Should you start your own ‘Monopoly Project’? Should you start acquiring rental properties?

First, this is a lifestyle decision. If you ask people if they want to be “rich”, almost all say, “Yes”. But there are costs, opportunity costs, to getting rich. The most obvious is time. It will take time that you could be doing something else. If working a job that provides a good living for you and your family is enough; that is a valid lifestyle choice. There is no need to be “rich”. And, even when you get “rich”, you will spend a lot of time on maintaining your “richness”. Nobody gets rich and retires to a Pacific island. The second “cost” of being rich is that it changes everyone around you. Felix Dennis’ book “How to Get Rich: One of the World’s Greatest Entrepreneurs Shares His Secrets” explains this unintended consequences of becoming rich better than any other “how to get rich” book I’ve read.

“Happiness? Do not make me laugh. The rich are not happy. I have yet to meet a single really rich happy man or woman – and I have met many rich people. The demands from others to share their wealth become so tiresome, and so insistent, they nearly always decide they must insulate themselves. Insulation breeds paranoia and arrogance. And loneliness. And rage that you have only so many years left to enjoy rolling in the sand you have piled up. The only people the self-made rich can trust are those who knew them before they became wealthy. For many newly rich people, the world becomes a smaller, less generous and darker place. It sounds ridiculous, doesn’t it? Ridiculous and gloomy.”

So, if you’re willing to pay the costs and want to get “rich” via a Monopoly Project of your own, where do you start?

Executing a Monopoly Project of your own is like running a marathon. You must be in shape before you start. Like this?

No. But it wouldn’t hurt to put down the potato chips, get off the couch, turn off the TV and get out and do some real exercise.

You need to be in FINANCIAL shape. What is financial shape?

I refer to Dave Ramsey a lot for financial advice. He’s not the only good advisor out there, but his methods are based on actual human nature. For example, most advisors tell you to pay off your highest interest rate debt first. That makes perfect financial sense. But we, humans, are not financial optimizers. Dave’s “Snowball Recommendation” to pay off your smallest debt first fits our human nature that wants to see “results”, however small and incremental. Therefore, Dave Ramsey is my go-to guy for the basics of financial health.

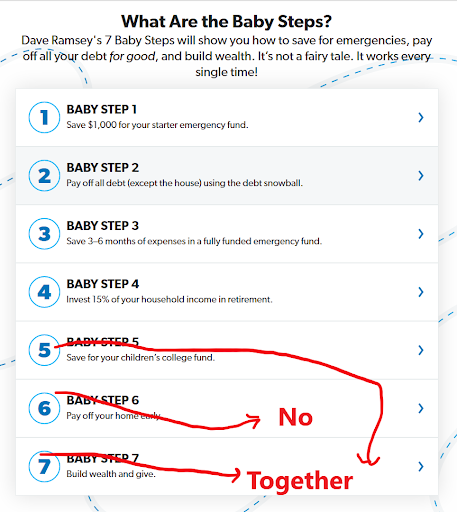

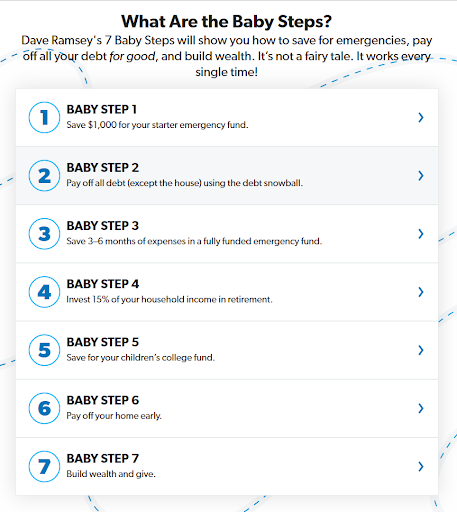

Here are his “Seven Baby Steps”:

If you’re not in good financial step, start with the first four “Baby Steps”. That may take you 6 months to a year or two years. Keep reading TheMonopolyProject.com and other FIRE websites to gain knowledge and for encouragement.

Next, we will discuss TheMonopolyProject path for steps 5, 6, and 7 above. I don’t agree with Dave on his entire path. For example, you may not need Baby Step 5 or you may do it another way. In fact, we started our own MonopolyProject specifically to accomplish Baby Step 5, “Our Story – Part 1: Can I Meet Zack?”. Then we’ll talk about Steps 5, 6 and 7 TheMonopolyProject way.