Should you start your own ‘Monopoly Project’? Should you start acquiring rental properties? In this series we examine the ways to start your own “Monopoly Project” (TMP).

In our first post of this series, we explained the first thing you should do is to get into shape – Financial Shape. Then we showed how and why we started our MonopolyProject in ‘Start Your Own Monopoly Project – Step 2: Our Way’. Then we explained a method you should never use: Step 3: OPM – Other People’s Money. In “Start Your Own Monopoly Project – Step 4: House Hacking – Joey Sleeps in the Sink” we took a side street and looked at “House Hacking”. Then we looked at ‘Step 5: Get A Partner.’

If you own your own home now, with or without a mortgage, how should you proceed? The huge advantage of owning a current residence and wanting to do a TMP is that you can use owner occupied financing to borrow at the lowest rates with the least down payment.

Let me repeat, LOWEST RATES WITH THE LEAST DOWN PAYMENT. Analysis:

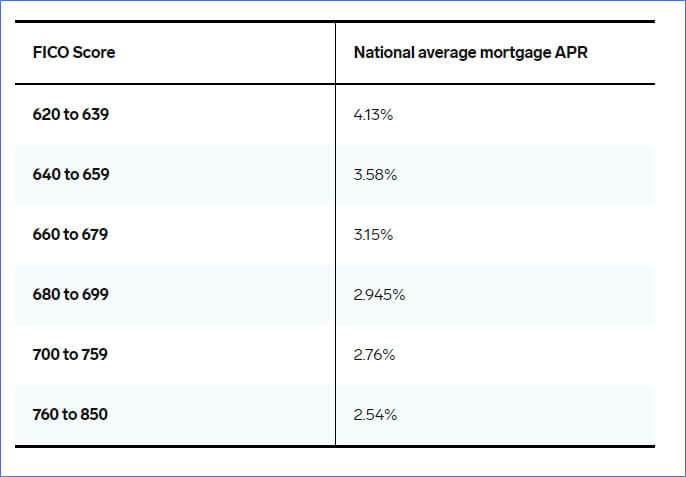

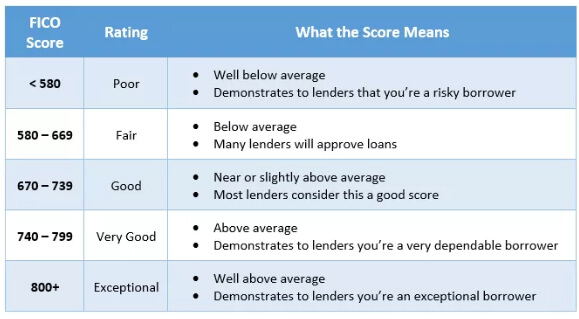

1. Lowest rates: Interest rates for owner occupied residential housing are the lowest of all borrowing categories. Rates now (January 2021) are in the high 2s. And these are typically non-recourse loans; that is, if you default, the lender can only take that property back. The lender cannot come after your other assets. Note that the rate you get is based on your credit score; the better the credit score, the lower the rate. The ‘high 2s’ is for excellent credit. Here’s a table showing the interest rate you will be charged versus your “FICO score”, the most common measure of ‘credit score’.

An ‘exceptional’ credit score is almost two percentage points better than a ‘fair’ credit score. That’s why it is so important to get into good shape, good financial state before starting you own monopoly project!

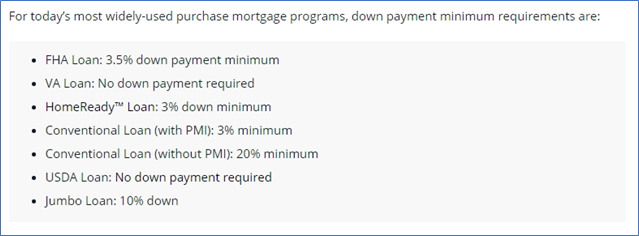

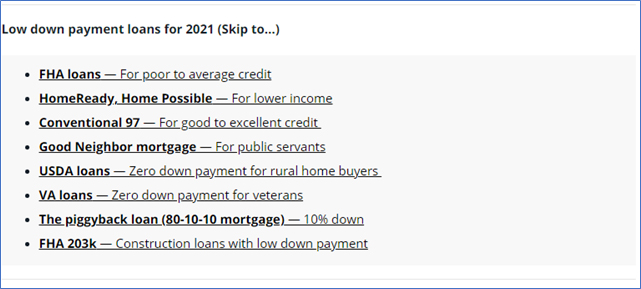

2. Least down payment: Many “low” down payment, even zero down payment, programs are available for owner occupied houses.

And certain loan programs allow as little as 3% or even zero down.

The right amount depends on your current savings and your home buying goals.

Here’s a good video on the subject from the above links:

The financial advantage to the ‘buy a new home, then rent out your current home’ strategy is you get the lowest rates and low or no down payment. And there could be non-financial benefits such as moving up (or down) in house size, buying in a new location (closer to work, closer to family, further from family) that you always wanted.

And if you want to start your own MonopolyProject but are scared of being a landlord, just call Sherman.

Next: we make our first offer as partners on what is the PERFECT Monopoly house.