Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset. We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Now that we’ve taken two trips through the options, we are going to take a side trip away from SFHs, to buying commercial real estate.

From our current portfolio, we did a cash out refinance.

And the beauty of this cash out refinance was that we paid off the old loan that was at a HIGHER interest rate. So, we saved money on the existing balance due to a lower rate.

Our strategy is to buy commercial real estate with our existing equity without selling any (appreciating) assets. We are also not constrained by 1031 exchange timelines. We believe that income producing assets will continue to appreciate strongly given the difficult circumstances in the world now.

In late December of 2021 we closed on a 10,000 sq ft commercial building. It was advertised as an NNN building. When we did our due diligence, we found that that was not the case. Far from it. Because of the problems with the existing leases with the two tenants, we had a plan to get the property at an attractive price. We did.

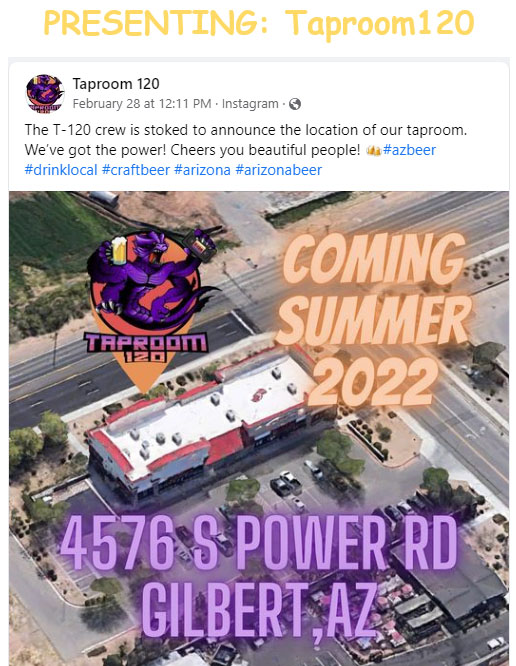

And part of that plan, was to welcome a new tenant.

We took a small, non-active investment in Taproom120 and are excited to see what happens.