Earlier we discussed the concept of ‘opportunity cost’ primarily in the financial sense. But opportunity cost applies to all of life’s choices. If you marry one person, you pass up the opportunity to marry another. If you vacation in the Caribbean on a cruise, you pass up the opportunity to ski in Switzerland. If you buy stocks you pass up the opportunity to “invest” in a “Classic Car“.

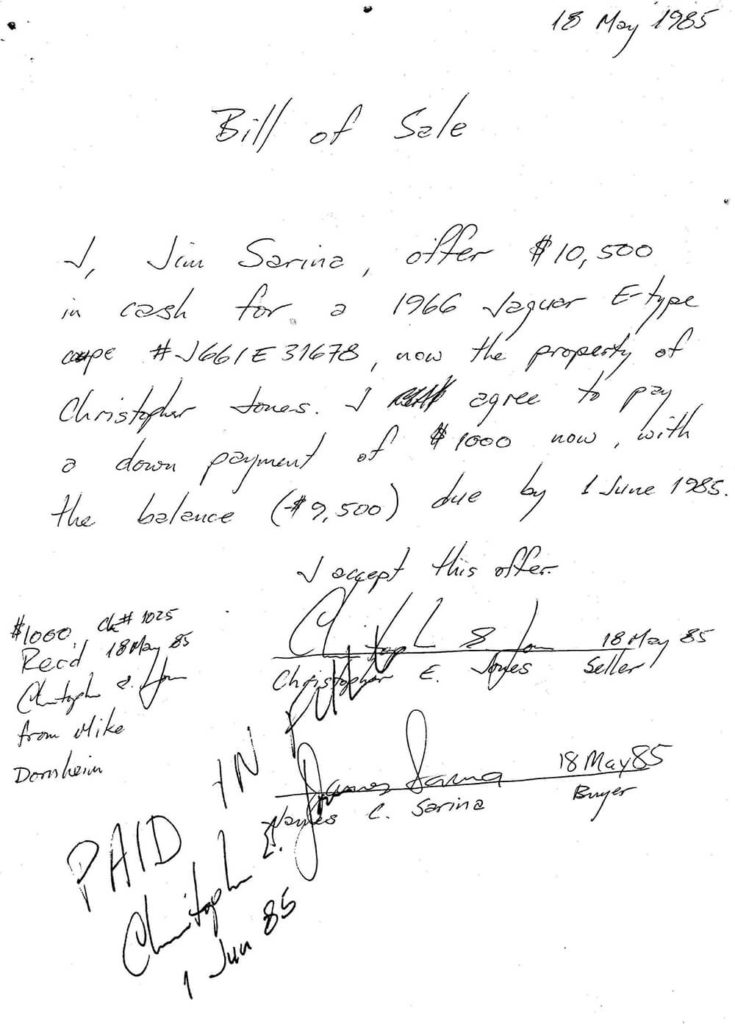

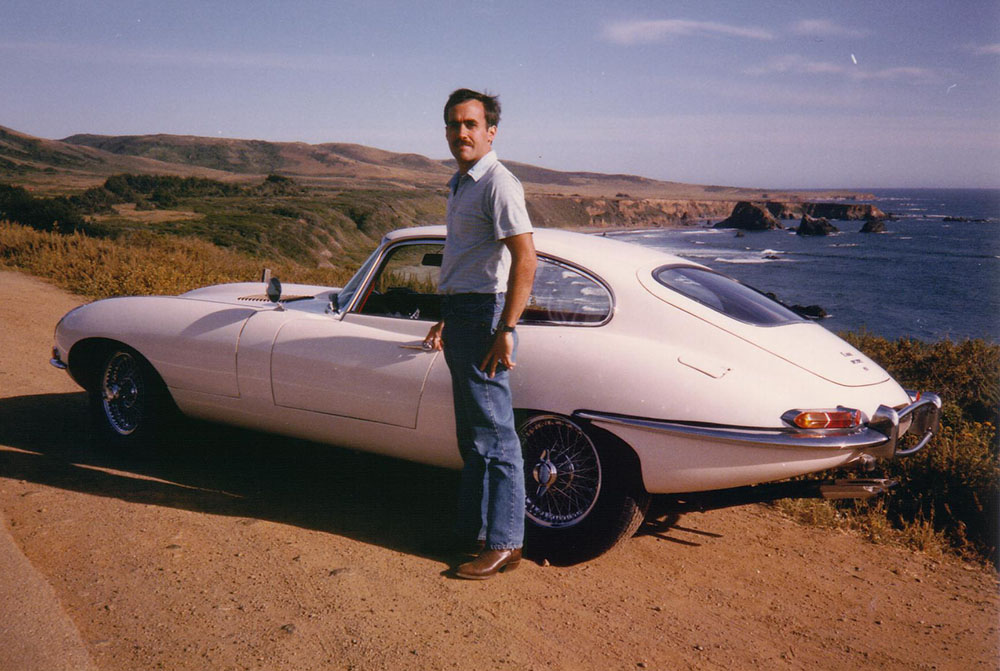

In May of 1985 I bought a 1966 Jaguar E Type for $10,500 dollars.

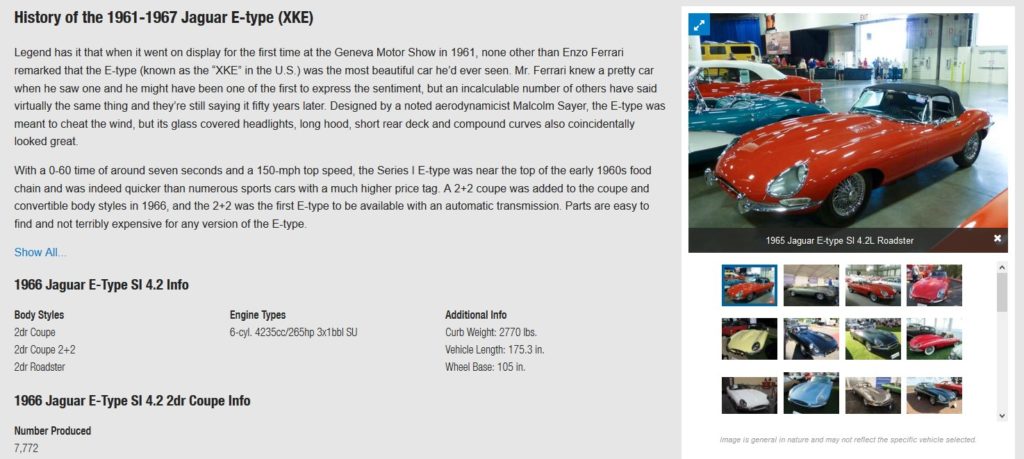

