Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. This “cost” is true whether it is money, time, or any other asset.

We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Here are the other 9 investment options, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- United States 12 Month Oil Fund, LP (USL)

- Gold

- Angel Investing (investing in startup companies)

We have discussed 7 of the 9 alternative investments (“Opportunities”). We are down to “Gold” and “Angel Investing”.

What is “gold”?

Gold is a chemical element with the symbol Au (from Latin: aurum) and atomic number 79, making it one of the higher atomic number elements that occur naturally. In a pure form, it is a bright, slightly reddish yellow, dense, soft, malleable, and ductile metal. Chemically, gold is a transition metal and a group 11 element. It is one of the least reactive chemical elements and is solid under standard conditions. Gold often occurs in free elemental (native) form, as nuggets or grains, in rocks, in veins, and in alluvial deposits.

Gold has been used as money since the beginning of time. It is simultaneously an investment and money. Gold has few industrial uses and is used for cosmetic purposes, jewelry, or as an investment/store of value.

For most of history, the world’s economies were on a ‘gold standard’. “The gold standard is a monetary system where a country’s currency or paper money has a value directly linked to gold.” But as of now, “The gold standard is not currently used by any government. Britain stopped using the gold standard in 1931 and the U.S. followed suit in 1933 and abandoned the remnants of the system in 1973.” The USA and other countries still hold gold assets though. The USA has 4,583 metric tons of gold bars stored in Fort Knox, Kentucky and more elsewhere.

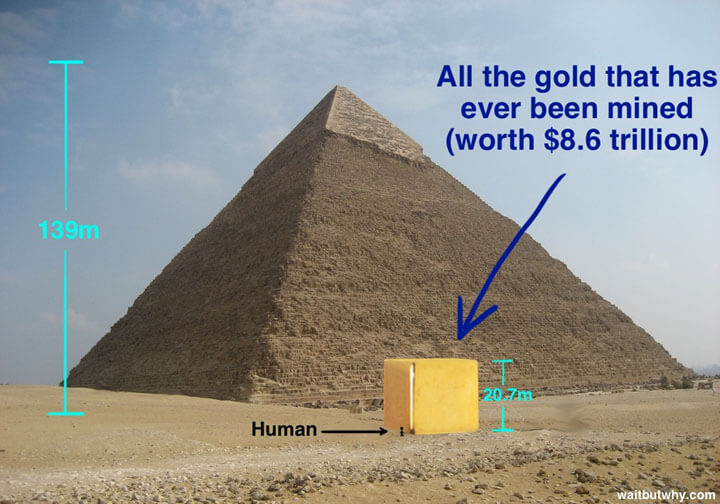

Gold is very compact. All the gold ever mined (as of 2014) would fit in a 20.7 meter cube equal to a 66.6 foot cube. This is the is the infamous “number of the beast,” allegedly Satan’s secret code for evil.

“After all, 666 is the infamous “number of the beast,” allegedly Satan’s secret code for evil.

Just kidding: 20.7 meters is 66.9 feet. But you get the idea. The Bible says 1 Timothy 6:10 (KJV) “For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.”

