Previously we discussed the concept of “Opportunity Cost”. If you choose to do one thing, you forgo many other choices. The “cost” is applicable whether it is money, time, or any other asset.

We talked about the opportunity cost of going on a ‘once in a lifetime’ 10 day trip to the 75th anniversary of D Day on Omaha Beach in the middle of our Valencia house deal. We talked about the opportunity cost of buying a classic car in 1984 for $10,000.

Here are the other 9 investment options, in (perceived) order of risk to capital:

- Cash

- US Treasury Note

- Bank Certificate of Deposit (CD)

- A Bond Mutual Fund (VBTLX – Total Bond Market Index Fund)

- A Stock Mutual Fund (VTSAX – Total Stock Market Index Fund)

- A REIT Mutual Fund (VGSLX – Vanguard REIT)

- Crowdfunding (a real estate play)

- Gold

- Angel Investing (investing in startup companies)

Today we are talking about Bond Mutual Funds.

First, what is a ‘Mutual Fund’?

So, a “Bond Mutual Fund” is a mutual fund that invests only in bonds:

Specifically, we chose the Vanguard Fund “VBTLX – Total Bond Market Index Fund” because of the low expense ratio, see below.

Why Vanguard? Two well-known FIRE bloggers can explain it better than I can:

‘Mr. Money Mustache’ who I highly recommend for his financial insights…

…recommends Vanguard:

Another blogger, ‘My Money Wizard’, explains five reasons to go with Vanguard:

- Vanguard funds are cheap [low expense ratio]

- Vanguard is different – they’re owned by the investors

- Vanguard’s mutual funds are the most tax efficient funds in the world.

- Vanguard created the index fund

- Speaking of that Jack, he’s one of the few good guys in the world of finance

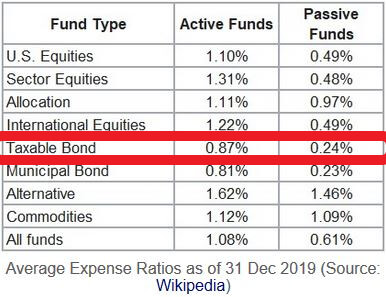

By low expense ratio we mean 0.05%. For comparison, the average bond fund expense ratio in 2019 for ‘Passive Funds’ was 0.24%; almost five times higher!

What is the risk? US Treasury Notes are rated as effectively zero risk; you will get your capital back and almost certainly the accrued interest. Bond mutual funds such as Vanguard VBTLX invest in a combination of US Treasury Notes/Bonds and private company bonds. The risk factor to capital is exceptionally low, effectively zero if the US economy does not collapse. There is some slight risk to the accrued interest; you might get slightly less than advertised if of on the private companies’ defaults. But all in all, a quality bond mutual fund is ‘safer’ than cash. You will get your principal back and enough accrued interest to offset inflation.

Now “I mustache you a question. But I’m shaving it for later.”

Later is now: Mustache versus Moustache: Which Is Correct?

Mustache and moustache are both correct spellings of the same word.

Mustache is the most common spelling in the United States.

Moustache is is used in other English-speaking countries.

So how does my mustache compare to Mr. Money Mustache?

I started growing it when my third grandson, Khoi, was born five months ago on July 5th, 2020:

Khoi also started growing mustaches in his mustache-of-the-month club:

For the next Opportunity Cost option, we will look at a Stock Fund; a mutual fund that invests in stocks. Our choice was the Vanguard Stock Fund “VTSAX – Total Stock Market Index Fund”.