How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions. Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” In Part 2, we explained our motivation and documented our initial baby step of buying our first rental house in 1999. By February of 2001 we had bought two more SFHs, and three triplexes: “Our Story – Part 3: We Start Buying Triplexes”. By the end of 2002, “Our Story – Part 4: More ‘Plexes”, we were up to 8 investment properties. 2003 was to be a pivotal year for us. In June of 2003, Jim left his W2 job to start our own engineering company; SEAIT LLC. We also bought three more properties; two fourplexes and a 2,500 sq ft office building for the new company. That totals to 11 investment properties in less than five years.

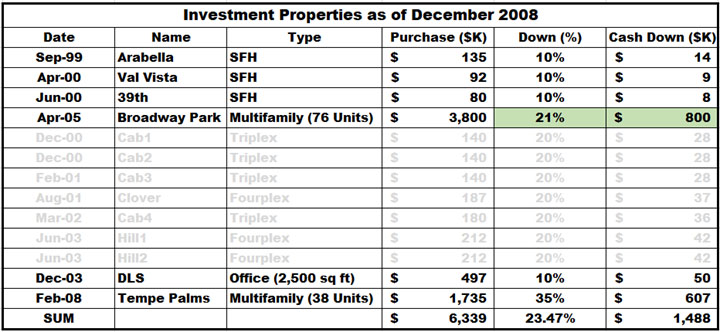

That was at the beginning of 2005. From a property standpoint, we did not make any changes until 2008. By that time the ‘subprime mortgage crisis’ was starting to be felt. We used the opportunity to do a cash-out refinance of our apartment complex and buy an additional, smaller complex. We refinanced Broadway for $3.8M at 5.94% pulling out $880K. With the proceeds we bought a 38-unit apartment complex in Tempe right across from ASU. The loan for ‘Tempe Palms’ was 1,127,500 at 6.51% with a 65% LTV. This is what our investment portfolio looked like in 2008:

At the end of 2008 the subprime loan crisis was looming, and we were up to 114 apartment units, 3 SFHs and an office condo.

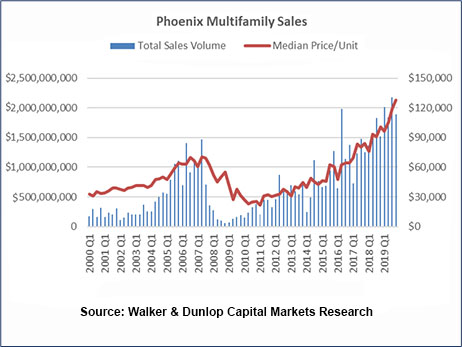

Looking back, this is what happened to apartment values, right hand axis, ‘Median Price/Unit’:

We bought in 2005 at $50K/unit. In 2008, we refinanced and pulled out money to buy Tempe Palms at $45K/unit. As you can see in the above graph, by 2011 per unit prices were below $30K. We were formally bankrupt since the loan was greater than the value of the assets. Yes, there is a clause in the loan agreement to that effect. They could have called the loan due immediately. But that would have collapsed the entire banking system in the US; because everyone was under water.

Instead, Chase proposed a temporary loan renegotiation to decrease the rate by 1% (absolute) and, more importantly, from a cash flow point of view, make the loan interest-only for two years. The catch was that the loan was due in 2015.

Subject: Loan Modification

Michelle,

Per our conversation, I am sending you the proposed terms and conditions of the loan modification for the property located at 1120 W. Broadway Rd., Tempe, AZ.

The following terms are subject to change at any time.

-

-

- Convert payments to interest only for 24 months beginning October 1, 2010.

- Reduce interest rate to 5.00% for 24 months beginning September 1, 2010.

- Reset the maturity date to February 1, 2015.

-

The estimated fees associated with this loan modification will be $1,500 modification fee and $2,100 title endorsement fee.

[redacted]

Please call me with any questions.

Elisabeth [redacted] As part of the entire sub-prime crisis, the Fed arranged for the banks to sell the “bad” loans to third parties.

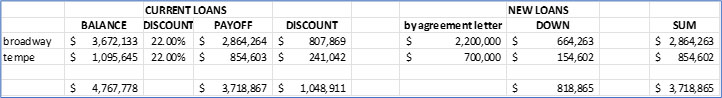

In 2012, the “third party” contacted us and offered to discount the debt we owed in exchange for an immediate payoff. Any new lenders would require that we put up sufficient capital to make it a minimum 70% loan-to-value (LTV) deal. After 10 months of negotiation, we came to a 22% discount equating to $1.048M and the requirement for additional capital of $818K from the new lenders. Practically speaking that meant we would have about $1M in debt forgiven, but we would have to come up with $800K in new capital.

Besides coming up with the new capital, that raised the Cancellation of Debt (COD) issue:

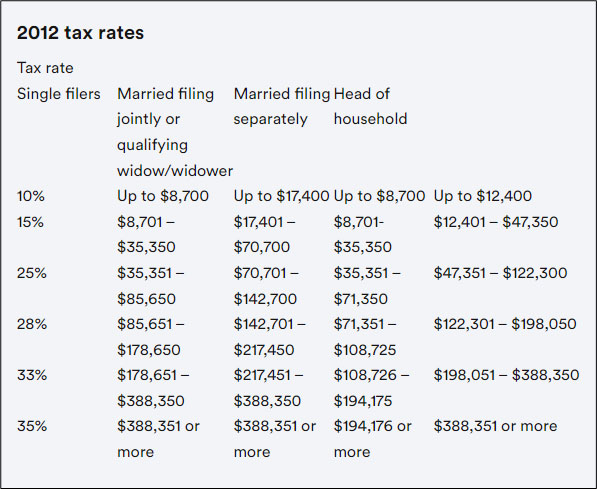

We would have to pay taxes on the $1M as ‘ordinary income’! Here is the 2012 tax rate table:

In addition to the taxes we already owed and having to come up with the $800K capital contribution, we would owe an additional $350K in taxes!

Needless to say, that is not going to work. How do we get out of this mess?

In the meantime, real life went on. Katie got accepted to USC. Jennifer got accepted to Franklin College in Lugano, Switzerland. That’s another $100K per year in after-tax money.

And Michelle and I went to Fallingwater; Frank Lloyd Wright’s masterpiece house on a creek in Pennsylvania.