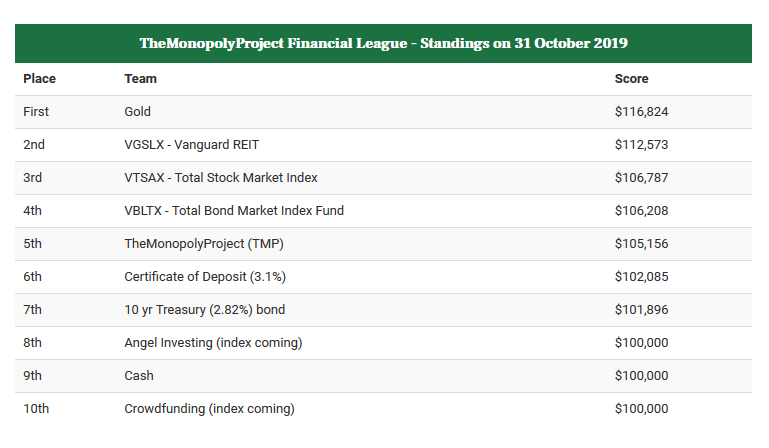

Previously we blogged that for October TMP had “fallen” to 5th place.

So far TMP has ‘made’ $5,156 in about six months but we’re still behind several other investment options.

But we’ve only employed less than half of the $100,000 capital. What if we had used all of the capital or more than the approximately 40%, we did use? Let’s do a ‘thought experiment’ or what the Germans call ‘a Gedankenexperiment’. We’ll estimate the results three different ways:

- Scale current results so that we use all the capital starting on the purchase date for the Valencia house.

- Scale so that we bought two ‘Valencia’ houses.

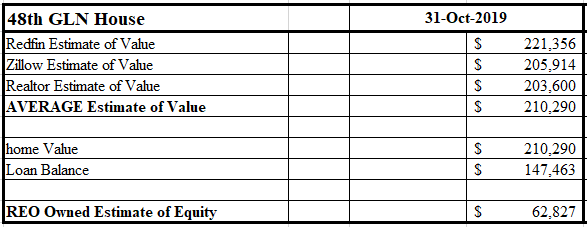

- Scale as if we bought the shot up house on 48th GLN. As you remember we declined to buy the house even though the seller offered a $15,000 discount because we were worried about the risk.

Here is a description and results of the three methods.

- For the Valencia house we made a down payment of $39,580 on the loan from the ‘Bank of Michelle’. In addition, we had closing costs of $967, low because the ‘Bank of Michelle’ did not charge TMP the normal loan fees. Let’s call it $40,000 even. If we had used all the capital, with the same return as the Valencia deal then we would have achieved $100,000/$40,000 = 2.5 times our “return” of $5,156. So, our gain would be $12,890 for a total score of $112,890. Good enough for third place.

- Let’s assume that we bought two identical Valencia houses. Then our gain would have been twice the $5,156 or $10,312. So, our gain would be $12,890 for a total score of $110,312. Still a solid third place.

- Let’s assume that we bought the shot up house on 48th GLN for the discounted price of $185,000. Assume we got a 80% loan and that the rental income and expenses were a break-even situation. We calculate 20% down ($37,000) and 2% closing costs ($3,700) for a total decrement to the bank account of $40,700.

We use our standard methodology of estimating the house value; the average of three websites:

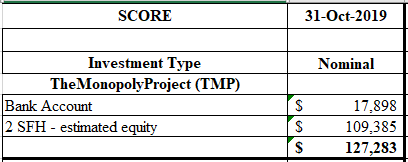

Adding the $46,558 equity of the Valencia house give us a total “2 SFH – estimated equity” of $109,385.

Adding our bank account values, our total value is then $127,283! Wow! We’ve jumped way into the lead beating “Gold” at $116,824 by over $10,000. We’re Number One!

As usual, Redfin is an outlier on the upside for the value. But even disregarding the Redfin estimate still leads to a TMP value of over $120,000. We’re still comfortably in first place.

What can we learn from this GedankenExperiment? Two thoughts:

- Should we have bought the ‘shot up house’? Given what we know now: YES. But we made the decision with the information we had then. I would make the same decision then with that set of information and our personal philosophy.

- We should have deployed our capital (i.e., bought more houses) immediately. Again, the premise of TMP is to buy appreciating assets with low margins (e.g., we put 20% down but also gain the appreciation from the bank’s 80% share).

Let’s say goodbye to the world of ‘what if’ and return our world and not the many worlds.

And here’s Marlon Brando putting it in emotion instead of words, numbers and equations; “instead of a bum”.