We’re coming close to buying our first house for TheMonopolyProject.Previously we had to specify three fixes to the house on Valencia. Then the appraisal came in $11,000 UNDER the sales price. As you learned, we turned that to our advantage and negotiated a reduction in price of over $5,000. That $5,000 goes directly into our pocket!

Now we come to find out that the lending company had the WRONG date of closing. The contract specifically listed “17 June 2019” as the closing date. We had worked with this company before to secure a loan for the shot-up house that fell through. It wasn’t like they didn’t have time to collect the paperwork. For example, as of 24 June they were asking for an IRS Form 4506-T, request for transcript of tax returns. That should have been one of the first forms requested.

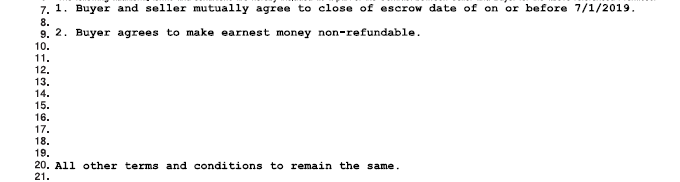

We did execute an agreement (BINSR) with the seller to move the closing to 1 July 2019 to allow time to fund the loan:

The seller asked that the earnest money, $2,000, be made “hard”; that is, he gets the money if we don’t complete the transaction. If we do complete the transaction the earnest money is applied to the purchase price as usual. We agreed because we have a ‘secret weapon’.

In the meantime, Realtor Jeff called the company, four levels up, with no results. They offered no explanation for the mixup, no compensation, not even an “I’m sorry.”

By the last week of June, after the IRS Form 4506-T request, we lost all confidence in their ability to fund the loan. Needless to say, we are done with them.

Remember, both Jeff and Jim & Michelle had scheduled foreign trips for the beginning of June. Did this contribute to this problem? This is another type of ‘opportunity cost.

“Afterwards we do some immediate planning for the offer explanation especially in light of Jeff’s planned trip to Israel in connection with his vicarage. He has arranged to have one of his eXp Realty colleagues, Rayven, fill in for him while he is in Israel.

And Jim and Michelle are scheduled to be in France for the 75th anniversary of D Day.”

Had we been able to catch this error early enough to fix it had we not (both) been out of the country? It’s not clear. Whose “fault” is this? We will analyze this more in a later post.

What is our ‘secret weapon’?

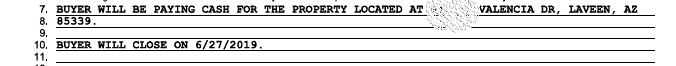

Yes, we were able and willing to pay all cash for the house. Our earnest money was not at risk.

We know that most (all?) of you reading this do not have $200,000 laying around to execute this strategy. And paying all cash is not in keeping with the spirit of “The Monopoly Project”. We will discuss this and more (including how we plan to score for TheMonopolyProject purposes) in a later post.

But, TheMonopolyProject is first an investment strategy and second, a website/blog.

We did pay cash and we did close escrow.

TheMonopolyProject has officially bought their first house on 27 June 2019!