How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions. Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” In Part 2, we explained our motivation and documented our initial baby step of buying our first rental house in 1999. By February of 2001 we had bought two more SFHs, and three triplexes: “Our Story – Part 3: We Start Buying Triplexes”. By the end of 2002, “Our Story – Part 4: More ‘Plexes”, we were up to 8 investment properties. 2003 was to be a pivotal year for us. In June of 2003, Jim left his W2 job to start our own engineering company; SEAIT LLC. We also bought three more properties; two fourplexes and a 2,500 sq ft office building for the new company. That totals to 11 investment properties in less than five years.

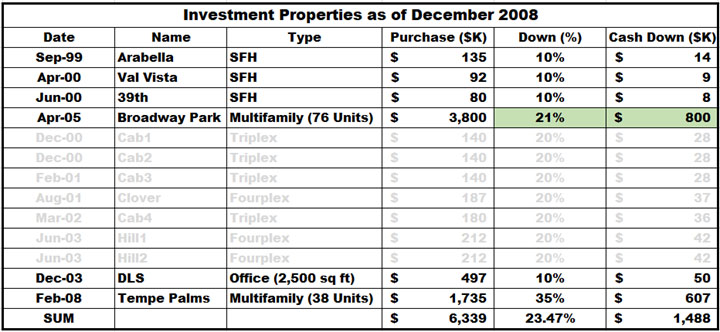

That was at the beginning of 2005. From a property standpoint, we did not make any changes until 2008. By that time the ‘subprime mortgage crisis’ was starting to be felt. We used the opportunity to do a cash-out refinance of our apartment complex and buy an additional, smaller complex. We refinanced Broadway for $3.8M at 5.94% pulling out $880K. With the proceeds we bought a 38-unit apartment complex in Tempe right across from ASU. The loan for ‘Tempe Palms’ was or $1,127,500 at 6.51% with a 65% LTV. This is what our investment portfolio looked like in 2008:

At the end of 2008 the subprime loan crisis was looming, and we were up to 114 apartment units, 3 SFHs and an office condo.

We’re going to pause the story now to start a rental property LLC. Our daughter and son-in-law bought a house in Gilbert in September 2019. Now his job has him in Casa Grande, so they bought a new-build home there. They plan to rent out the Gilbert house.

So, we formed an Arizona LLC named after their first cat, Nixon. It is a family tradition to name your business entities after your pet. Our first LLC was Zack Properties LLC. Here is Zack (RIP):

Here is Nixon in his favorite nap spot:

Here’s the video of us forming the LLC and obtaining an EIN. It took about two hours because we had to ‘babysit’ three children, 5, 3, and 1 years old. The name is:

NIXON RENTALS LLC

Here’s the one-page explanation of how to form an Arizona disregarded entity LLC:

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

HOW TO ESTABLISH AN ARIZONA LLC

- Form the LLC:

- Check if name already used: https://ecorp.azcc.gov/EntitySearch/Index

- Write the Articles of Organization (now can be done online) and having them approved by the ACC (also online): https://ecorp.azcc.gov/AzAccount?sessionExpired=False, you need an account. Make one or we can use mine. There is an $85 fee for this.

- Write an Operating Agreement. You can use our generic, disregarded entity (for tax purposes) agreement. Note that this is NOT needed to form the LLC, to get an EIN, or to open a bank account. No fee.

- Obtain an EIN:

- You need the approved Articles of Organization from above.

- Go to https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online. No fee.

- Select “disregarded entity for tax purposes”. This means the LLC will not be taxed directly. It will appear on your personal tax return on Schedule E.

- Open a bank account:

- You need the Articles of Organization and EIN from above.

- Must be done in person at the bank.

- You need to formally “Fund the LLC”. This is documented in the Operating Agreement.

- Order checks. Best and cheapest place is Costco checks: https://www.costcochecks.com/home, I ordered 400 Zack checks for $25 yesterday.

- When you open the account as in 3b above, they can print out a few (6-9, three to a sheet) checks to use before the ordered ones arrive.

- You will have to pay the ‘rental tax’ (1.50% plus county, state for Gilbert) formally known as the Transaction Privilege Tax (TPT). For one unit, you can pay yearly. You must make an online account at aztaxes.gov.

- https://azdor.gov/sites/default/files/media/TPT_2017_residentialrental-matrix.pdf

- https://www.gilbertaz.gov/departments/finance-mgmt-services/tax-compliance-division/real-property-rentals

- https://azdor.gov/transaction-privilege-tax/tpt-license/applying-tpt-license

- https://azdor.gov/sites/default/files/media/TPT_RATETABLE_10012021.pdf

The difficult step in this process is 1c. The Operating Agreement explains how the business will be run, responsibilities, return or capital and profits and so forth. For complicated LLCs (e.g., SEAIT, AHC) we had a lawyer draft the Operating Agreement and do all the above (although we could have done the other steps ourselves). For your initial LLC, it is a single owner (Kody and Jennifer) entity that is disregarded for tax purposes. The Operating Agreement is a [necessary] formality since there are not multiple owners to dispute how to run the business or complicated issues on using the money.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

We still need to open the bank account and order checks. Then we need to register with the aztaxes.gov to pay the Transaction Privilege Tax (TPT) which is a tax on residential rentals. Here is their explanation: “Although commonly referred to as a sales tax, the Arizona transaction privilege tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.”

Our out-of-pocket expenses are/were $85 for the LLC formation plus about $25 for checks; total $110 and we’re in business.