“The most beautiful car ever made.” – Enzo Ferrari” and here, and here, and here.

How much is the Jaguar E Type worth today? According to the this “American Picker’s” segment anywhere from $45,000 to $65,000 to $125,000.

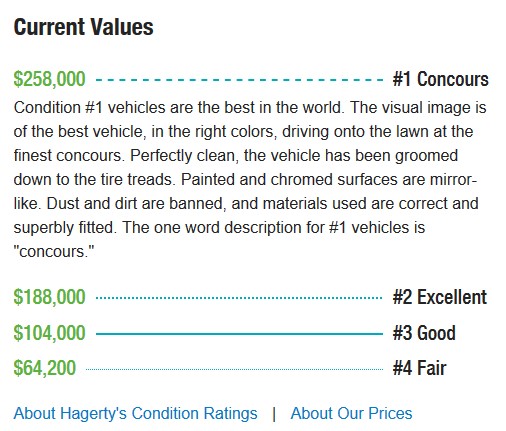

That segment may be outdated. Here are some other estimates from Hagerty.com “For People Who Love Cars“. Hagerty says $64,200 to $258,000 and probably the $104,000 “Good” to $188,000 “Excellent” applies

Or there is this listing for $198,500 from ClassicCars. So, our estimates run from $50,000 to $200,000; more or less.

