Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset.

We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Here are the other 9 investment options, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- Crowdfunding (a real estate play)

- Gold

- Angel Investing (investing in startup companies)

We’ve discussed six of the nine alternative investments (“Opportunities”). We’re down to three: Crowdfunding (Real Estate), Gold, and Angel Investing. Even though we started TheMonopolyProject (TMP) two years ago this month, we still to not have an index for ‘Crowdfunding’ or ‘Angel Investing’. Why? I cannot find one. I have asked my experts in the two fields John Kobierowski Co-Founder of “Neighborhood Ventures” a crowdfunding platform for real estate in Phoenix. And I’ve asked Jim Goulka, Chairman of the “Arizona Tech Investors” angel investing group, with no luck. There is not a publicly available index for either.

The other issue with Crowdfunding (Real Estate) is that there are so many ways to do it. Some offer a guaranteed return, typically 12% or more, but no equity. Others offer equity. And others allow you to tailor your investment, see Fundrise. Another option is Roofstock which invests in “single family rentals” and offers an option for accredited investors or non-accredited investors. Roofstock One is only for accredited investors. We will take a closer look at these opportunity options in a later post. For now, we will replace “Crowdfunding” according to the following criteria:

- Readily available public proxy index for performance for a relatively long period, at least 10 years.

- Open to all investors, not just accredited investors.

- Available as a “fund” or “index”; not an individual asset.

We have only one commodity, gold, as an opportunity option:

“Some traditional examples of commodities include the following:

We are trying to decide which commodity to choose. We want something “real”. Real in the sense that it is of everyday use. We have narrowed our choices down to “Oil” or “Food”.

Our oil choice is “UNITED STS 12 MONTH OIL FD LP”:

We all remember the importance of oil from “The Beverly Hillbillies”:

Note that Jed was “…shootin’ at some food” when he struck oil. So, it complements our choice between ‘food’ and ‘oil’. Note also that Jed owned the mineral rights to his land. The deed to our house lot on 29th Avenue in Apache Junction that we just purchased specifically excludes ownership of the mineral rights.

So, Jim and Jeff will not get rich “while shootin’ at some food EFT”.

Here’s the performance of this Oil EFT over the past 3 years:

We will “buy” 4,500 shares in March 2019; about $22.22 per share.

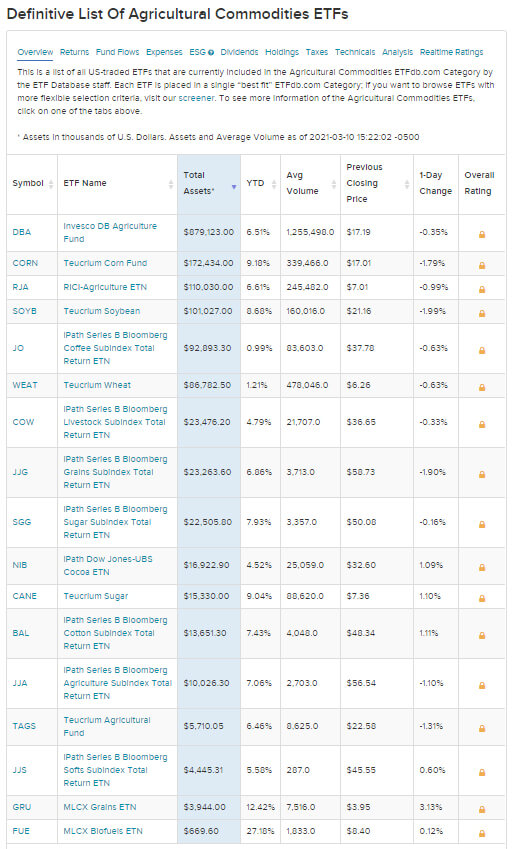

Next, our food choice is an agricultural commodity EFT, “Invesco DB Agriculture Fund”. We chose this fund because it is the largest of the 17 “Definitive List Of Agricultural Commodities ETFs”:

Here is the performance of this Food EFT over the past 3 years:

We will “buy” 6,000 shares in March 2019; about $16.67 per share.

We will decide between “Food” and “Oil” before the end of the month.

We are going address “Gold” in next month’s Opportunity Cost review and then we will tackle what to do with “Angel Investing”.