Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset. We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

When we first started TheMonopolyProject in 2019 we included “Angel Investing’ as one of the nine alternative options for our $100,000. This was because I had just started as an angel then. In May of 2021, we removed ‘Angel Investing’ as an option:

I’m removing Angel Investing as an option for two reasons:

- It is difficult, if not impossible to find an index that we can track the Angel Investing option.

- And the definition above, points out that you basically have to be a ‘high-net-worth individual, i.e., “rich”, to be an Angel Investor. Formally, you have to be an “accredited investor” to participate in angel investing although there are now some crowdsourcing options that do not require that status. So, if you’re already “rich”, you’re probably not interested in getting there via angel investing.

We now have a solution to issue number 1, the lack of an index. Recently our angel group, ATI (Arizona Tech Investors) signed up with the Seraf group for a tool that “… provides powerful portfolio management tools and educational content for venture funds, angel groups, universities, family offices, accelerators and other early stage investors.” Seraf provides information angel investing and powerful tools to manage each individual portfolio.

I’ve only been an angel investor for 3 years, with investments in only three companies. But you can see the Seraf view of my investments.

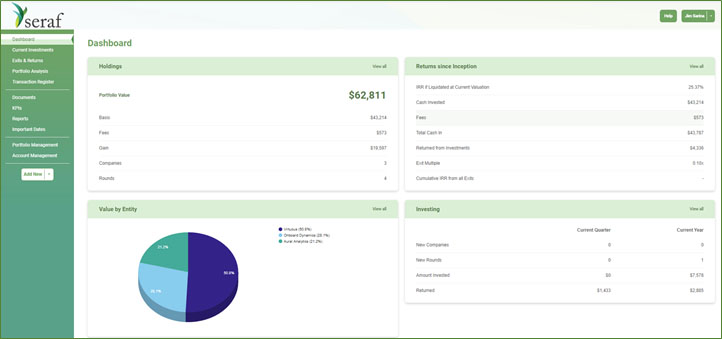

Here’s the intro, Dashboard to my account.

The summary dashboard includes a calculated IRR which would be the index needed to compare angel investments to other. Note that my 3 investment “portfolio” is not predictive of anything. The numbers in terms of companies and years invested is just too small. But this is indicative of the power of the tool that Seraf offers.

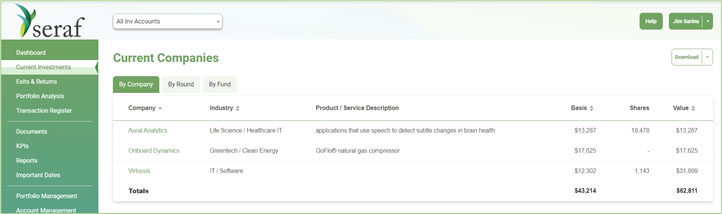

You can further drill down to “Current Investments”:

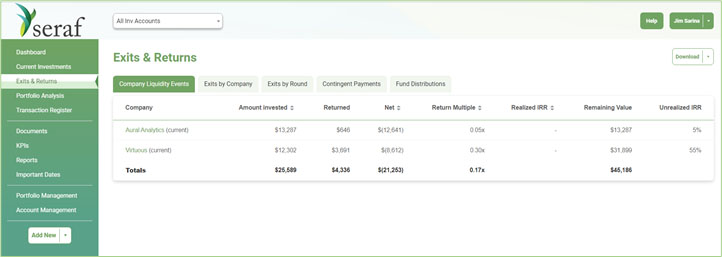

And see the exits and returns.

These are powerful tools to manage angel investments and to give real world information on actual performance. Seraf could aggregate all their info to show typical returns sorted by various categories while still maintaining the privacy of each investor.

We have previously mentioned and reviewed Seraf and the Founders; Christopher Mirabile and Hambleton Lord:

“Next up is “Fundamentals of Angel Investing” by Hambleton Lord and Christopher Mirabile.

But angel investing still suffers from #2; you basically have to be rich to be an angel investor. In my conclusion to the review, I ask ‘is angel investing for everyone?’ No.

So, angel investing is still not an appropriate investment alternative for TheMonopolyProject.