Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset. We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

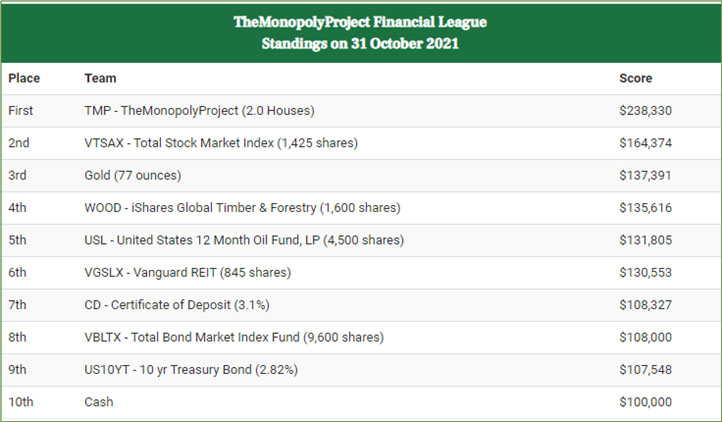

We’re cycling back through the investment options. This time we are concentrating on categories of investments. Today we discuss commodities. We chose GOLD, Lumber (WOOD) and Oil. These opportunity options are grouped in the middle (3rd, 4th, 5th) of the standings:

What are Commodities?

We expected this outcome at the start of TheMonopolyProject. Commodities benefit from true economic growth and inflation, but do not return any income. We expect them to be better performers than fixed income assets, but lag assets whose income grows (e.g., real estate, stocks).

UPDATE on 15 December 2021: Here’s more evidence that commodities will continue to increase in the future; “US Producer Prices Explode To Record High In November (And There’s Worse To Come)”.

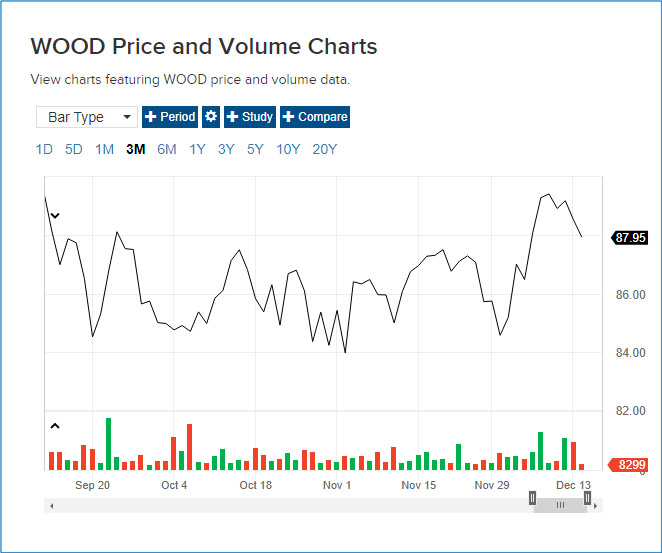

And we note that we made an error in reporting the share price of WOOD in the November monthly update.

We recorded $61.40 per share; it should be $84.56 per share making the 1,600 shares worth $135,296; good enough for 4th place. We will correct the error in the December update.

Let’s check in with our super-agent, ‘Just Jeff’ on the Phoenix market:

Jeff discusses how to choose a broker in “Housing Market Update: Phoenix, AZ ~ December 2021”.

See all of Jeff’s content at www.justjeffaz.com www.jeffsutherlin.exprealty.com.

Here’s are review of “20211205 TMP Floating Book Review – The Encyclopedia of Commercial Real Estate Advice”. I can’t praise this book enough. We are in the middle of a commercial escrow and his advice is outstanding.

And a Merry Christmas to all: