Last month we reviewed the last of our ten “Opportunity Costs”: WOOD.

Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset.

We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Here are the other 9 investment options, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- United States 12 Month Oil Fund, LP (USL)

- Gold

- WOOD – iShares Global Timber & Forestry

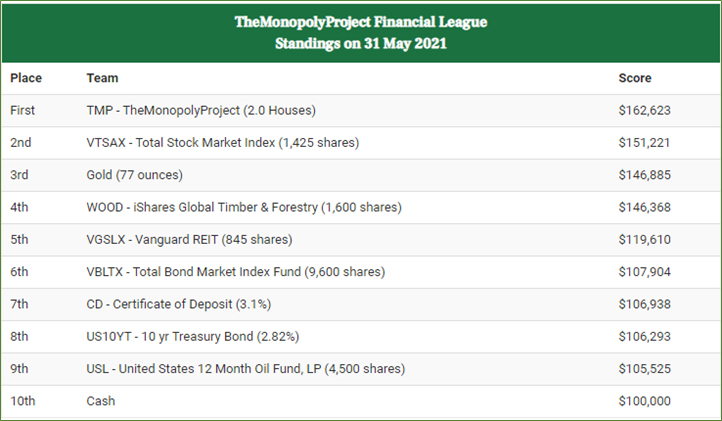

Now that we have discussed all nine alternative opportunities, we will review where we are.

First, I would reorder the list in (actual) order of risk to capital; riskiest last:

- TheMonopolyProject – Investing in Single Family Homes (SFH)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- United States 12 Month Oil Fund, LP (USL)

- WOOD – iShares Global Timber & Forestry

- Gold

- Bank Certificate of Deposit (CD)

- US Treasury Note

- Cash

We explained our philosophy for buying houses as opposed to the other nine investments in “Rent Versus Buy; Three Reasons to Buy; A Qualitative Analysis”. In an inflationary environment, those assets that return an income are the ones that will hold their value. That’s why I put “Cash” last; it is guaranteed to lose value relative to goods and services due to inflation. US Treasury Notes and Bank CD’s are close behind in losing value. They provide a nominal return, but it is fixed and will not keep up with inflation. The problem with Gold is that it does not provide a return and costs money to “store” it. Oil and Wood will retain their basic value relative to inflation because they are necessary commodities. Perhaps I should rate the Bond Mutual fund lower since it is functionally equivalent to US Treasury Notes and Bank CD’s. Real estate and stocks are the best investments because the income increases along with inflation. This increases the value of the asset.

The latest standings show this sorting taking place. Cash and the fixed income assets are now at the bottom of the pile.

Since we talked about WOOD and TIMBER in our last post, here is the 10 second version of felling a pine tree at our cabin in Flowing Springs:

Here is the complete version of the tree felling:

And here’s two videos on how to fell a tree safely “How to Cut Down a Tree With a Chainsaw – The Right Way!”:

Or perhaps, we should have used explosives after our book review of “TMP Floating Book Reviews – Seven Books and D Day Again” like these New Zealanders: