How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions. Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

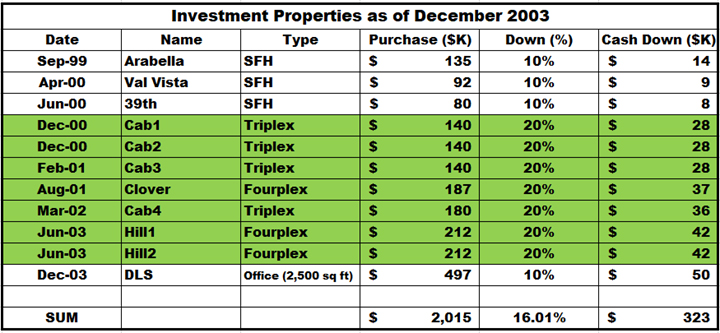

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” In Part 2, we explained our motivation and documented our initial baby step of buying our first rental house in 1999. By February of 2001 we had bought two more SFHs, and three triplexes: “Our Story – Part 3: We Start Buying Triplexes”. By the end of 2002, “Our Story – Part 4: More ‘Plexes”, we were up to 8 investment properties. 2003 was to be a pivotal year for us. In June of 2003, Jim left his W2 job to start our own engineering company; SEAIT LLC. We also bought three more properties; two fourplexes and a 2,500 sq ft office building for the new company. That totals to 11 investment properties in less than five years.

Last month we explained how we traded (1031 exchange) 24 units for 76 units. Here is what our REO (Real Estate Owned) list looked at the beginning of 2005:

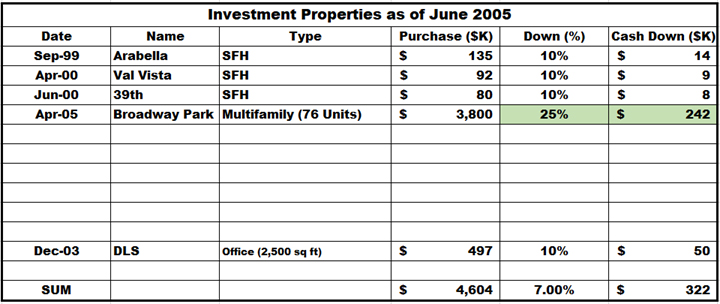

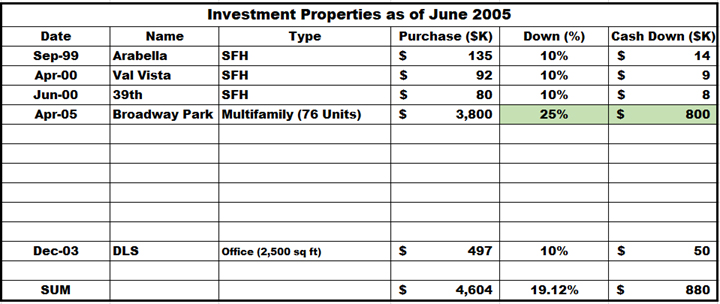

The seven properties in green are the ones we sold to “exchange” into a 76 unit apartment complex in Tempe, AZ. When we update the REO list we get:

Formally, we put $800,000 down on a $3.8M loan; 25% down. But we only put $242K down on the original seven properties. The difference is increase in value. If we use the $242K number, we end up with an aggregate down of 7%. That is somewhat misleading, so let us calculate it with the literal down payment of $800K for Broadway Park Apartments. That way we get a more reasonable value of 19% down.

That was quite a roller coaster ride for about 5 years of investing. Now we own a 76-unit apartment and can “afford” a full-time manager and full time maintenance man. But the roller coaster ride will continue and get even more exciting.

Trouble ahead, but first fun. We buy a cabin in the mountains on a river.

But first, August of 2005 was when we recorded our “Traditional Activities” video: