How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions.

Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” In Part 2, we explained our motivation and documented our initial baby step of buying our first rental house in 1999. By February of 2001 we had bought two more SFHs, and three triplexes: “Our Story – Part 3: We Start Buying Triplexes”. By the end of 2002, “Our Story – Part 4: More ‘Plexes”, we were up to 8 investment properties.

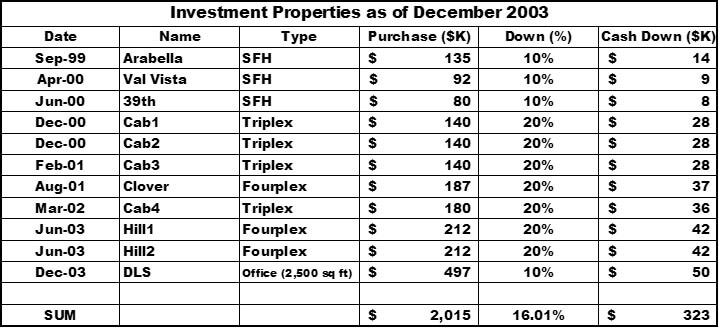

2003 was to be a pivotal year for us. In June of 2003, Jim left his W2 job to start our own engineering company; SEAIT LLC. We also bought three more properties; two fourplexes and a 2,500 sq ft office building for the new company. That totals to 11 investment properties in less than five years. We put a total of $323,000 as cash down (ignoring closing costs):

SEAIT is an engineering firm providing scientific, engineering, and program management expertise on high technology programs. We provide these services to the US Government and major aerospace companies. SEAIT LLC is still in business as of now and has executed over $20 million in contracts. SEAIT currently supplies Subject Matter Experts (SME) in the areas of Satellites and Rockets to NASA and other government agencies. We had a GSA schedule contract for ‘Professional Engineering Services (PES)’:

Schedule for – Professional Engineering Services (PES)

Federal Supply Group: 871 Class: R425

For more information on ordering from Federal Supply Schedules

click on the FSS Schedules button at http://www.gsa.gov/schedules-ordering

Contract Period: February 25, 2010 through February 24, 2010

Based on the initial financial success of SEAIT, we bought a 2,500 sq ft office building; Dana Landing Suites (DLS) in December of 2003.

The building was purchased as a “shell” with the Tenant Improvements (TI) managed by Michelle. Here is the shell:

First SEAIT employee, Dave Maiden signed up before the building was even complete:

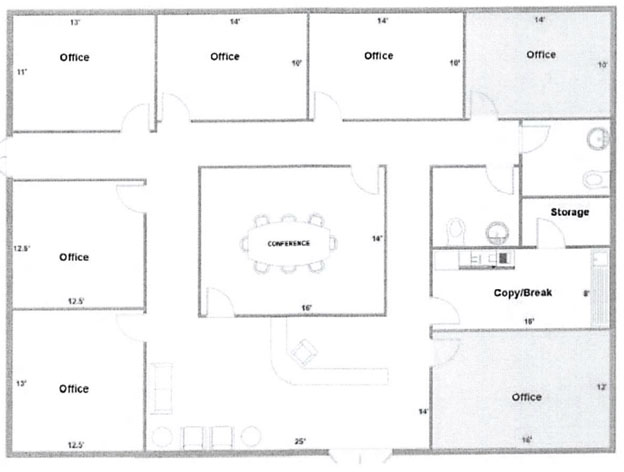

The finished configuration had seven offices surrounding a central conference room and a lobby.

The Tenant Improvements were completed in April 2004:

We had a Grand Opening with the mayor of Mesa, Arizona present:

Were we making money? From our 2003 tax return:

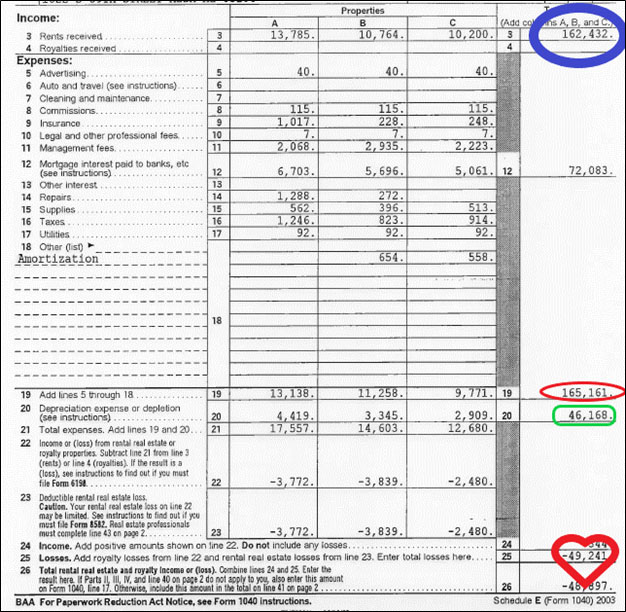

Income from rents (blue oval) was $162,432 with expenses (red oval) of $113,689 (including $72,083 of mortgage interest expense) and ‘depreciation’ (green rectangle) of $46,168 shows a loss (red heart) of $49,241. If you add (subtract?) the depreciation out, we lost $3K on a cash basis. But, at that time, we had a ‘management company taxed as a C Corp’, “Mermaid Management LLC”, that added $39K income:

So, we made about $36K of income. More on Mermaid, later. The properties were yielding some income, but the major point was APPRECIATION.

You will see this next month when in 2005 we ‘trade’ (1031 exchange) seven properties; 3 fourplexes and 4 triplexes; for a 76-unit apartment complex.