How did we do our own monopoly project? How did we start investing in real estate and build our current holdings (two apartment complexes, two medical building and two SFH’s)? In this series we will trace the history of our real estate acquisitions. Previously we described how we got started by buying our first SFH in 1999. What was our motivation?

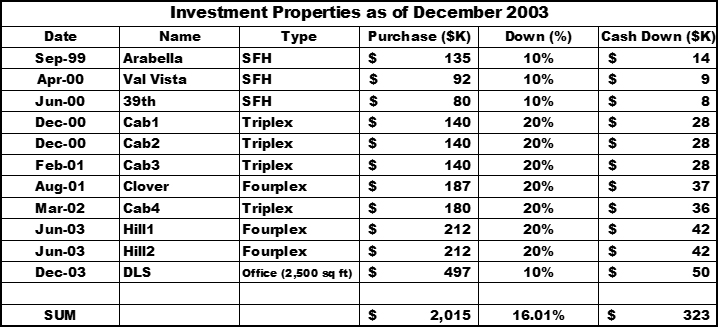

In the first post of our “Start Your Own Monopoly Project – Step 1: Get In Shape”, we referenced Dave Ramsey’s “Baby Steps” to financial fitness. Step 5 according to Dave it to “Save for your children’s college fund.” In Part 2, we explained our motivation and documented our initial baby step of buying our first rental house in 1999. By February of 2001 we had bought two more SFHs, and three triplexes: “Our Story – Part 3: We Start Buying Triplexes”. By the end of 2002, “Our Story – Part 4: More ‘Plexes”, we were up to 8 investment properties. 2003 was to be a pivotal year for us. In June of 2003, Jim left his W2 job to start our own engineering company; SEAIT LLC. We also bought three more properties; two fourplexes and a 2,500 sq ft office building for the new company. That totals to 11 investment properties in less than five years.

It is January 2005 now. Our investment property holdings were 3 SFHs; 4 triplexes, 3 fourplexes and a 2,500 sq ft office building:

In late December 2004 we saw that a 76 unit apartment was for sale in Tempe, Arizona. We were on a snow trip to SnowBowl in Flagstaff, AZ.

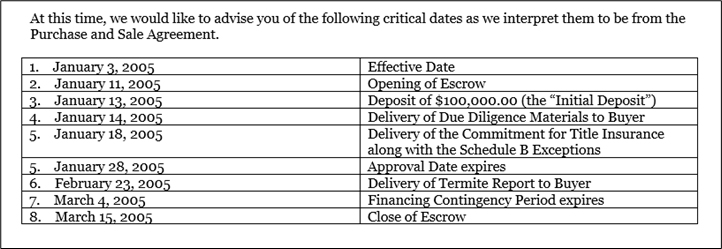

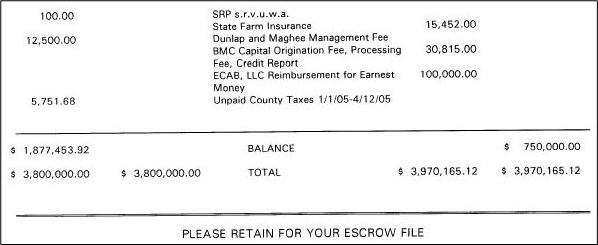

We started the process by rapidly faxing materials on our qualifications to purchase the property. We were going to “1031 exchange” the 4 triplexes and 3 fourplexes (that’s 4 times 3 plus 3 times 4 for a total of 24 units) for the down payment on the 76-unit apartment complex. We opened escrow on January 11th and on the 13th put down a non-refundable “Initial Deposit” of $100,000:

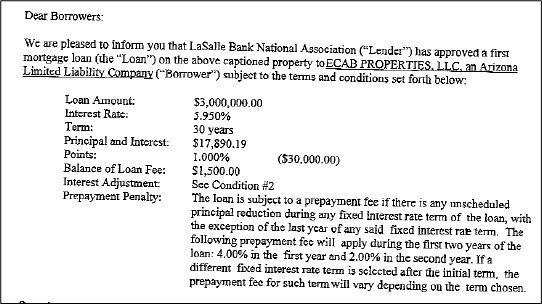

We arranged for a $3M loan at around 6% based on the LIBOR index, which came back to bite us hard in a few years. Our other option was a fixed, 30-year loan from World Savings at 4.5% but it required a $1M down. We were not confident that we could hit that number.

Michelle sold the seven properties in less than a month without using any real estate agents, simply opening an escrow for each property. The buyers were all investors who also did not utilize agents. One buyer bought 3 properties and the others, as I remember, were one buyer, one property.

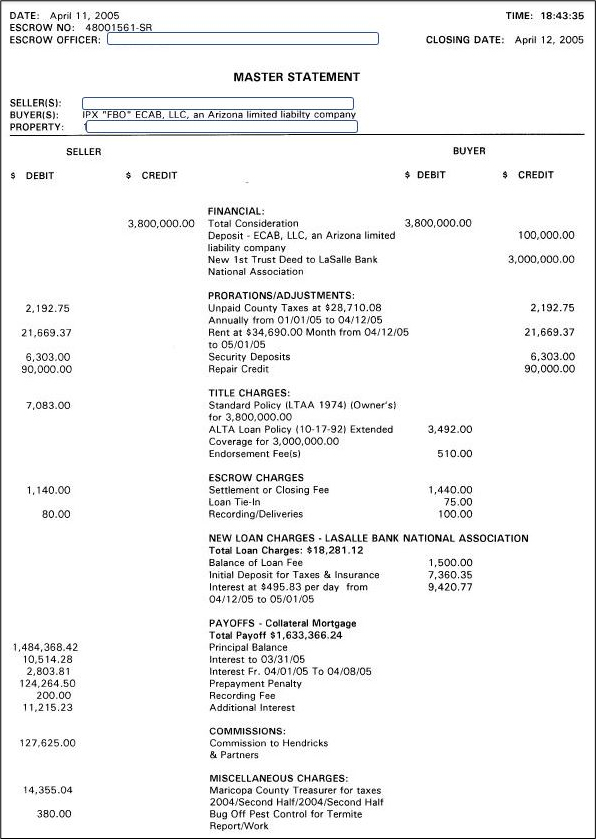

We did an extensive due diligence on the property documenting many issues and needed repairs. After lots of negotiation we were able to obtain a credit of $90,000 at closing to cover the repairs.

To summarize the financial details: we sold the fourplexes for $288K each; $72K per unit, netting $118K for each. We sold the triplexes for $265k each, $88K per unit, netting $111K each. The sum after all payoffs and fees was $798K. Overall, we sold 24 units at $72K – $88K per unit and bought 76 units at about $48K per unit after taking into account the credits against the $3.8M sales price. We consolidated 24 widely spaced units into 76 units at one location. This allowed us to economically hire a full time on site manager and maintenance man.

We had planned a trip to Paris for June after school was out. Even though we had just bought a new building we went on the trip. This is another example of ‘opportunity cost’.

Our Hotel Was Just Down the Road From the Eiffel Tower

In Those Days You Could Just Stand Next to One of the Most Famous Paintings in the World

And Surprisingly Enough, Whistler’s Mother Is in Paris

Michelle Was Fascinated by This Painting of Cain Fleeing from God

Jim & Michelle On Top of The Eiffel Tower.

In those days, the Eiffel Tower “sparkled” at night:

If You Go to Paris Do Not Miss ‘Sainte Chapelle’