We’ve now cycled through all nine of the alternative investments we could have made with our $100,000.

Here are the other 9 investment options with links to our previous posts, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- United States 12 Month Oil Fund, LP (USL)

- Gold

- WOOD – iShares Global Timber & Forestry

Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset. We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

We’re going to start over with “Cash” as an investment option. It is perceived to be risk free. It might be stolen or burned up in a fire, but it is never worth less than the face value?

The problem with cash is that it is constantly losing value as compared to income producing assets. This is because our economy is designed to include a mild inflation. And it produces no income.

I will appeal to authority and let legendary investor Warren Buffet make my case. His first rule of investing (at about 0:55 seconds) is “cash is always a bad investment”:

And an anecdote to further illustrate the point.

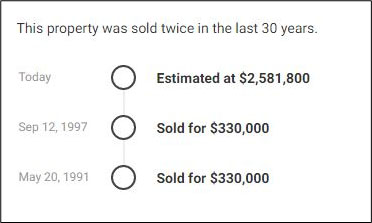

In 1979 I bought a house in Manhattan Beach, California for $97,000. This was a 1,200 sq ft, 3 bedroom, 1.5 bath single-story house on a 50 by 100 ft lot. That was a LOT of money then. Two or three times what a house was going for in most of the USA. The “house” is now a 3,541 sq, 5 bedroom, 5 bath, two-story on the same lot. It is now valued at $2.5 million dollars!!

I won’t show any pictures as it is irrelevant. I bought the house in 1979 for $97,000:

We sold it in 1991 for $330,000. The new owners then sold it for the same in 1997. The 1990’s were a flat time for real estate, at least in Southern California. I talked to the new owners in 1998. They have leveled our little house and built the huge house. The only thing on the lot they retained was the avocado tree that I planted on the back fence.

The moral of the story?

- Cash loses value.

Don’t sell property in prime areas. Rent it. Do your own MonopolyProject.

Next, we’ll talk about the house we bought in 1991 with the $330,000. It just sold last month. Guess how much?