money so that he would have at least earned interest on the money. Don’t hold cash around that man. Now who do you suppose he represents?

Regardless of the sinfulness, holding cash is a bad investment strategy. Inflation eats away the capital value and you are not earning any return on your wealth. As in the ‘Parable of the Talents’, you should at least place the money on deposit to earn interest. A good investment should either return a regular income or appreciate in value. Ideally, it would do both.

Next, we’ll look at two options, US Treasury Bonds or a bank Certificate of Deposit (CD) that reliably return income while preserving the value of your capital.