How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions.

Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” That was also our motivation. In fact, that is why I disagree with Dave on steps 5, 6, 7 as stated in that post. We will explain that further in our upcoming posts for “Start Your Own Monopoly Project.”

In the late 1990s we had three young daughters and were concerned about college costs. Here was our best and worst case calculation for college costs:

Anywhere from $240,000 to $750,00 coming due starting in 10 years!

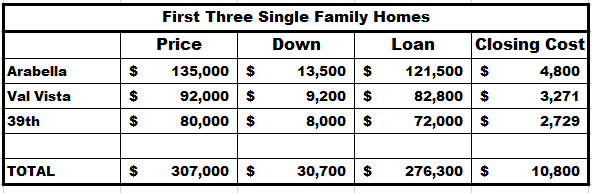

That’s why we bought our first rental house (SFH) in 1999. In 2000 we bought two more. Our total cash investment including down payments and closing costs was about $40,000:

How did we do those first two years?

Here’s our 2000 and 2001 Schedule E Federal Tax Return where real estate income for ‘disregarded entities’ is reported.

Let’s start in 2000 just for Arabella since that is a full year of ownership. How did we do from an income point of view? Rents collected were $12,100 while expenses (not including depreciation) were $12,940. So basically, we broke even from an income point of view. BUT we also have “depreciation” in line 20. This allows you to claim depreciation as an expense which lowers your reported income. “Depreciation is essentially a non-cash deduction that reduces the investor’s taxable income.” In this case, we claimed $4,419 in depreciation. Assuming a 30% tax rate, that means we kept about $1,200 in our pocket that absent the depreciation deduction we would have had to send to the government.

The next year, 2001, we see the same story. Expenses are about equal to rental income. We’re in a break-even environment on the income side for the early years since we are concentrating on building equity to pay for college ten years later.

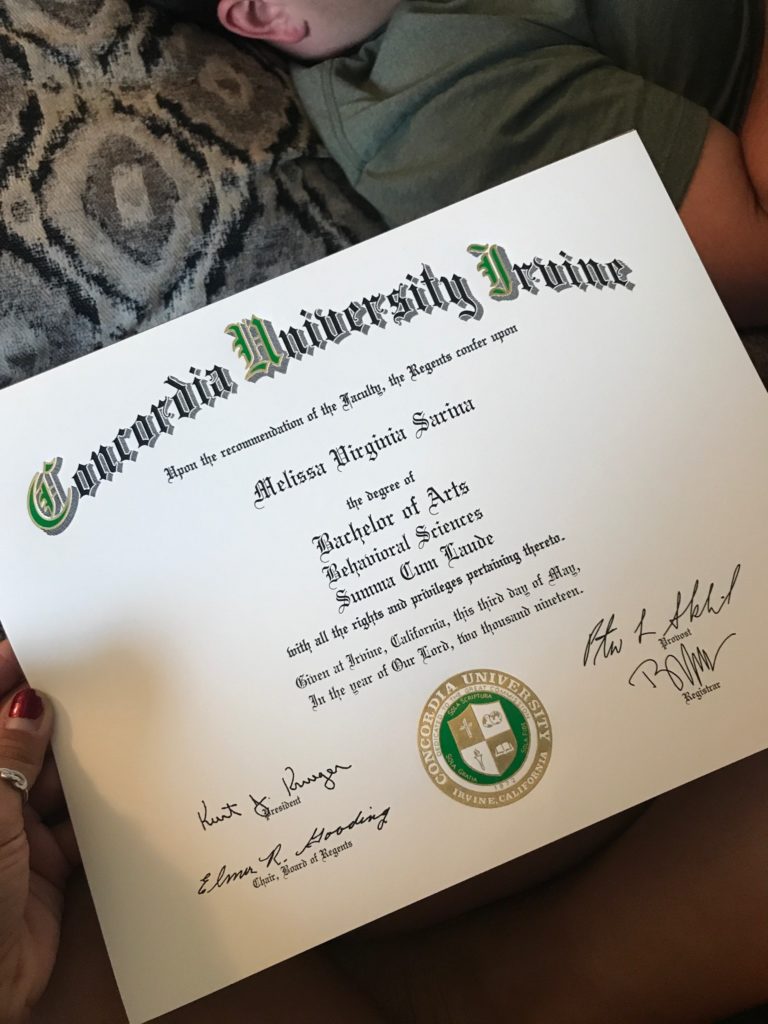

And how did we do college wise? Our youngest daughter Melissa graduated summa cum laude in May of this year. Total expenses were half the worst-case estimate. And for 2013-2014 we were paying $100,000 per year for two private colleges. Note that is an after-tax outlay and given our income, we did not qualify for any financial aid. It worked; not exactly as we planned it, but it worked well.

Next, we’ll talk about buying triplexes the same year. You can see a hint of that in the 2001 Schedule E where total rental income is shown as $101,758, way more than the three SFH total. We will also get into the “AS AMEMNDED” stamp on the Schedule E and PAL’s Amortization.