Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset. We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

We’re cycling back through the investment options. Today we discuss stocks.

What are Stocks?

From Investopedia.com:

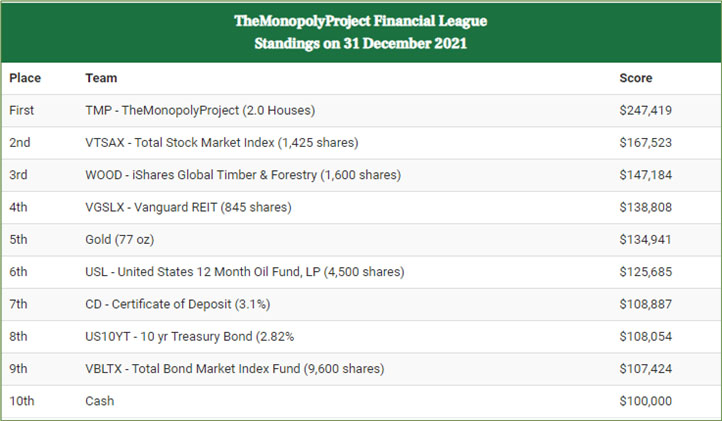

Stocks are doing great in The Monopoly Project Financial League. They are comfortably in second place:

We expected this outcome at the start of TheMonopolyProject. Stocks benefit from true economic growth that leads to increased income. Stocks also benefit from “inflation”. We expect them to be better performers than fixed income assets or commodities and the record confirms that belief.

As a representative of “stocks” we chose “Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)”:

Some people have suggested that you can do better than VTSAX. This guy Dan quotes Albert Einstein “Make Everything as Simple as Possible, But Not Simpler”:

From “Beating VTSAX…”

What’s not to love about VTSAX? It’s the entire U.S. stock market in one fund.

Maximal diversification! Low cost! Simple! You’re guaranteed the market’s return!

Too many well-meaning DIY investors!”

I’m not sure why we should listen to a bagel shop owner, but I like Dan’s argument because he has a guillotine photo in his post.

This guy proposes an alternate Vanguard product: “Vanguard Total Stock Market Index Fund vs.Vanguard 500 Index Fund”. But I downplay him because he has no quotes or guillotine photos.

Could we have done better than VTSAX as a proxy for ‘stocks’?

Maybe.

I searched for top performing stock mutual funds for the past three years, the lifetime of TMP. VTSAX was not in any of the lists. But mutual funds (and now ETFs, more later on that) sometimes outperform and sometimes under perform. VTSAX is an adequate proxy for the overall USA stock market.

I compared VTSAX against the S&P 500 and against the Vanguard ETF, VTI which is the ETF equivalent of VTSAX.

Could we have done better with another stock fund?

I don’t think so. VTSAX is a good proxy for US stocks.

I will leave the ‘last word’ to our super-agent and partner, ‘Just Jeff’ as he talks about “Believing in yourself, the mission, and the team”.