Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset. We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

We’re cycling back through the investment options. This time we are concentrating on categories of investments. Today we discuss fixed income assets. They could bonds, notes or CD’s. What’s the difference?

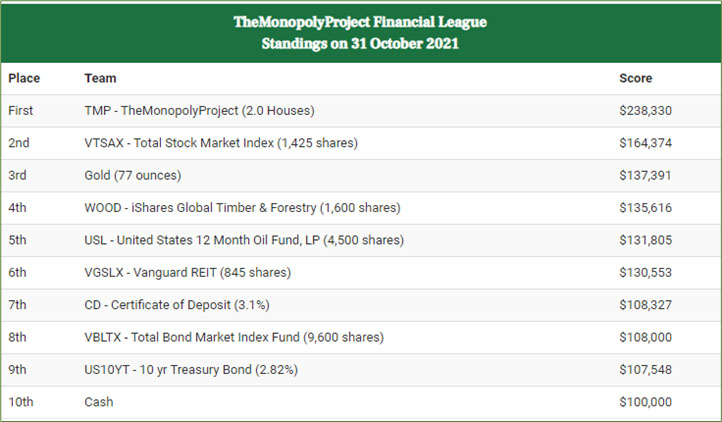

They are all fixed income assets: “Fixed income broadly refers to those types of investment security that pay investors fixed interest or dividend payments until its maturity date.” You can see that our three fixed income opportunity options are grouped near the bottom (7th, 8th, 9th) of the standings:

We anticipated this outcome at the start of TheMonopolyProject. The income from fixed income assets does not increase. It is constant. The income from stocks and real estate can and does increase. “Rents are skyrocketing.” Not surprisingly, the fixed income assets are lagging behind the increasing income assets.

Note that the CD (3.1%) is ahead of the Vanguard Total Bond Market Index Fund (VBLTX). This suggests that the available return in the market is now below the 3.1% we got in March 2019.

So the moral of the story is Bonds, NO.

Bonds, James Bonds, YES.