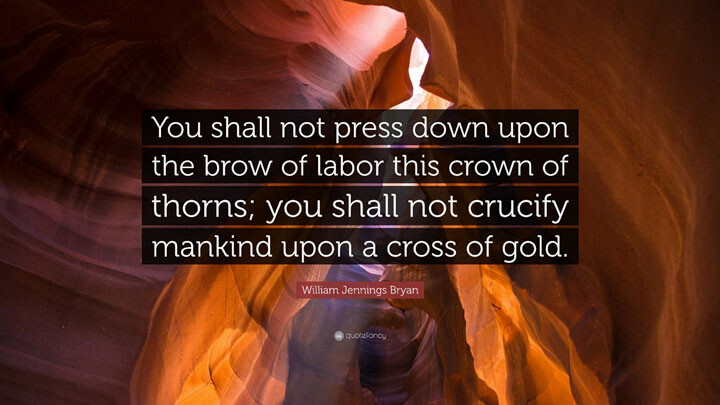

Democrat Presidential candidate Williams Jennings Bryan extended this thought and tied it to the crucifixion of Jesus in his (in)famous 1896 speech: “The Cross of Gold speech was delivered by William Jennings Bryan, a former United States Representative from Nebraska, at the Democratic National Convention in Chicago on July 9, 1896. In the address, Bryan supported bimetallism or “free silver”, which he believed would bring the nation prosperity. He decried the gold standard, concluding the speech, “you shall not crucify mankind upon a cross of gold”. Bryan’s address helped catapult him to the Democratic Party’s presidential nomination; it is considered one of the greatest political speeches in American history.”

Caitlyn Jenning, next governor of CA, is a distant relative on William Jennings Bryan mother’s side. Just kidding; Jennings with an “s” identified as singular, whereas Jenning without an “s” identifies as plural.

In 1924, the most influential economist of the 20th Century, John Maynard Keynes, famously called gold “a barbarous relic”. In truth, he called the gold standard “a barbarous relic”.

“The economist John Maynard Keynes (1883-1946) wrote in his book, A Tract on Monetary Reform (1923):

“In truth, the gold standard is already a barbarous relic.””

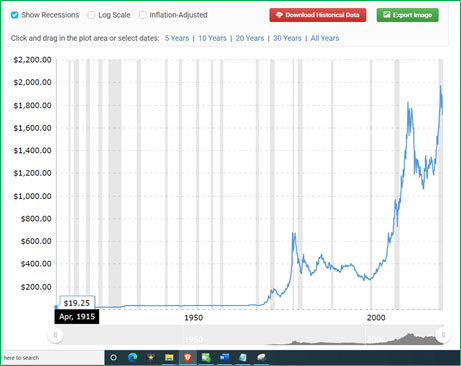

As stated above, the entire world went off the gold standard in the decades to come. The price of gold was ‘fixed’ during the gold standard days. Since the USA went off the gold standard in 1973, the price of gold now “floats”. You can see the huge increase in nominal and real dollars in this video:

Gold can be used as an investment option. But the price of gold is very volatile, and it has an inverse relationship to economic activity. That is, if the economy is doing well, gold does poorly. If the economy is bad, especially if there are political tensions, gold does well (see 1980 in the video above). Holding gold as an investment, either physical gold or ‘paper’ gold, does not return any income. It ‘costs’ money either in storage fees for physical gold or ‘fund’ fees for paper gold. And note that ‘paper’ gold is worthless in a real, world crisis/end of the world, scenario since the financial system will collapse. Your EFTs, mutual funds, or any other claim on assets will be worthless. If you are buying gold for the end of the world, only buy real physical gold, preferably coins. Nobody is going to give you change on a 10-kilogram bar of gold!

Last month we replaced ‘Crowdfunding (real estate)’ with an Oil Fund. We ‘bought’ a round number of shares, 4,500, for our imaginary portfolio. Now, we are going to adjust our gold holdings to a ‘round’ number. In March of 2019 we committed $100,000 to buy gold at $1,293.15 per ounce. That came out to 77.33055 ounces. We will now adjust this down to 77 even to make it easier to track and envision. This results in a decrease of 0.43% and a buy price of $1,298.70. Next month we will ‘adjust’ all the other opportunity options to round numbers for the same reason.

77 also is consistent with Jesus’ command on how often we are to forgive our brother:

And finally, one more gold reference in popular culture; the man with the license to kill: 007. Apparently, it is a real thing. Who knew? In the 1964 “Goldfinger” movie; Bond, James confronts arch villain Auric Goldfinger with the question, “Do you expect me to talk?” when threatened with a free vasectomy. Goldfinger quips: “No Mister Bond, I expect you to die”:

Next month in May 2021 we will look our final Opportunity option, Angel Investing. Should we replace it also?