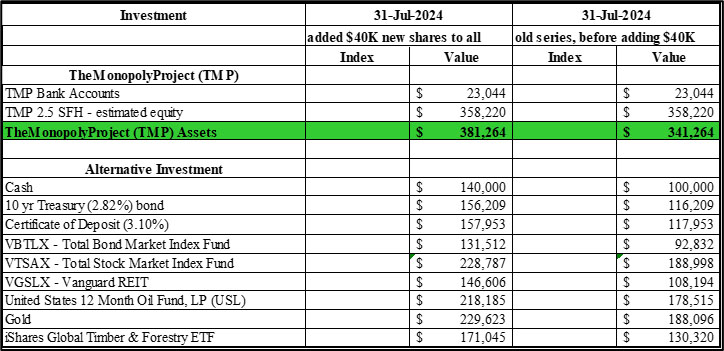

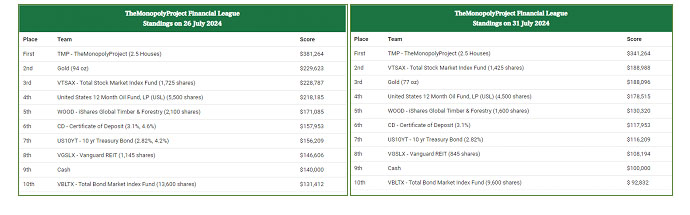

In our last post “Our July 2024 Standings – New Purchase in Laurens, South Carolina” we explained how we bought another TMP2 house, in South Carolina. To do so, we had to add $40K in capital to TMP2. Note that Jeff matched that with $40K of new capital also. So, how do adjust our results to account for the additional capital?

In the blog post referenced above, we just subtracted $40K from the total TMP value. That is not correct.

What we should have done is “bought” $40K more of each of the nine alternative investments. In the original “Opportunity Cost” post we showed the 1966 Jaguar E Type purchased in 1985 for $10,500:

We just put the Jaguar in the repair shop to be fully reconditioned. There is nothing mechanically wrong with it. It just hasn’t been driven/started in 25 years!

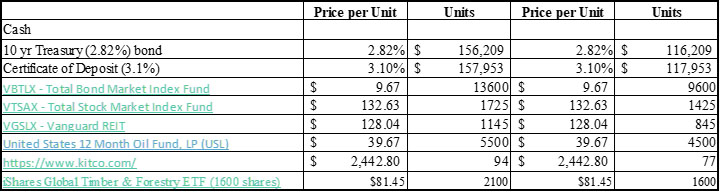

We calculated the unit (share) price for each of the nine investments and “bought” $40K more at the 26 July 2024 value, that being the closing date of the Myers Lane house.

We did slightly round the numbers per the chart above.

Here’s changes in units; e.g., we originally had 1,425 shares of VTSAX now we have 300 more, 1,725 shares.

So, we had the Jaguar towed to the repair shop. Should be 3 – 6 months.