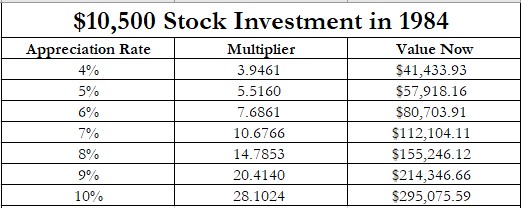

What if we had invested in stocks? Let’s use a 7% nominal return based on this article. So, a 7% appreciation; in 35 years, $10,500 investment would be worth $112,104. Let’s generalize it to rates of return below and above 7%:

If you bought on margin (50% margin on stocks), then these results would be even greater.

Or if you were super lucky or super prescient you could have invested in one of these three: “If you had invested $1,000 in each of just three companies back in the 1980s — Apple, Microsoft and M&T Bank — you would be a millionaire today.”

Interestingly enough; the ‘Classic Car’ is right in there with stocks, without using any margin!

So, what else can you do with your $100,000 besides investing it?

Spend it on yourself (things, trips, experiences)

Spend it on others (children, other relatives)

Donate to educational institutions (universities, colleges…), established non-profits, or even your own non-profit/charity.

Donate it to an international Christian charity (we will explore three later; MATC, World Vision, Mission to Honduras)

One more word on Opportunity Cost: My current go to site for FIRE (Financial Independence, Retire Early) is FinancialSamurai.com. Sam talks about Opportunity Cost here. I will have lots more to say about how FinancialSamurai.com inspired me in future posts.

And the car? Yes, we still have it.

No, it’s not for sale at any price.

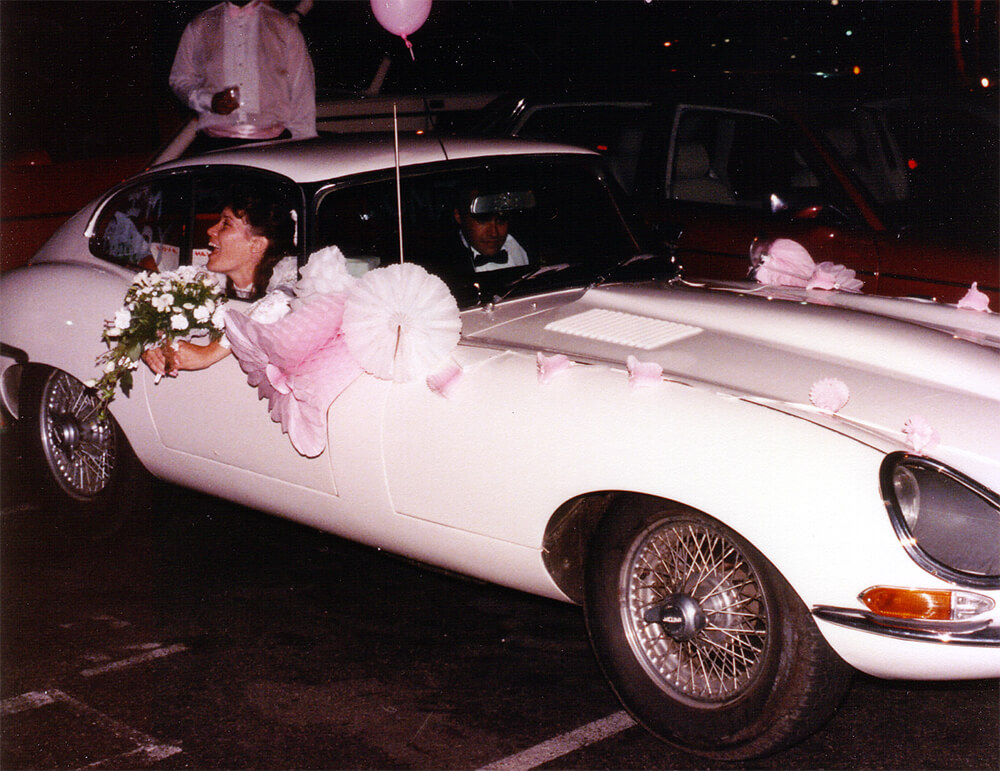

Here we are driving away from our July 1989 wedding:

Thirty-five years of memories, three children, two grandsons (so far) …

Here’s to the next thirty-five.

Jim Driving the 1966 E Type Home Just South of Santa Barbara in 1985