Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset.

We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Here are the other 9 investment options, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- Crowdfunding (a real estate play)

- Gold

- Angel Investing (investing in startup companies)

Today we are talking about a REIT Mutual Fund.

First, what is a ‘Mutual Fund’?

So, what is a REIT Fund?

What Is a Real Estate Investment Trust (REIT)?

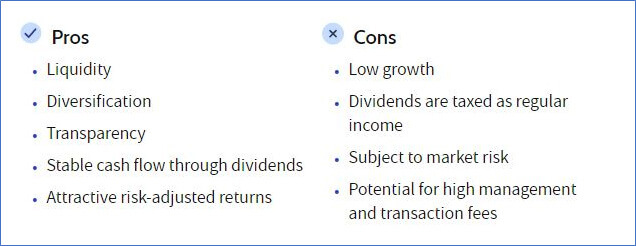

In other words, a REIT is another way to invest in real estate. The REIT managers do all the work and you collect the dividends. It’s a hands off way of investing in real estate. But there are pros and cons:

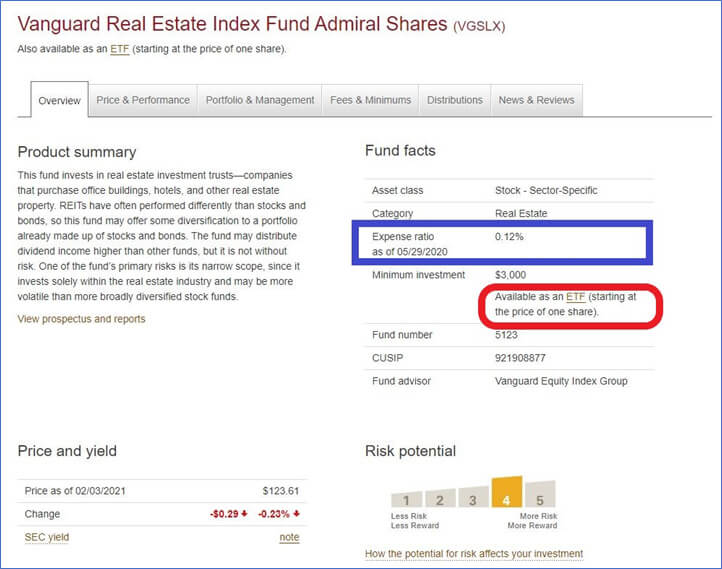

Specifically, we chose the Vanguard Fund “VGSLX – Vanguard REIT” because of the low expense ratio, see below.

Why Vanguard? Two well-known FIRE bloggers can explain it better than I can:

‘Mr. Money Mustache’ who I highly recommend for his financial insights …

…recommends Vanguard:

Another blogger, ‘My Money Wizard’, explains five reasons to go with Vanguard:

- Vanguard funds are cheap [low expense ratio]

- Vanguard is different – they’re owned by the investors

- Vanguard’s mutual funds are the most tax efficient funds in the world.

- Vanguard created the index fund

- Speaking of that Jack, he’s one of the few good guys in the world of finance

By low expense ratio we mean 0.12%. That’s why we go with Vanguard. Here’s some interesting information on the late John “Jack” Bogle who founded Vanguard and is the father of index investing.

Note that VGSLX is also available as an EFT. What is an EFT?

For our purposes, they can be considered effectively the same. But’s here is more if you are interested:

Where do REIT funds fall on the risk (perceived or real) scale. Long term, we think that holding real estate in the form of a REIT or equivalent EFT is relatively low risk. If the economy is doing well and we do not have a general societal breakdown, real estate will do well and the price will appreciate, certainly in line with inflation.

What is the difference between a REIT and an actual rental house?

- REITs allow individual investors to make money on real estate without having to own or manage physical properties.

- Direct real estate offers more tax breaks than REIT investments, and gives investors more control over decision making.

- Many REITs are publicly traded on exchanges, so they’re easier to buy and sell than traditional real estate.

- I would add that transaction costs on REIT are very low, effectively zero; whereas transaction costs on physical real estate are relatively high; 3%-8%. And physical real estate is relatively illiquid; it takes weeks and months to sell and a significant amount of work. That is why you should consider real estate as a long term hold type of investment.

For the next Opportunity Cost option, we will have a second look at two of our options: Crowdfunding and Angel Investing. For the Second Anniversary (March 2021) of TheMonopolyProject, we will also talk about some changes to the nine alternative investments to The Monopoly Project.