How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions.

Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

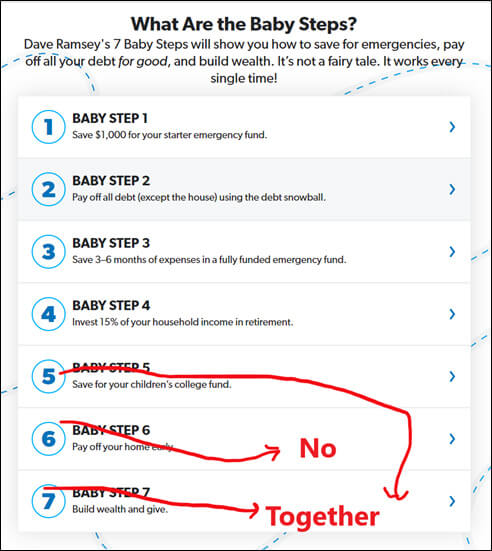

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” That was also our motivation. In fact, that is why I disagree with Dave on steps 5, 6, 7 as stated in that post.

In Part 2, we explained our motivation and documented our initial baby step of buying our first rental house in 1999. The next year, 2000 (we were not afraid of the Y2K bug), we bought two more SFHs (Single Family Home) but also two triplexes.

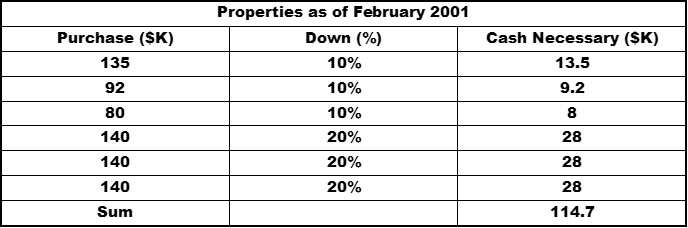

First the two SFH: In April and June 2020 we bought a ‘house’ and a ‘townhouse’ for $92,000 and $80,000 respectively with 10% down financing.

But then we bought two triplexes. We explained the advantages of “plexes” compared to a SFHs in our “TMP Floating Book Reviews – ‘Investing in Duplexes, Triplexes & Quads’ by Larry Loftis, Esq”:

- You can buy duplexes, triplexes or fourplexes with conventional SFH financing. This allows lower interest rates and lowers down payments. If the property is owner-occupied down payments can be 10%, 5%, 3% or ‘no down’.

- Plexes are easier to manage since the units are in one location.

- You can learn the basics of multifamily property management. Multifamily properties attract a different clientele than SFHs. While it is possible to build an SFH “empire”, eventually most people go into multifamily investments as the next step in the real estate wealth path.

- Another key advantage of plexes is that they are sold on the investment value (return); not on the ‘curb appeal’. People will pay a premium above investment value for a home they really want to live in. This is the main reason we started buying plexes in 2001 after buying 3 SFHs. “Curb Appeal” can add 7% to 20% to the price of a property!

We paid $140,000 for each of the three triplexes: two in Dec 2000 and one in Feb 2001. All three deals were 20% down conventional financing. So, for the three SFHs at 10% down and the three triplexes at 20% down, we had put up a total of about $115,000 plus a few per cent more for closing costs:

Where did we get the $115,000? From personal savings. Jim was still working as an engineer at “Spectrum Astro” an aerospace company that built satellites founded by W. David Thompson.

Did we make money from the five properties (leaving out the February 2001 purchase and noting that we only owned the two triplexes for the month of December) in 2000? The tax return shows a “loss” of $6,671. But with the depreciation of $9,175 we had a cash flow of $2,504. Not much, but we also had the appreciation of all the properties. That is harder to calculate in retrospect since our records are not that detailed.

Michelle raised our three daughters (ages 9, 7, 4) while doing all the property management and most of the repairs herself. All three triplexes were on the same street in Mesa in a BAD neighborhood. Think lots of drugs, especially meth. I would NOT recommend that the normal person do this. More landlord stories later. And if you want to start your own MonopolyProject, but are scared of being a landlord, just call Sherman at 480-838-9558.

Next, we continue buying properties in 2001 and 2002.